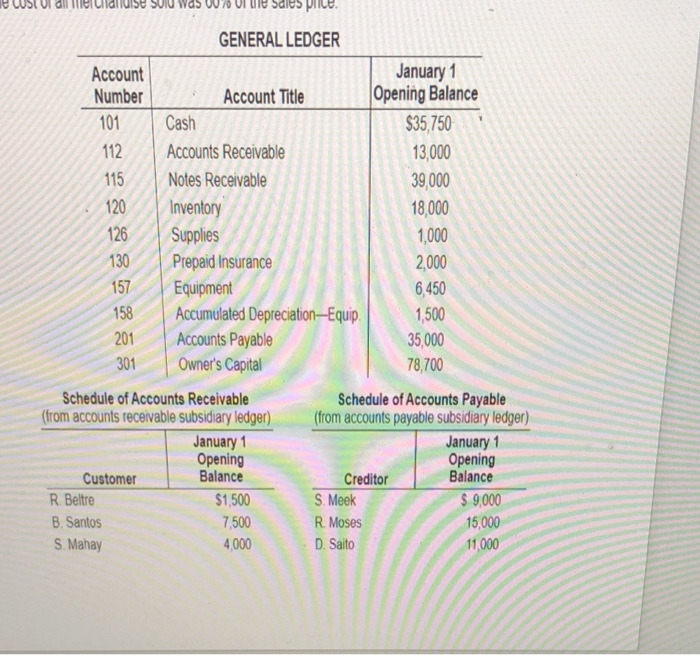

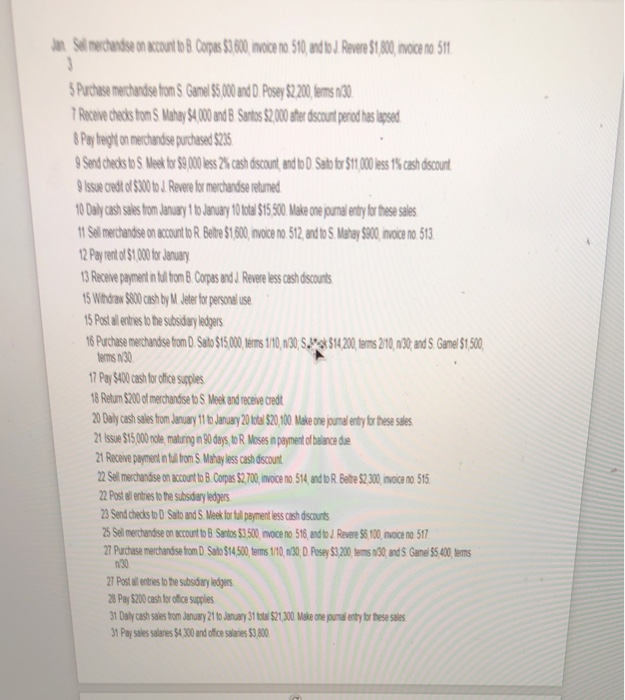

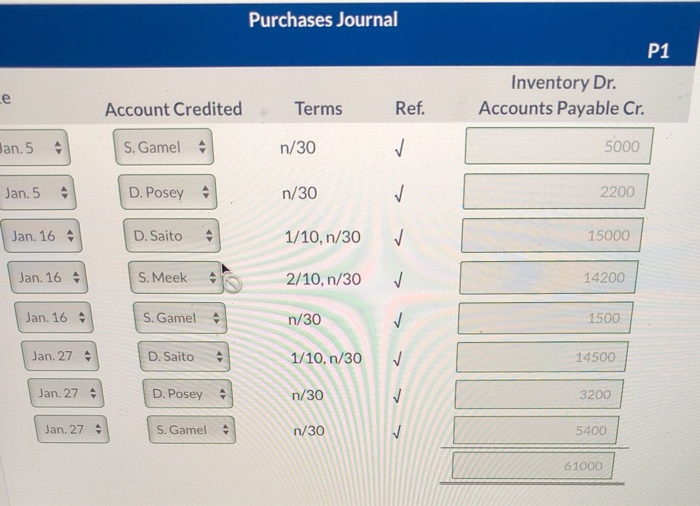

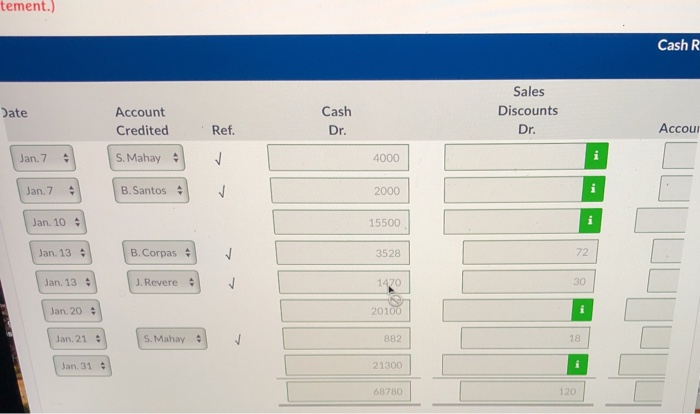

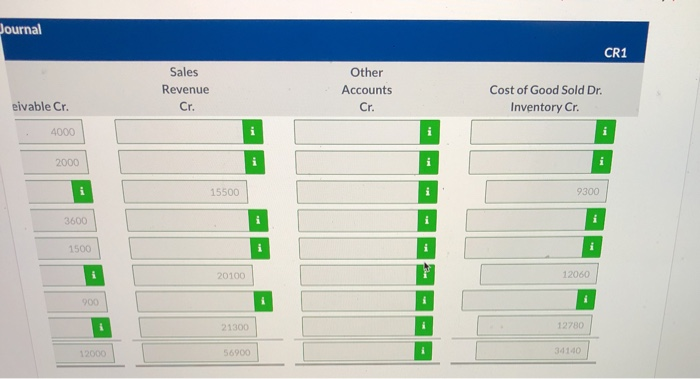

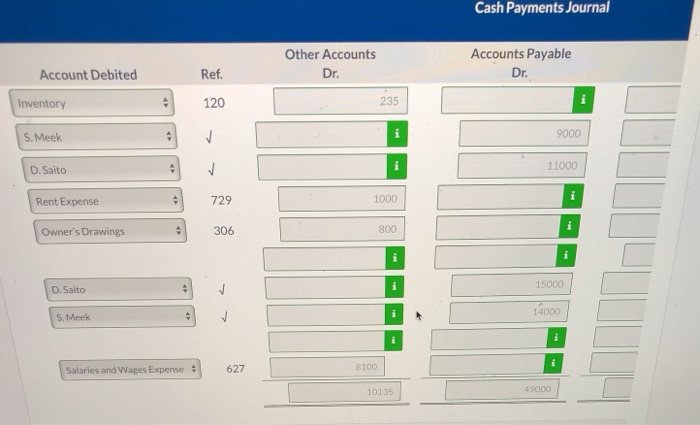

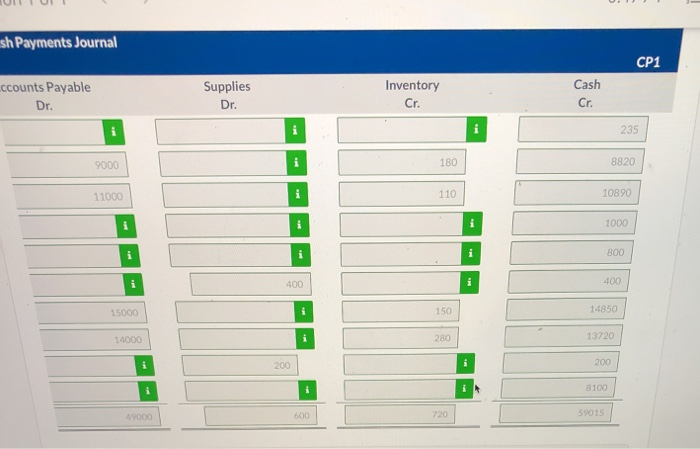

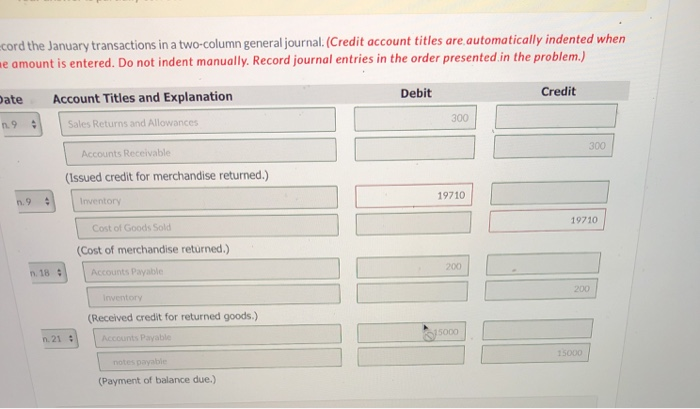

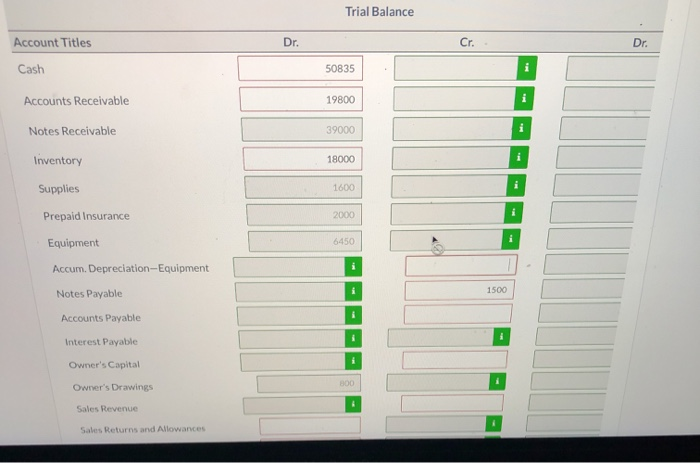

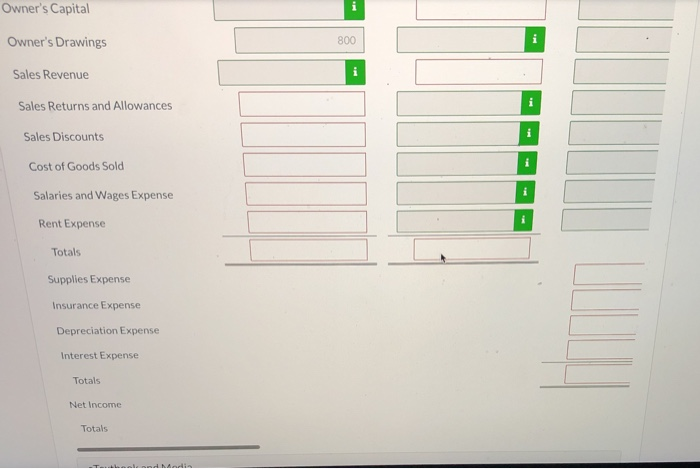

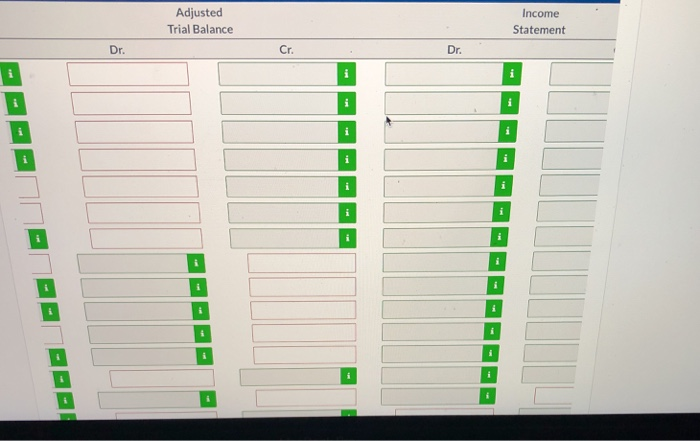

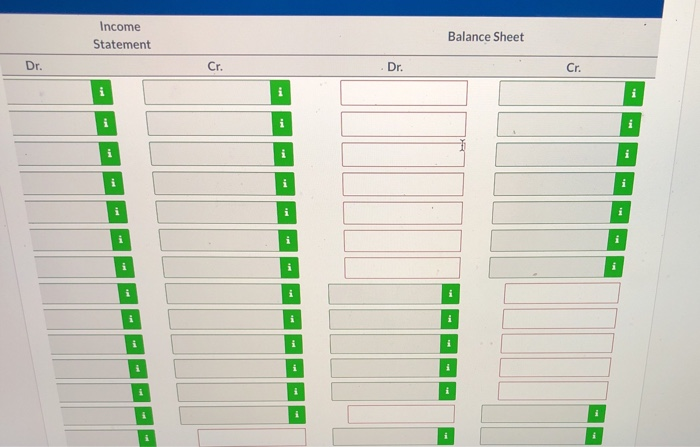

ule Sdies price GENERAL LEDGER Account January 1 Number Account Title Opening Balance 101 Cash $35,750 112 Accounts Receivable 13,000 115 Notes Receivable 39,000 120 Inventory 18,000 126 Supplies 1,000 130 Prepaid Insurance 2,000 157 Equipment 6,450 158 Accumulated Depreciation-Equip 1,500 201 Accounts Payable 35,000 301 Owner's Capital 78,700 Schedule of Accounts Receivable Schedule of Accounts Payable (from accounts receivable subsidiary ledger) (from accounts payable subsidiary ledger) January 1 January 1 Opening Opening Customer Balance Creditor Balance R. Beltre $1,500 S. Meek $ 9,000 B. Santos 7,500 R. Moses 15,000 S. Mahay 4,000 D. Saito 11,000 dan Sel merchandise an account to 8 Corpas $3,800, inace no 510, and to). Revere $1,800, invoice no 511. 3 5 Purchase merchandise from s Gemel 85 000 and 0. Posey 82200, terms 130 7 Recewe checks tons Mahay $4,000 and B Santos $2.000 afer discount period has lapsed 8 Pay height on merchandise purchased $225 9 Send checks to S. Meek for 89,000 less 2% cash discount, and to D Sato ter 511 00 less 1% cash discount 9 Issue credit of $300 wo). Revere for merchandise retuned 10 Daly cash sales hom January 1 10 January 10 total $15,500. Make one journal entry for these sales 11 Sel merchandise on account to R Belve $1,800, invoice no. 512, and to 5. Malay 5900, invoice no. 513. 