Answered step by step

Verified Expert Solution

Question

1 Approved Answer

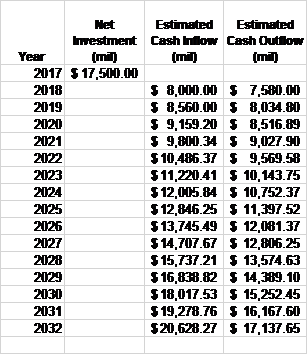

Tyson Foods is considering the acquisition of a popular foods company. They estimate the following proforma cash flows for the next 15 years. After-tax hurdle

- Tyson Foods is considering the acquisition of a popular foods company. They estimate the following proforma cash flows for the next 15 years. After-tax hurdle rate for Tyson Foods is 6%. Find the NPV and IRR for this acquisition. Should Tyson continue to pursue the acquisition based on the data estimates?

NPV =

IRR =

How do you solve this with a Ti-84?

Net Estimated Estimated Inwestment Cash now Cash Outflow Year (mil) (mi) (mil) 2017 S 17,500.00 2018 $ 8,000.00 $ 7,500.00 2019 $ 8,560.00 $ 8,034.80 2020 $ 9,159.20 $ 8,516.89 2021 $ 9,800.34 $ 9,027.90 2022 $ 10,486.37 $ 9,569.58 2023 $11,220.41 $ 10,143.75 2124 $ 12,005.84 10,752.37 2125 $ 12,846.25 $ 11,397.52 2026 $ 13,745.49 $ 12,081.37 2027 $ 14,707.67 $12,816.25 2028 $15.737.21 $ 13,574.63 2129 $ 16,838.82 $ 14,809.10 2130 $ 18,017.53 $ 15,252.45 2131 $ 19,278.76 $ 16,167.60 2132 $20,628.27 $ 17,137.65Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started