undefined

undefined

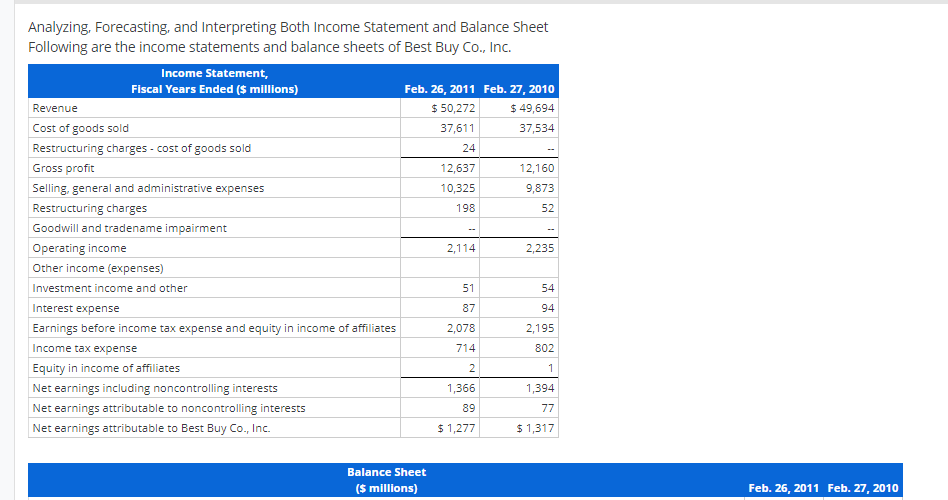

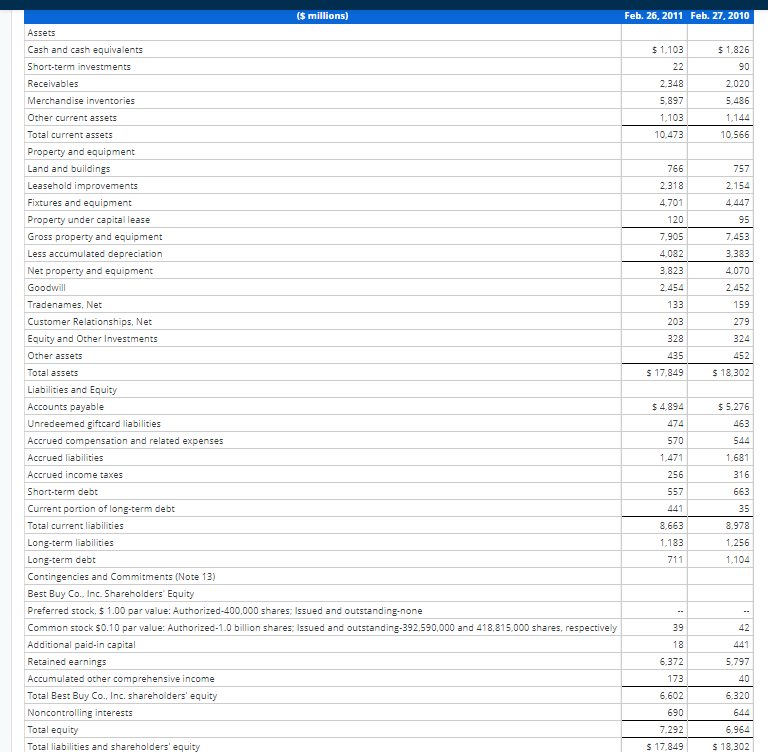

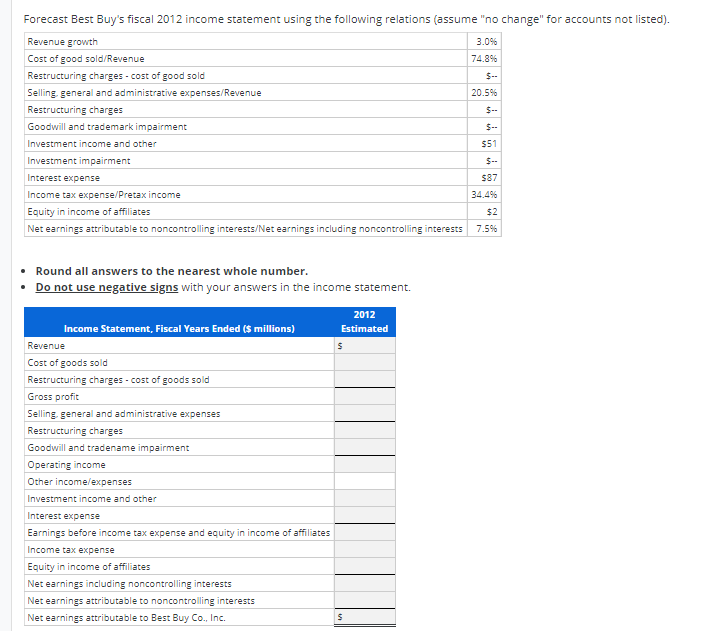

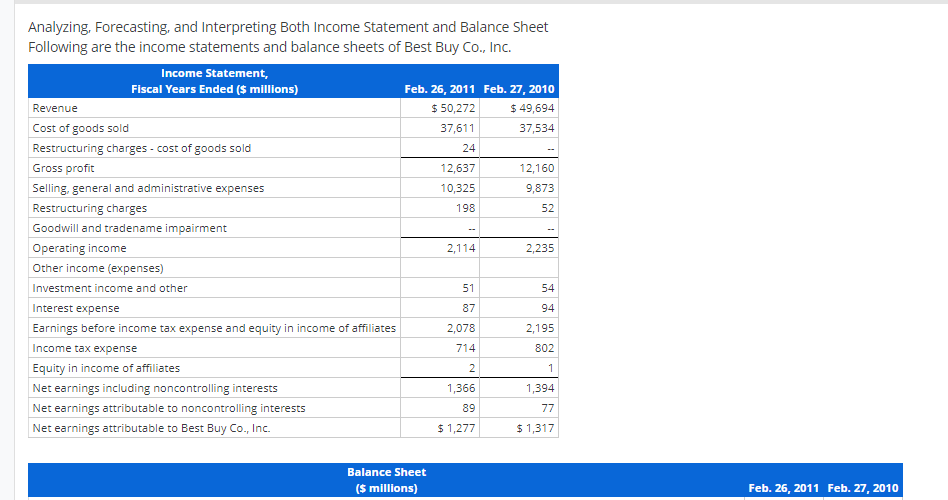

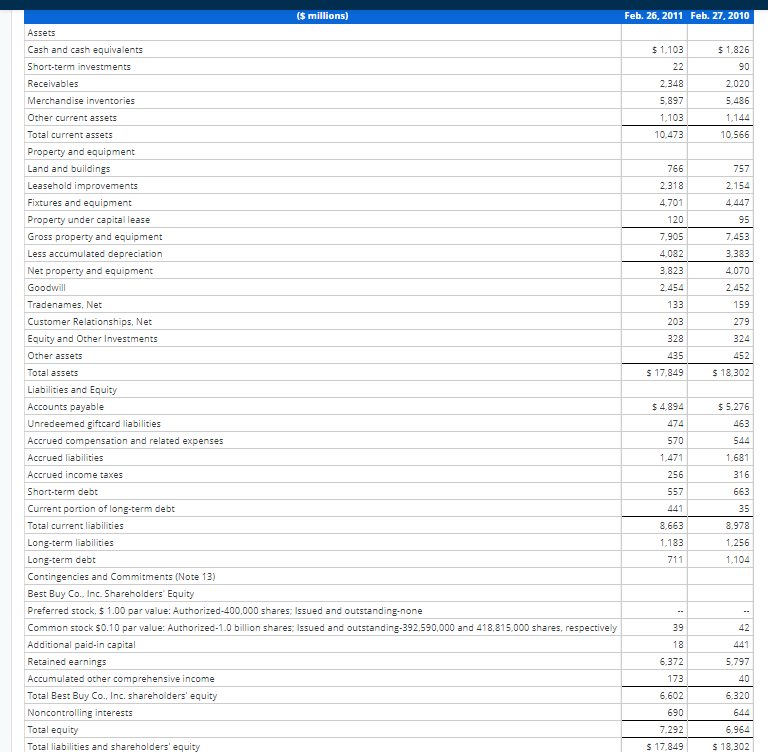

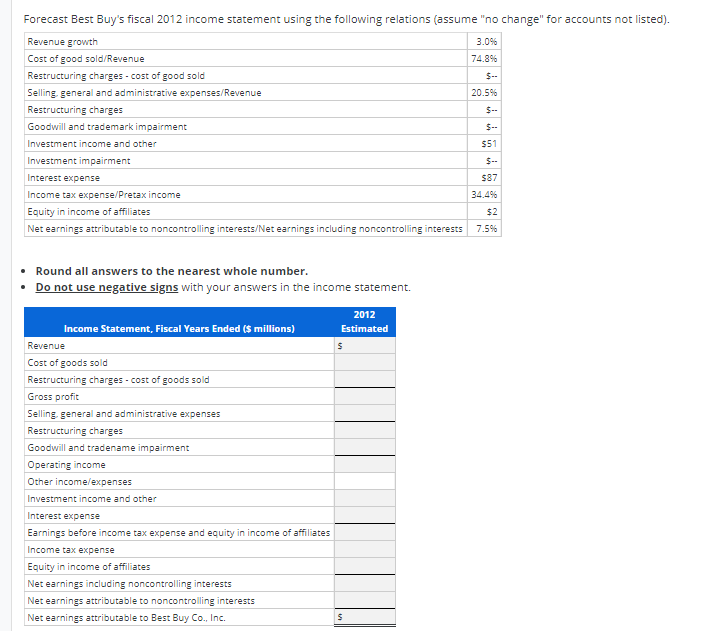

Analyzing, Forecasting, and Interpreting Both Income Statement and Balance Sheet Following are the income statements and balance sheets of Best Buy Co., Inc. Income Statement, Fiscal Years Ended ($ millions) Feb. 26, 2011 Feb. 27, 2010 Revenue $ 50,272 $ 49,694 Cost of goods sold 37,611 37,534 Restructuring charges - cost of goods sold 24 Gross profit 12,637 12,160 Selling, general and administrative expenses 10,325 9,873 Restructuring charges 198 52 Goodwill and tradename impairment Operating income 2,114 2,235 Other income (expenses) Investment income and other 51 54 Interest expense 87 Earnings before income tax expense and equity in income of affiliates 2,078 2,195 Income tax expense 714 802 Equity in income of affiliates 2 Net earnings including noncontrolling interests 1,366 1,394 Net earnings attributable to noncontrolling interests 89 77 Net earnings attributable to Best Buy Co., Inc. $ 1,277 $ 1,317 94 1 Balance Sheet ($ millions) Feb. 26, 2011 Feb. 27, 2010 ($ millions) Feb. 26, 2011 Feb. 27, 2010 Assets Cash and cash equivalents $ 1.103 $ 1,826 Short-term investments 22 90 Receivables 2.348 2020 Merchandise