12 Pay rent of 54,000 for January 13 Receve payment in til trom B. Corpes und J. Revere less cash dscounts 15 Wihdrew $800 cash by M Jeter for personal use. 15 Post all entries to be subsidiary ledgers 16 Purchase merchandse from D. Salo $15,000, terms 1/10, 1/30, 5.514200, terms 2010, 130, and S. Gamel 1,500 terms 130 17 Pay 5400 cash for ofice supples 18 Retum $200 of merchandise to S. Meek and receive credt 20 Daly cash sales from January 11 to January 20 total 820 100. Make one jounal entry for these sales 21 Issue $15,000 note, maturing in 90 days to Moses in payment of balance die 21 Receive payment in til tom 5. Mahay less cash discount 22 Sel merchandise on account to B. Corpus $2,700, invoice no. 514, and to R. Bete $2,300, invoice no. 515. 22 Postal entries to the subsday ledgers 23 Send checks to D. Salo and S. Meek for tul payment less cash discounts 25 Sel merchandise on account to B. Santos $3,500, invoice no 516, and to J. Revere $ 100, invoice no 517 27 Purchase merchandise from D. Salo $14.500, terms 110, 1/30, D. Posey 53,200, les 30, and S Ganel $5,400, tems 1:30 27 Post all entries to the subsidiary ledgers 28 Pay $200 cash for ofice supples 31 Daly cash sales from January 21 10 January 31 tota 521,300. Make one journal entry for these sales. 31 Pay sales salaries S4300 and ofice salaries 53 800. Purchases Journal P1 Inventory Dr. Accounts Payable Cr. e Account Credited Terms Ref. Jan.5 4 S. Gamel n/30 5000 Jan. 5 D. Posey n/30 2200 Jan. 16 - D. Saito 1/10, n/30 15000 Jan. 16 S. Meek 2/10, n/30 14200 Jan. 16 - S. Gamel n/30 1500 Jan. 27 D. Saito 1/10,n/30 4500 14500 Jan. 27 D. Posey n/30 3200 Jan. 27 S. Gamel . n/30 5400 61000 tement.) Cash R Sales Discounts Date Account Credited Cash Dr. Ref. Dr. Accoui Jan.7 S. Mahay 4 4000 Jan.7 B. Santos 2000 Jan. 10 15500 Jan. 13 - B. Corpas 4 3528 72 Jan 13 4 J. Revere 1470 30 Jan. 20 20100 Jan. 21 S. Mahay 882 18 Jan. 31 21300 68780 120 Journal CR1 Sales Revenue Cr. Other Accounts Cr. eivable Cr. Cost of Good Sold Dr. Inventory Cr. 4000 2000 i i i 15500 9300 3600 i 1500 20100 12060 900 21300 12780 