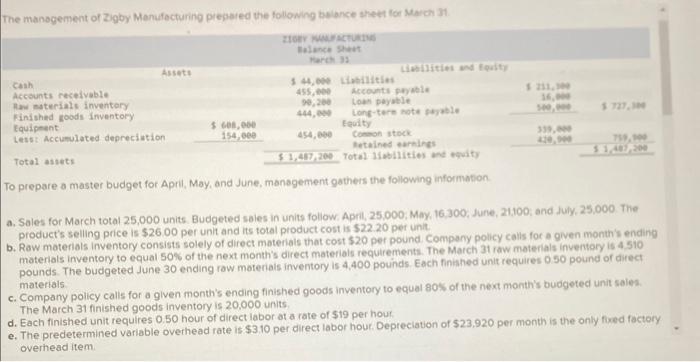

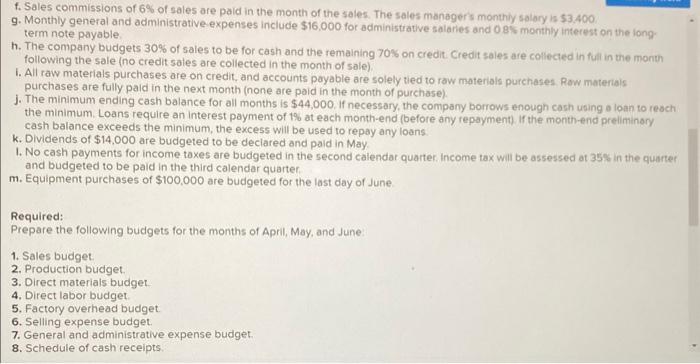

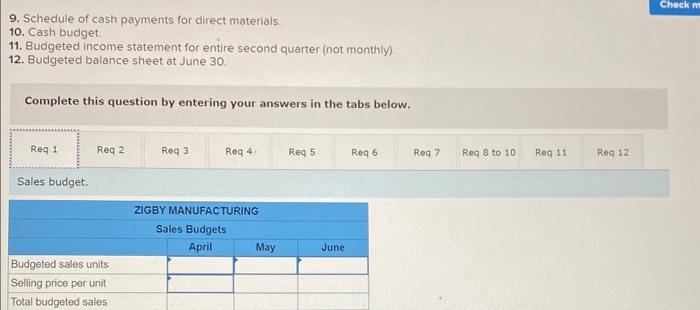

The manogement of Zigby Manufecturing pregared the following balance sheet for March 31 To prepare a master budget for April, May, and June, monagement gathers the following information. a. Sales for March total 25,000 units. Budgeted sales in units foliow: April, 25,000; May, 16,300; June, 21,100; and July, 25,000. The product's selling price is $26.00 per unit and its total product cost is $22.20 per unit. b. Raw materials inventory consists solely of direct moterials that cost $20 per pound Company policy calis for a given monthis ending materials inventory to equal 50% of the next month's direct materials requirementi. The March 31 raw meterials inventory is 4.510 pounds. The budgeted June 30 ending raw materiais inventory is 4,400 pounds. Each finiahed unit requires 050 pound of direct c. Company policy calis for a given month's ending finished goods inventory to equal 80$ of the next month's budgeted unit sales. matertals The March 31 finished goods inventory is 20,000 units d. Each finished unit requires 0.50 hour of direct labor at a rate of $19 per houf e. The predetermined variable overhead rate is $3.10 per direct labor hout. Depreciation of $23,920 per month is the only fixed factory overhead item f. Sales commissions of 6% of sales are paid in the month of the sales. The sales managers monthiy salory is 53,400 g. Monthly general and administrative expenses include $16,000 for administrative salaries and 0.8$ monthly interest on the long: term note payable h. The company budgets 30% of sales to be for cash and the remaining 70% on credit. Credit sales are collected in full in the month following the sale (no credit sales are collected in the month of sale) 1. All raw materials purchases are on credit, and accounts payable are solely tied to raw materials purchases. Row materials purchases are fully paid in the next month (none are paid in the month of purchase). J. The minimum ending cash balance for all months is $44,000. If necessary, the company borrows enough cash using a loan to resch the minimum. Loans require an interest payment of 18 at each month-end (before any repayment). If the month-end preiiminory. cash balance exceeds the minimum, the excess will be used to repay any loans k. Dividends of $14,000 are budgeted to be declared and paid in May 1. No cash payments for income taxes are budgeted in the second calendar quarter. Income tax will be assessed at 35% in the quartel and budgeted to be paid in the third calendar quarter. m. Equipment purchases of $100,000 are budgeted for the last day of June Required: Prepare the following budgets for the months of April, May, and June: 1. Sales budget. 2. Production budget. 3. Direct materials budget. 4. Direct labor budget. 5. Factory overhead budget. 6. Selling expense budget. 7. General and administrative expense budget. 8. Schedule of cash receipts. 9. Schedule of cash payments for direct materlals 10. Cash budget. 11. Budgeted income statement for entire second quarter (not monthly). 