undefined

undefined

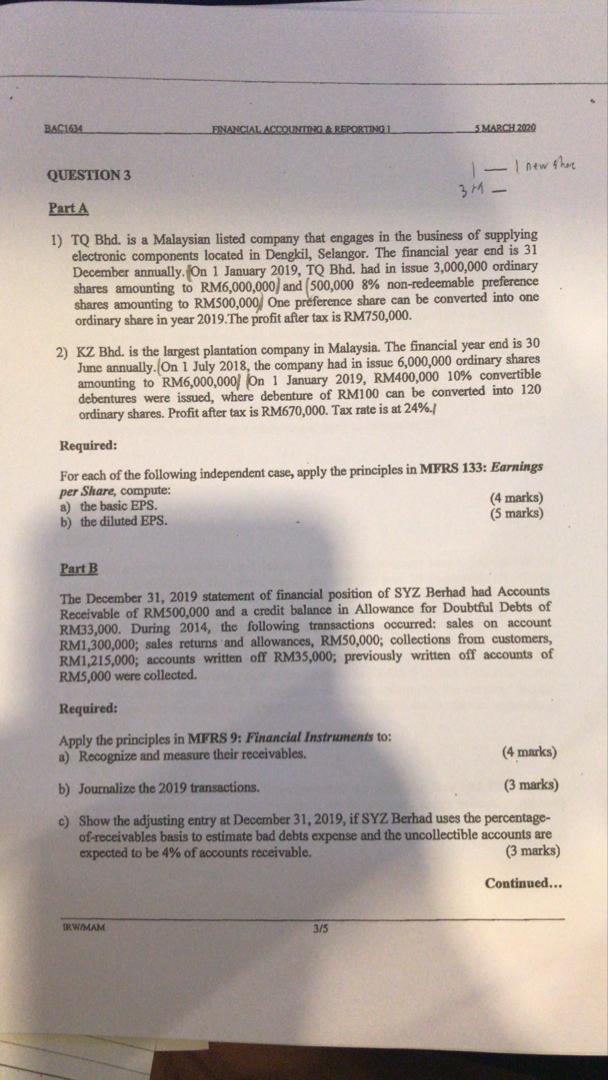

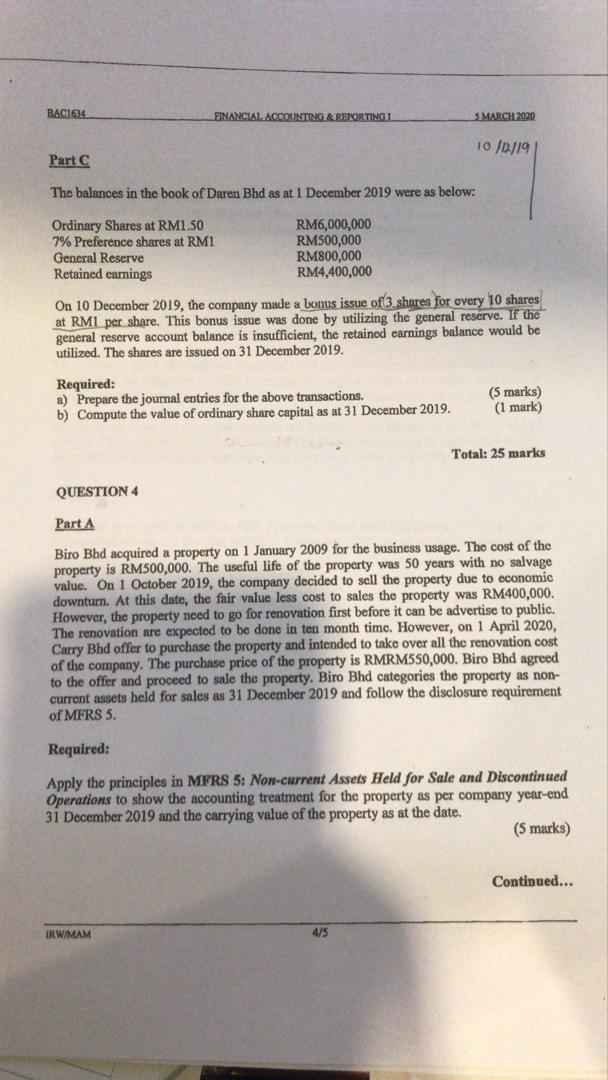

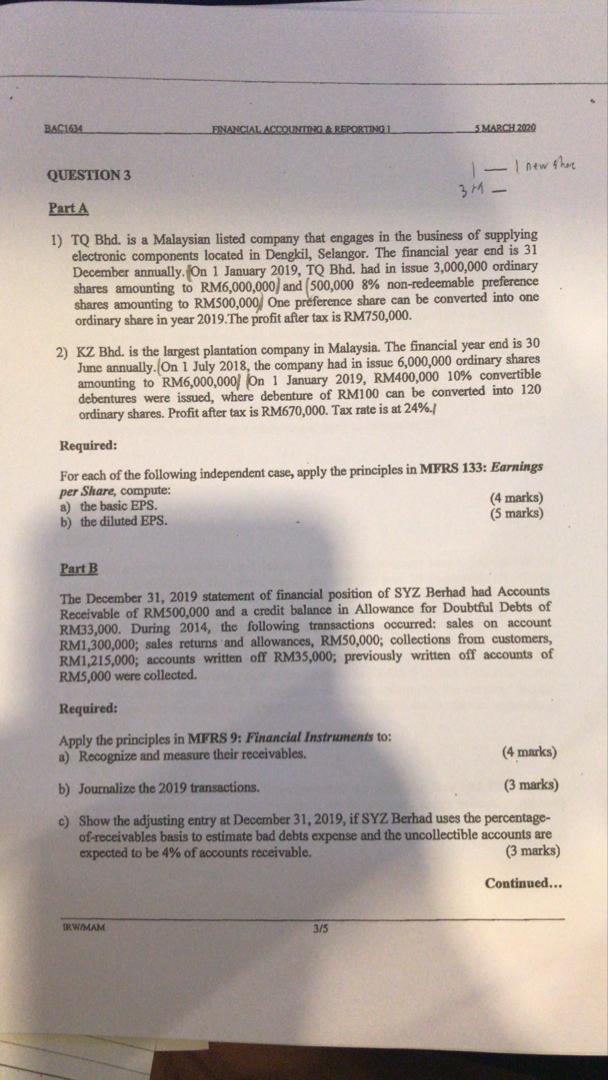

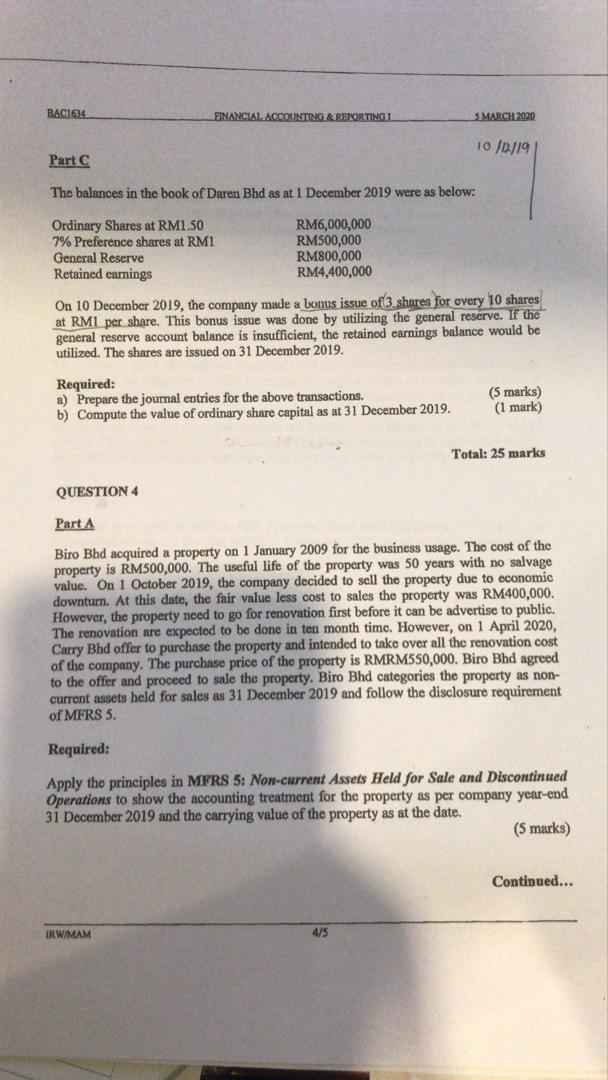

BAC1634 FINANCIAL ACCOUNTING A REPORTING 1 5 MARCH 2020 QUESTION 3 - 1 new sher 3M - Part A 1) TO Bhd. is a Malaysian listed company that engages in the business of supplying electronic components located in Dengkil, Selangor. The financial year end is 31 December annually. On 1 January 2019, TQ Bhd. had in issue 3,000,000 ordinary shares amounting to RM6,000,000) and (500,000 8% non-redeemable preference shares amounting to RM500,000) One preference share can be converted into one ordinary share in year 2019. The profit after tax is RM750,000. 2) KZ Bhd. is the largest plantation company in Malaysia. The financial year end is 30 June annually. On 1 July 2018, the company had in issue 6,000,000 ordinary shares amounting to RM6,000,000) on 1 January 2019, RM400,000 10% convertible debentures were issued, where debenture of RM100 can be converted into 120 ordinary shares. Profit after tax is RM670,000. Tax rate is at 24%. Required: For each of the following independent case, apply the principles in MFRS 133: Earnings per Share, compute: a) the basic EPS. (4 marks) b) the diluted EPS. (5 marks) Part B The December 31, 2019 statement of financial position of SYZ Berhad had Accounts Receivable of RM500,000 and a credit balance in Allowance for Doubtful Debts of RM33,000. During 2014, the following transactions occurred: sales on account RM1,300,000; sales returns and allowances, RM50,000; collections from customers, RM1,215,000; accounts written off RM35,000; previously written off accounts of RM5,000 were collected Required: Apply the principles in MFRS 9: Financial Instruments to: a) Rocognize and measure their receivables. (4 marks) b) Journalize the 2019 transactions. (3 marks) c) Show the adjusting entry at December 31, 2019, if SYZ Berhad uses the percentage- of-receivables basis to estimate bad debts expense and the uncollectible accounts are expected to be 4% of accounts receivable. (3 marks) Continued... RWIMAM 3/5 BAC1634 FINANCIAL ACCOUNTING REPORTING 5 MARCH 2020 10/02/19 Part The balances in the book of Daren Bhd as at 1 December 2019 were as below: Ordinary Shares at RM1.50 RM6,000,000 7% Preference shares at RMI RM500,000 General Reserve RM800,000 Retained earnings RM4,400,000 On 10 December 2019, the company made a bonus issue of 3 shares for overy 10 shares at RM1 per share. This bonus issue was done by utilizing the general reserve. If the general reserve account balance is insufficient, the retained earnings balance would be utilized. The shares are issued on 31 December 2019. Required: a) Prepare the journal entries for the above transactions. b) Compute the value of ordinary share capital as at 31 December 2019. (5 marks) (1 mark) Total: 25 marks QUESTION 4 Part A Biro Bhd acquired a property on 1 January 2009 for the business usage. The cost of the property is RM500,000. The useful life of the property was 50 years with no salvage value. On 1 October 2019, the company decided to sell the property due to economic downturn. At this date, the fair value less cost to sales the property was RM400,000. However, the property need to go for renovation first before it can be advertise to public. The renovation are expected to be done in ten month time. However, on 1 April 2020, Carry Bhd offer to purchase the property and intended to take over all the renovation cost of the company. The purchase price of the property is RMRM550,000. Biro Bhd agreed to the offer and proceed to sale the property. Biro Bhd categories the property as non- current assets held for sales as 31 December 2019 and follow the disclosure requirement of MFRS 5. Required: Apply the principles in MFRS 5: Non-current Assets Held for Sale and Discontinued Operations to show the accounting treatment for the property as per company year-end 31 December 2019 and the carrying value of the property as at the date. (5 marks) Continued... IRW/MAM 4/5

undefined

undefined