12000 56900 34140 Cash Payments Journal Other Accounts Dr. Accounts Payable Dr. Account Debited Ref. Inventory 120 235 S. Meek i 9000 D. Saito 11000 Rent Expense 729 1000 Owner's Drawings 306 i 800 15000 D. Saito S. Meek 14000 Salaries and Wages Expense 627 8100 10135 49000 sh Payments Journal CP1 ccounts Payable Dr. Supplies Dr. Inventory Cr. Cash Cr. 235 9000 180 8820 11000 110 10890 1000 i 800 400 400 15000 i 150 14850 14000 280 13720 200 200 i 8100 600 49000 720 59015 cord the January transactions in a two-column general journal. (Credit account titles are automatically indented when me amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Credit Debit Account Titles and Explanation Sales Returns and Allowances 300 n. 9 300 Accounts Receivable (Issued credit for merchandise returned.) 19710 ng Inventory 19710 Cost of Goods Sold (Cost of merchandise returned.) Accounts Payable 200 n. 18 200 Inventory (Received credit for returned goods.) Accounts Payable 15000 n. 21 15000 notes payable (Payment of balance due.) Trial Balance Account Titles Dr. Cr. Dr. Cash 50835 Accounts Receivable 19800 Notes Receivable 39000 Inventory 18000 Supplies 1600 Prepaid Insurance 2000 Equipment 6450 i Accum. Depreciation-Equipment Notes Payable 1500 Accounts Payable Interest Payable Owner's Capital 300 Owner's Drawings 4 Sales Revenue Sales Returns and Allowances Owner's Capital Owner's Drawings 800 Sales Revenue Sales Returns and Allowances Sales Discounts Cost of Goods Sold Salaries and Wages Expense Rent Expense Totals Supplies Expense Insurance Expense Depreciation Expense Interest Expense Totals Net Income Totals Adjusted Trial Balance Income Statement Dr. Cr. Dr. i i i 1 i Income Statement Balance Sheet Dr. Cr. Dr. Cr. i i i i i i i i i i i i i i i i i Acceptable correct answers also include: 0 i Prepare a trial balance at January 31, 2020, in the trial balance columns of the worksheet. Complete the worksheet using the following additional information. 