12. Budgeted balance sheet at June 30 . Complete this question by entering your answers in the tabs below. Sales budget. The manogement of Zigby Manufecturing pregared the following balance sheet for March 31 To prepare a master budget for April, May, and June, monagement gathers the following information. a. Sales for March total 25,000 units. Budgeted sales in units foliow: April, 25,000; May, 16,300; June, 21,100; and July, 25,000. The product's selling price is $26.00 per unit and its total product cost is $22.20 per unit. b. Raw materials inventory consists solely of direct moterials that cost $20 per pound Company policy calis for a given monthis ending materials inventory to equal 50% of the next month's direct materials requirementi. The March 31 raw meterials inventory is 4.510 pounds. The budgeted June 30 ending raw materiais inventory is 4,400 pounds. Each finiahed unit requires 050 pound of direct c. Company policy calis for a given month's ending finished goods inventory to equal 80$ of the next month's budgeted unit sales. matertals The March 31 finished goods inventory is 20,000 units d. Each finished unit requires 0.50 hour of direct labor at a rate of $19 per houf e. The predetermined variable overhead rate is $3.10 per direct labor hout. Depreciation of $23,920 per month is the only fixed factory overhead item f. Sales commissions of 6% of sales are paid in the month of the sales. The sales managers monthiy salory is 53,400 g. Monthly general and administrative expenses include $16,000 for administrative salaries and 0.8$ monthly interest on the long: term note payable h. The company budgets 30% of sales to be for cash and the remaining 70% on credit. Credit sales are collected in full in the month following the sale (no credit sales are collected in the month of sale) 1. All raw materials purchases are on credit, and accounts payable are solely tied to raw materials purchases. Row materials purchases are fully paid in the next month (none are paid in the month of purchase). J. The minimum ending cash balance for all months is $44,000. If necessary, the company borrows enough cash using a loan to resch the minimum. Loans require an interest payment of 18 at each month-end (before any repayment). If the month-end preiiminory. cash balance exceeds the minimum, the excess will be used to repay any loans k. Dividends of $14,000 are budgeted to be declared and paid in May 1. No cash payments for income taxes are budgeted in the second calendar quarter. Income tax will be assessed at 35% in the quartel and budgeted to be paid in the third calendar quarter. m. Equipment purchases of $100,000 are budgeted for the last day of June Required: Prepare the following budgets for the months of April, May, and June: 1. Sales budget. 2. Production budget. 3. Direct materials budget. 4. Direct labor budget. 5. Factory overhead budget. 6. Selling expense budget. 7. General and administrative expense budget. 8. Schedule of cash receipts. 9. Schedule of cash payments for direct materlals 10. Cash budget. 11. Budgeted income statement for entire second quarter (not monthly). 12. Budgeted balance sheet at June 30 . Complete this question by entering your answers in the tabs below. Sales budget