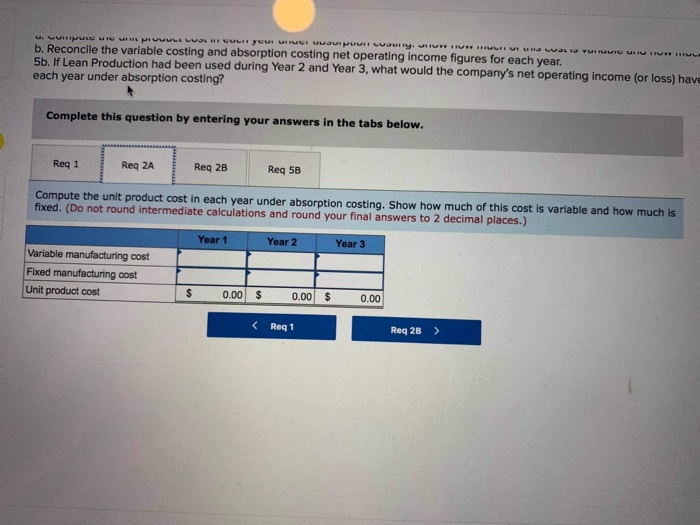

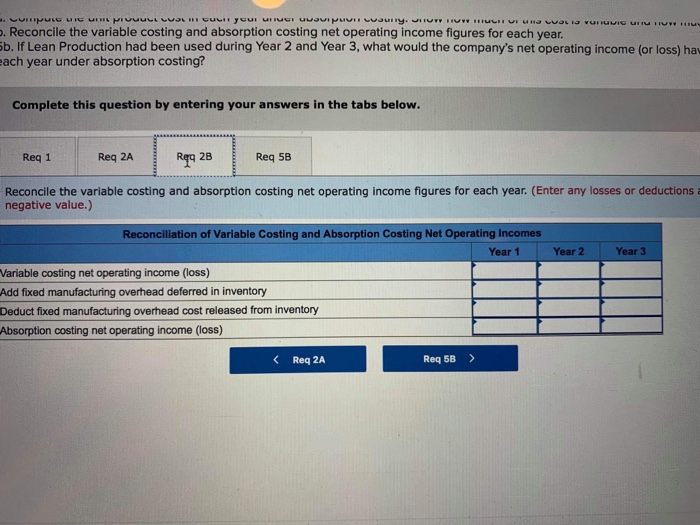

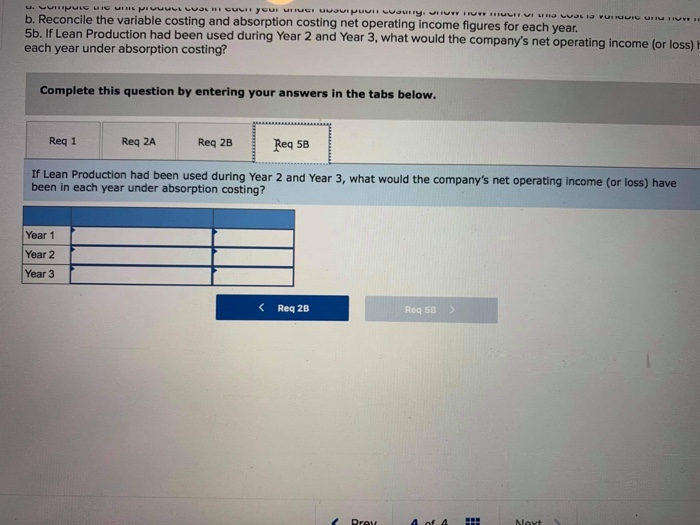

u pune un PUU LUO Cuycui urut uwou PU County. JHIN HUN HULUI WHS was to vuur III b. Reconcile the variable costing and absorption costing net operating income figures for each year. 5b. If Lean Production had been used during Year 2 and Year 3, what would the company's net operating income (or loss) have each year under absorption costing? Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Reg 2B Req 5B Compute the unit product cost in each year under absorption costing. Show how much of this cost is variable and how much is fixed. (Do not round intermediate calculations and round your final answers to 2 decimal places.) Year 1 Year 2 Year 3 Variable manufacturing cost Fixed manufacturing cost Unit product cost $ 0.00 $ 0.00 $ 0.00 (Reg 1 Reg 2B > Urpuve u pivuuu! LO CUCII yeur MIVU UUSVIPUI Launy. JIUN TUN HUU UIMH CUOLIS VUTTUIC II HUYU . Reconcile the variable costing and absorption costing net operating income figures for each year. Sb. If Lean Production had been used during Year 2 and Year 3, what would the company's net operating income (or loss) hav each year under absorption costing? Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Rgo 28 Req 5B Reconcile the variable costing and absorption costing net operating income figures for each year. (Enter any losses or deductions negative value.) Year 2 Year 3 Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Variable costing net operating income (loss) Add fixed manufacturing overhead deferred in inventory Deduct fixed manufacturing overhead cost released from inventory Absorption costing net operating income (loss) u. PUIC MIU IR pivuu LUGLI ULycur ure Uwavipur Laury. JITU TUN HUIVI WHO LOL ta vu Tuvie IU IUNIE b. Reconcile the variable costing and absorption costing net operating income figures for each year. 5b. If Lean Production had been used during Year 2 and Year 3, what would the company's net operating income (or loss) each year under absorption costing? Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Req 2B Reg 58 If Lean Production had been used during Year 2 and Year 3, what would the company's net operating income (or loss) have been in each year under absorption costing? Year 1 Year 2 Year 3 Urpuve u pivuuu! LO CUCII yeur MIVU UUSVIPUI Launy. JIUN TUN HUU UIMH CUOLIS VUTTUIC II HUYU . Reconcile the variable costing and absorption costing net operating income figures for each year. Sb. If Lean Production had been used during Year 2 and Year 3, what would the company's net operating income (or loss) hav each year under absorption costing? Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Rgo 28 Req 5B Reconcile the variable costing and absorption costing net operating income figures for each year. (Enter any losses or deductions negative value.) Year 2 Year 3 Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Variable costing net operating income (loss) Add fixed manufacturing overhead deferred in inventory Deduct fixed manufacturing overhead cost released from inventory Absorption costing net operating income (loss) u. PUIC MIU IR pivuu LUGLI ULycur ure Uwavipur Laury. JITU TUN HUIVI WHO LOL ta vu Tuvie IU IUNIE b. Reconcile the variable costing and absorption costing net operating income figures for each year. 5b. If Lean Production had been used during Year 2 and Year 3, what would the company's net operating income (or loss) each year under absorption costing? Complete this question by entering your answers in the tabs below. Req 1 Reg 2A Req 2B Reg 58 If Lean Production had been used during Year 2 and Year 3, what would the company's net operating income (or loss) have been in each year under absorption costing? Year 1 Year 2 Year 3