1. Office supplies at January 31 total $900. 2. Insurance coverage expires on October 31, 2020. Annual depreciation on the equipment is $1,500. Interest of $50 has accrued on the note payable. 3. 4 Income Statement Balance Sheet Dr. Cr. Dr. Cr i 1 i 1 ule Sdies price GENERAL LEDGER Account January 1 Number Account Title Opening Balance 101 Cash $35,750 112 Accounts Receivable 13,000 115 Notes Receivable 39,000 120 Inventory 18,000 126 Supplies 1,000 130 Prepaid Insurance 2,000 157 Equipment 6,450 158 Accumulated Depreciation-Equip 1,500 201 Accounts Payable 35,000 301 Owner's Capital 78,700 Schedule of Accounts Receivable Schedule of Accounts Payable (from accounts receivable subsidiary ledger) (from accounts payable subsidiary ledger) January 1 January 1 Opening Opening Customer Balance Creditor Balance R. Beltre $1,500 S. Meek $ 9,000 B. Santos 7,500 R. Moses 15,000 S. Mahay 4,000 D. Saito 11,000 dan Sel merchandise an account to 8 Corpas $3,800, inace no 510, and to). Revere $1,800, invoice no 511. 3 5 Purchase merchandise from s Gemel 85 000 and 0. Posey 82200, terms 130 7 Recewe checks tons Mahay $4,000 and B Santos $2.000 afer discount period has lapsed 8 Pay height on merchandise purchased $225 9 Send checks to S. Meek for 89,000 less 2% cash discount, and to D Sato ter 511 00 less 1% cash discount 9 Issue credit of $300 wo). Revere for merchandise retuned 10 Daly cash sales hom January 1 10 January 10 total $15,500. Make one journal entry for these sales 11 Sel merchandise on account to R Belve $1,800, invoice no. 512, and to 5. Malay 5900, invoice no. 513. 12 Pay rent of 54,000 for January 13 Receve payment in til trom B. Corpes und J. Revere less cash dscounts 15 Wihdrew $800 cash by M Jeter for personal use. 15 Post all entries to be subsidiary ledgers 16 Purchase merchandse from D. Salo $15,000, terms 1/10, 1/30, 5.514200, terms 2010, 130, and S. Gamel 1,500 terms 130 17 Pay 5400 cash for ofice supples 18 Retum $200 of