inventories 5,897 5.486 Other current assets 1,103 1,144 Total current assets 10,473 10.566 Property and equipment Land and buildings 766 757 Leasehold improvements 2.318 2.154 Fixtures and equipment 4.701 4,447 Property under capital lease 120 95 Gross property and equipment 7,905 7,453 Less accumulated depreciation 4,082 3.383 Net property and equipment 3,823 4,070 Goodwill 2.454 2,452 Tradenames, Net 133 159 Customer Relationships, Net 203 279 Equity and Other Investments 328 324 Other assets 435 452 Total assets $ 17.849 $ 18.302 Liabilities and Equity Accounts payable $ 4.894 $ 5.276 Unredeemed giftcard liabilities 474 463 Accrued compensation and related expenses 570 544 Accrued liabilities 1,471 1,681 Accrued income taxes 256 316 Short-term debt 557 663 Current portion of long-term debt 35 Total current liabilities 8.663 8.978 Long-term liabilities 1,183 1,256 Long-term debt 711 1,104 Contingencies and Commitments (Note 13) Best Buy Co. Inc. Shareholders' Equity Preferred stock, $ 1.00 par value: Authorized-400,000 shares: Issued and outstanding-none Common stock $0.10 par value: Authorized-1.0 billion shares: Issued and outstanding-392.590,000 and 418,815.000 shares, respectively 39 42 Additional paid.in capital 18 441 Retained earnings 6,372 5.797 Accumulated other comprehensive income 173 40 Total Best Buy Co., Inc. shareholders' equity 6,602 6.320 Noncontrolling interests 690 644 Total equity 7,292 6,964 Total liabilities and shareholders' equity $ 17,849 $ 18.302 Forecast Best Buy's fiscal 2012 income statement using the following relations (assume "no change" for accounts not listed). Revenue growth 3.0% Cost of good sold/Revenue 74.89 Restructuring charges - cost of good sold Selling general and administrative expenses/Revenue 20.5% Restructuring charges S- Goodwill and trademark impairment Investment income and other S51 Investment impairment Interest expense 587 Income tax expense/Pretax income 34.4% Equity in income of affiliates $2 Net earnings attributable to noncontrolling interests/Net earnings including noncontrolling interests 7.5% Round all answers to the nearest whole number. Do not use negative signs with your answers in the income statement. 2012 Estimated S Income Statement, Fiscal Years Ended ($ millions) Revenue Cost of goods sold Restructuring charges - cost of goods sold Gross profit Selling general and administrative expenses Restructuring charges Goodwill and tradename impairment Operating income Other income/expenses Investment income and other Interest expense Earnings before income tax expense and equity in income of affiliates Income tax expense Equity in income of affiliates Net earnings including noncontrolling interests Net earnings attributable to noncontrolling interests Net earnings attributable to Best Buy Co., Inc. S

undefined

undefined