undefined

undefined

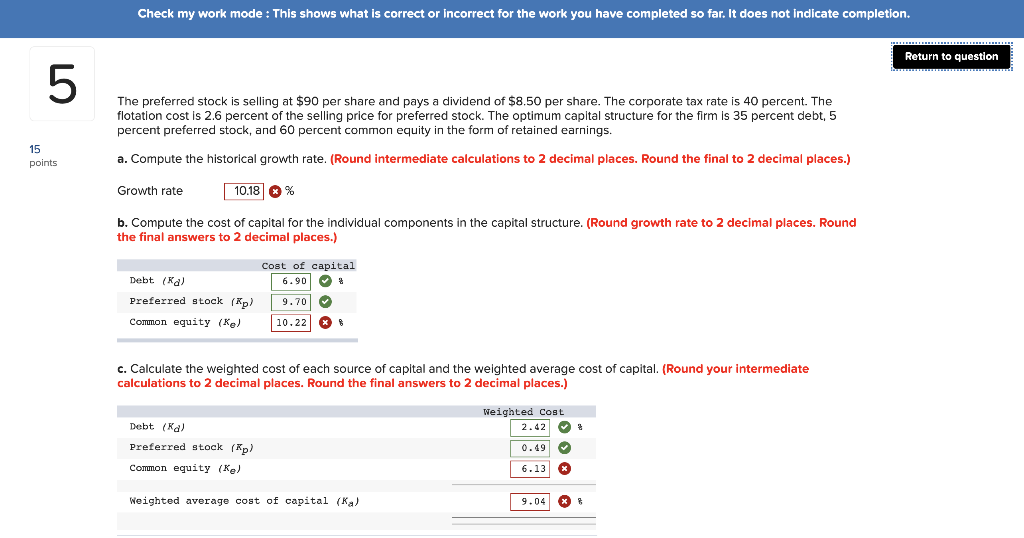

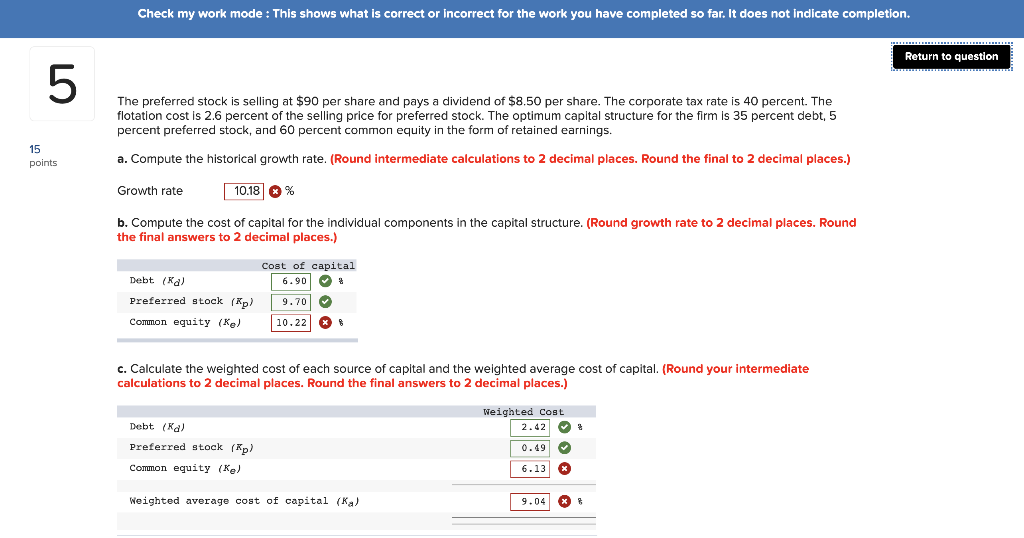

Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 5 The preferred stock is selling at $90 per share and pays a dividend of $8.50 per share. The corporate tax rate is 40 percent. The flotation cost is 2.6 percent of the selling price for preferred stock. The optimum capital structure for the firm is 35 percent debt, 5 percent preferred stock, and 60 percent common equity in the form of retained earnings. 15 points a. Compute the historical growth rate. (Round intermediate calculations to 2 decimal places. Round the final to 2 decimal places.) Growth rate 10.18 * % b. Compute the cost of capital for the individual components in the capital structure. (Round growth rate to 2 decimal places. Round the final answers to 2 decimal places.) Cost of capital 6.90 % Debt (ka) Preferred stock (Kp Common equity (K) 9.70 10.22 X c. Calculate the weighted cost of each source of capital and the weighted average cost of capital. (Round your intermediate calculations to 2 decimal places. Round the final answers to 2 decimal places.) Weighted Cost 2.42 Debt (d) Preferred stock (Kp) Common equity (K) 0.49 6.13 Weighted average cost of capital (Kg) 9.04 Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question 5 The preferred stock is selling at $90 per share and pays a dividend of $8.50 per share. The corporate tax rate is 40 percent. The flotation cost is 2.6 percent of the selling price for preferred stock. The optimum capital structure for the firm is 35 percent debt, 5 percent preferred stock, and 60 percent common equity in the form of retained earnings. 15 points a. Compute the historical growth rate. (Round intermediate calculations to 2 decimal places. Round the final to 2 decimal places.) Growth rate 10.18 * % b. Compute the cost of capital for the individual components in the capital structure. (Round growth rate to 2 decimal places. Round the final answers to 2 decimal places.) Cost of capital 6.90 % Debt (ka) Preferred stock (Kp Common equity (K) 9.70 10.22 X c. Calculate the weighted cost of each source of capital and the weighted average cost of capital. (Round your intermediate calculations to 2 decimal places. Round the final answers to 2 decimal places.) Weighted Cost 2.42 Debt (d) Preferred stock (Kp) Common equity (K) 0.49 6.13 Weighted average cost of capital (Kg) 9.04

undefined

undefined