merchandise to S. Meek and receive credt 20 Daly cash sales from January 11 to January 20 total 820 100. Make one jounal entry for these sales 21 Issue $15,000 note, maturing in 90 days to Moses in payment of balance die 21 Receive payment in til tom 5. Mahay less cash discount 22 Sel merchandise on account to B. Corpus $2,700, invoice no. 514, and to R. Bete $2,300, invoice no. 515. 22 Postal entries to the subsday ledgers 23 Send checks to D. Salo and S. Meek for tul payment less cash discounts 25 Sel merchandise on account to B. Santos $3,500, invoice no 516, and to J. Revere $ 100, invoice no 517 27 Purchase merchandise from D. Salo $14.500, terms 110, 1/30, D. Posey 53,200, les 30, and S Ganel $5,400, tems 1:30 27 Post all entries to the subsidiary ledgers 28 Pay $200 cash for ofice supples 31 Daly cash sales from January 21 10 January 31 tota 521,300. Make one journal entry for these sales. 31 Pay sales salaries S4300 and ofice salaries 53 800. Purchases Journal P1 Inventory Dr. Accounts Payable Cr. e Account Credited Terms Ref. Jan.5 4 S. Gamel n/30 5000 Jan. 5 D. Posey n/30 2200 Jan. 16 - D. Saito 1/10, n/30 15000 Jan. 16 S. Meek 2/10, n/30 14200 Jan. 16 - S. Gamel n/30 1500 Jan. 27 D. Saito 1/10,n/30 4500 14500 Jan. 27 D. Posey n/30 3200 Jan. 27 S. Gamel . n/30 5400 61000 tement.) Cash R Sales Discounts Date Account Credited Cash Dr. Ref. Dr. Accoui Jan.7 S. Mahay 4 4000 Jan.7 B. Santos 2000 Jan. 10 15500 Jan. 13 - B. Corpas 4 3528 72 Jan 13 4 J. Revere 1470 30 Jan. 20 20100 Jan. 21 S. Mahay 882 18 Jan. 31 21300 68780 120 Journal CR1 Sales Revenue Cr. Other Accounts Cr. eivable Cr. Cost of Good Sold Dr. Inventory Cr. 4000 2000 i i i 15500 9300 3600 i 1500 20100 12060 900 21300 12780 12000 56900 34140 Cash Payments Journal Other Accounts Dr. Accounts Payable Dr. Account Debited Ref. Inventory 120 235 S. Meek i 9000 D. Saito 11000 Rent Expense 729 1000 Owner's Drawings 306 i 800 15000 D. Saito S. Meek 14000 Salaries and Wages Expense 