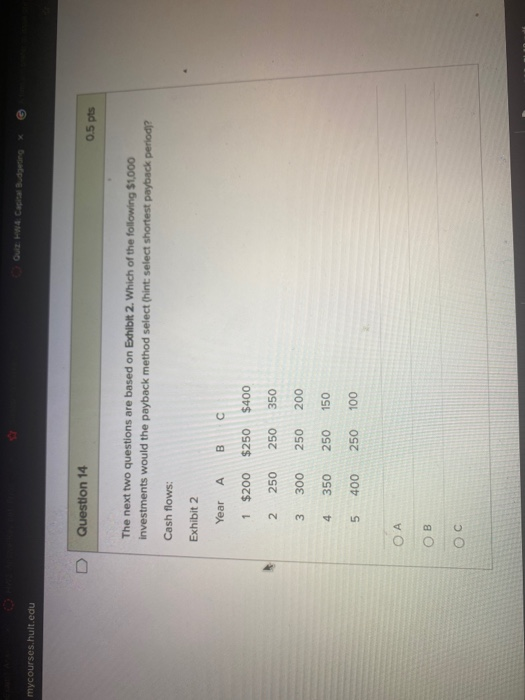

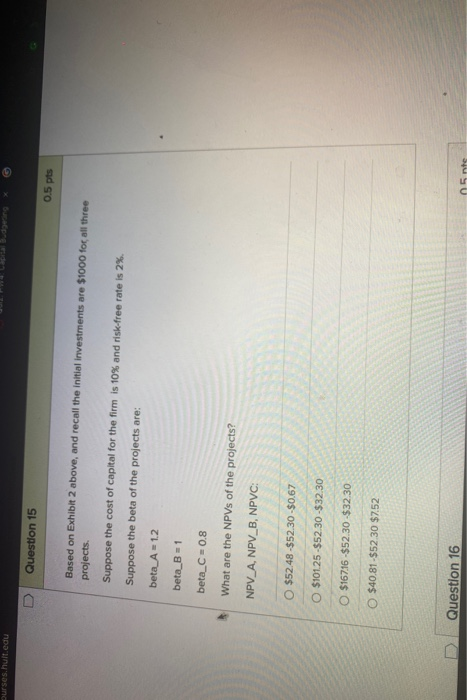

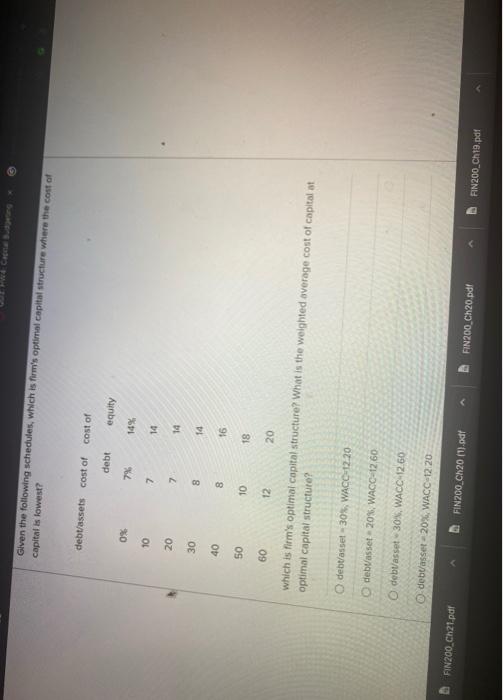

U Question 13 0.5 pts Based on Exhibit 1 above, c. If sales rise to 2,000 units, what are the firm's earnings or losses? O Loss of $250 O No Loss or Gain O Gain of $250 Gain of $500 Question 14 0.5 pts The next two questions are based on Exhibit 2. Which of the follo Gut We Care Budgeting mycourses.hult.edu Question 14 0.5 pts The next two questions are based on Exhibit 2. Which of the following $1,000 investments would the payback method select (hint: select shortest payback period? Cash flows: Exhibit 2 Year 1 $200 $250 $400 2 250 250 350 3 300 250 200 4 350 250 150 5 400 250 100 OA OB ourses.huit.edu Question 15 0.5 pts Based on Exhibit 2 above, and recall the initial investments are $1000 for all three projects Suppose the cost of capital for the firm is 10% and risk-free rate is 2% Suppose the beta of the projects are: beto_A =12 beta_B = 1 beta_C=0.8 What are the NPVs of the projects? NPV_A, NPV_B, NPVC: $52.48 -$52.30-$0.67 $101.25-$52.30-$32.30 $16716 -$52.30-$32.30 O $40.81-$52.30 $7.52 Question 16 n5nts Cacica Given the following schedules, which is firm's optimal capital structure where the cost of capital is lowest? debt/assets cost of cost of debt equity 0% 7% 10 7 14 20 7 14 30 8 14 40 8 16 50 10 18 60 12 20 which is firm's optimal capital structure? What is the weighted average cost of capital at optimal capital structure? O debt/asset - 30%, WACO- 12.20 debasset - 20%, WACC-12.60 debt/asset -30%, WACC-12.60 O debt/asset -20%, WACC-12.20 FIN200_Ch21.pdf FIN200_Ch20 (1).pdf FIN200_Ch20.pdf FIN200_Ch19.pdf U Question 13 0.5 pts Based on Exhibit 1 above, c. If sales rise to 2,000 units, what are the firm's earnings or losses? O Loss of $250 O No Loss or Gain O Gain of $250 Gain of $500 Question 14 0.5 pts The next two questions are based on Exhibit 2. Which of the follo Gut We Care Budgeting mycourses.hult.edu Question 14 0.5 pts The next two questions are based on Exhibit 2. Which of the following $1,000 investments would the payback method select (hint: select shortest payback period? Cash flows: Exhibit 2 Year 1 $200 $250 $400 2 250 250 350 3 300 250 200 4 350 250 150 5 400 250 100 OA OB ourses.huit.edu Question 15 0.5 pts Based on Exhibit 2 above, and recall the initial investments are $1000 for all three projects Suppose the cost of capital for the firm is 10% and risk-free rate is 2% Suppose the beta of the projects are: beto_A =12 beta_B = 1 beta_C=0.8 What are the NPVs of the projects? NPV_A, NPV_B, NPVC: $52.48 -$52.30-$0.67 $101.25-$52.30-$32.30 $16716 -$52.30-$32.30 O $40.81-$52.30 $7.52 Question 16 n5nts Cacica Given the following schedules, which is firm's optimal capital structure where the cost of capital is lowest? debt/assets cost of cost of debt equity 0% 7% 10 7 14 20 7 14 30 8 14 40 8 16 50 10 18 60 12 20 which is firm's optimal capital structure? What is the weighted average cost of capital at optimal capital structure? O debt/asset - 30%, WACO- 12.20 debasset - 20%, WACC-12.60 debt/asset -30%, WACC-12.60 O debt/asset -20%, WACC-12.20 FIN200_Ch21.pdf FIN200_Ch20 (1).pdf FIN200_Ch20.pdf FIN200_Ch19.pdf