627 8100 10135 49000 sh Payments Journal CP1 ccounts Payable Dr. Supplies Dr. Inventory Cr. Cash Cr. 235 9000 180 8820 11000 110 10890 1000 i 800 400 400 15000 i 150 14850 14000 280 13720 200 200 i 8100 600 49000 720 59015 cord the January transactions in a two-column general journal. (Credit account titles are automatically indented when me amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Credit Debit Account Titles and Explanation Sales Returns and Allowances 300 n. 9 300 Accounts Receivable (Issued credit for merchandise returned.) 19710 ng Inventory 19710 Cost of Goods Sold (Cost of merchandise returned.) Accounts Payable 200 n. 18 200 Inventory (Received credit for returned goods.) Accounts Payable 15000 n. 21 15000 notes payable (Payment of balance due.) Trial Balance Account Titles Dr. Cr. Dr. Cash 50835 Accounts Receivable 19800 Notes Receivable 39000 Inventory 18000 Supplies 1600 Prepaid Insurance 2000 Equipment 6450 i Accum. Depreciation-Equipment Notes Payable 1500 Accounts Payable Interest Payable Owner's Capital 300 Owner's Drawings 4 Sales Revenue Sales Returns and Allowances Owner's Capital Owner's Drawings 800 Sales Revenue Sales Returns and Allowances Sales Discounts Cost of Goods Sold Salaries and Wages Expense Rent Expense Totals Supplies Expense Insurance Expense Depreciation Expense Interest Expense Totals Net Income Totals Adjusted Trial Balance Income Statement Dr. Cr. Dr. i i i 1 i Income Statement Balance Sheet Dr. Cr. Dr. Cr. i i i i i i i i i i i i i i i i i Acceptable correct answers also include: 0 i Prepare a trial balance at January 31, 2020, in the trial balance columns of the worksheet. Complete the worksheet using the following additional information. 1. Office supplies at January 31 total $900. 2. Insurance coverage expires on October 31, 2020. Annual depreciation on the equipment is $1,500. Interest of $50 has accrued on the note payable. 3. 4 Income Statement Balance Sheet Dr. Cr. Dr. Cr i 1 i 1