undefined

undefined

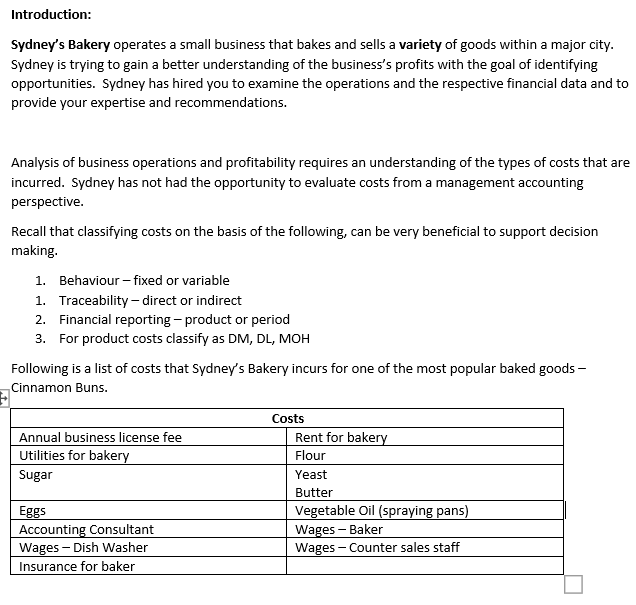

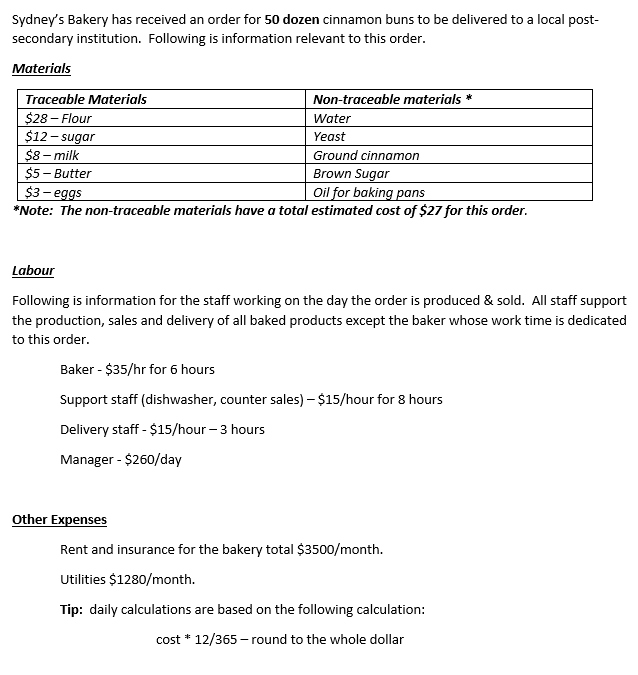

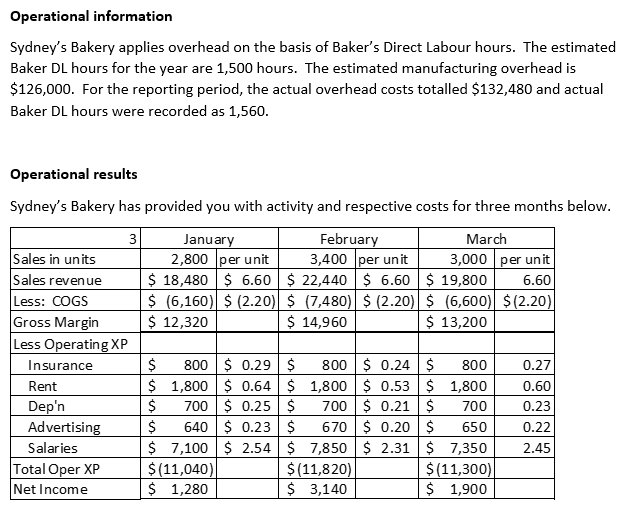

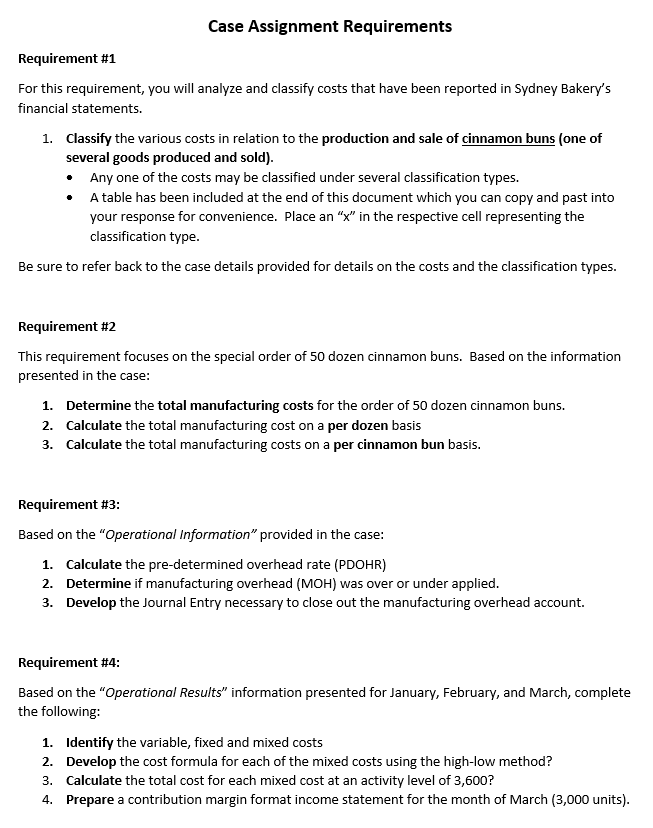

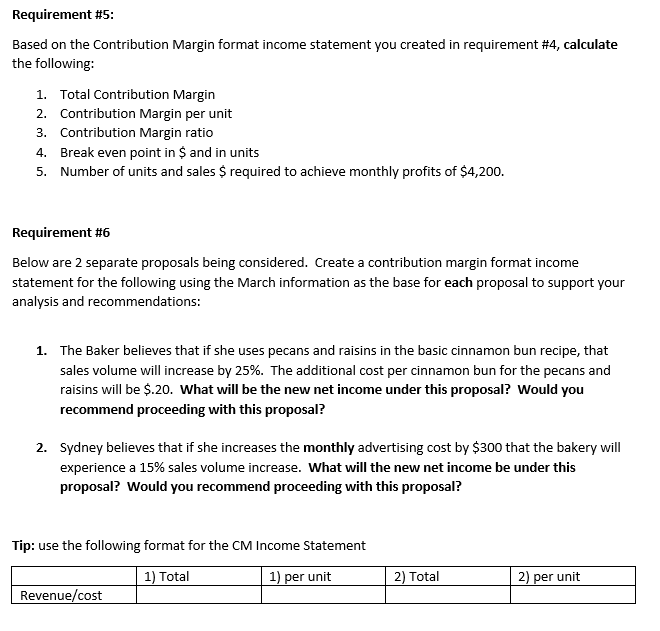

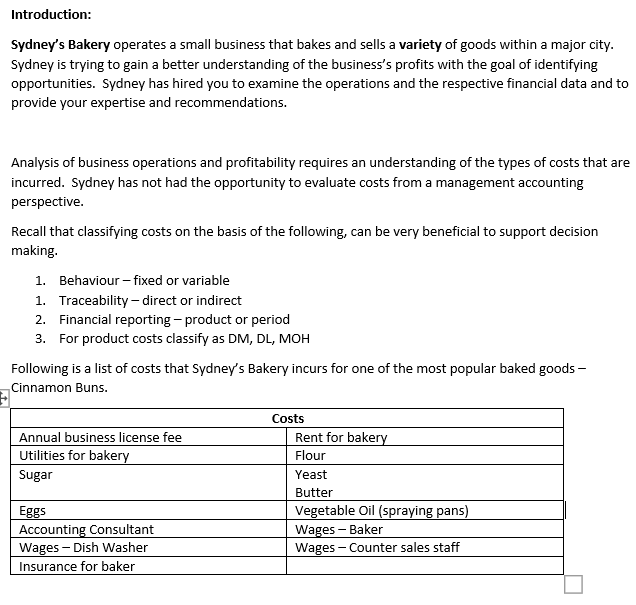

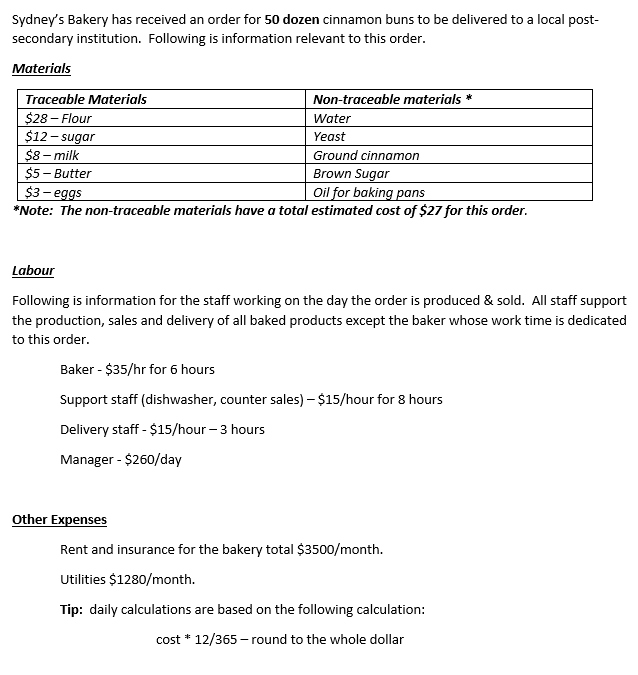

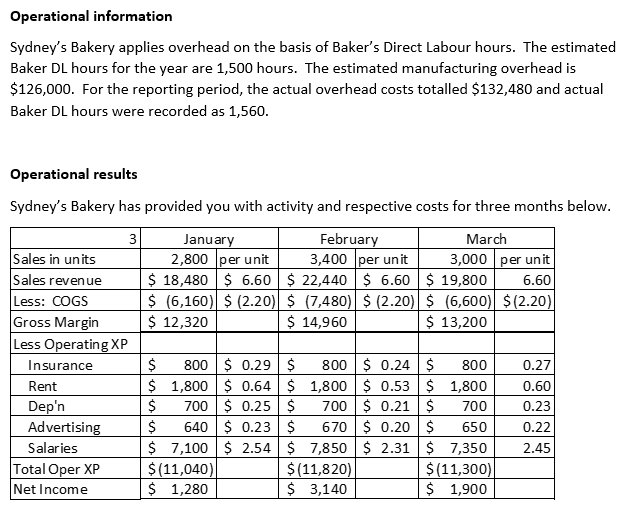

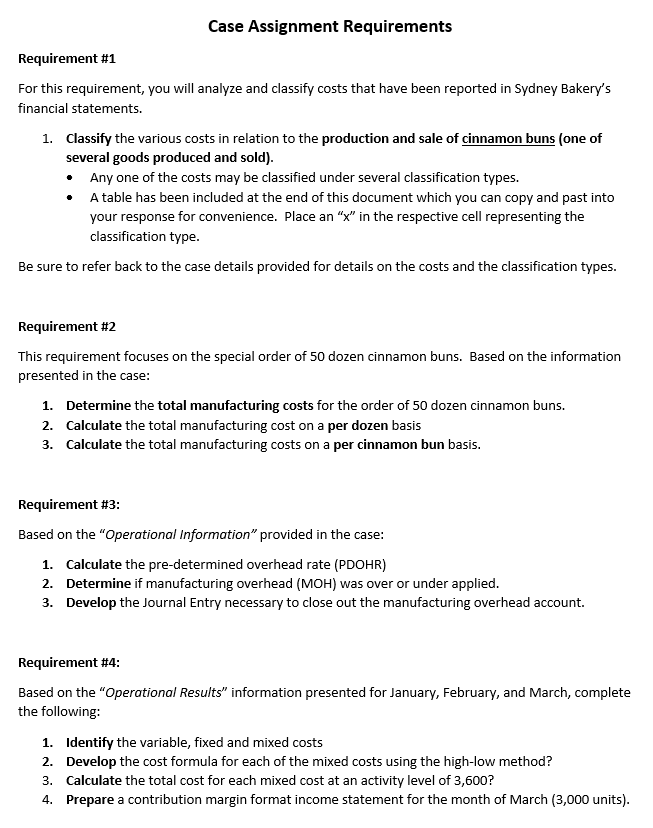

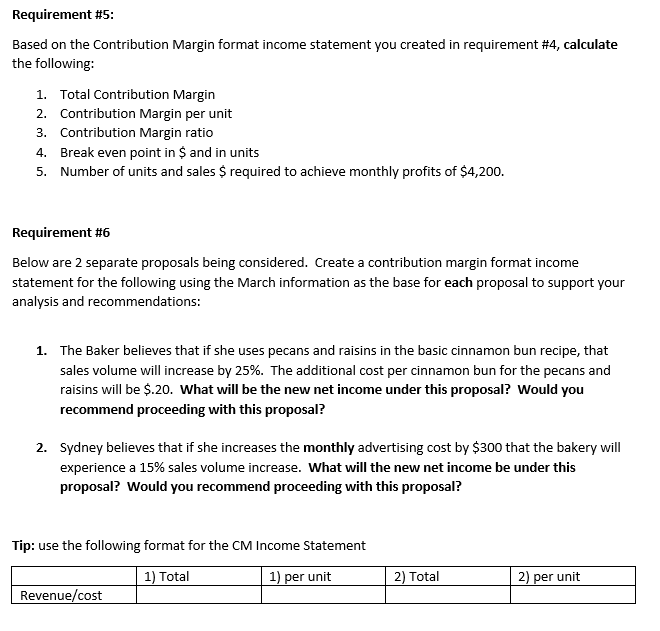

Introduction: Sydney's Bakery operates a small business that bakes and sells a variety of goods within a major city. Sydney is trying to gain a better understanding of the business's profits with the goal of identifying opportunities. Sydney has hired you to examine the operations and the respective financial data and to provide your expertise and recommendations. Analysis of business operations and profitability requires an understanding of the types of costs that are incurred. Sydney has not had the opportunity to evaluate costs from a management accounting perspective. Recall that classifying costs on the basis of the following, can be very beneficial to support decision making. 1. Behaviour - fixed or variable 1. Traceability - direct or indirect 2. Financial reporting - product or period 3. For product costs classify as DM, DL, MOH Following is a list of costs that Sydney's Bakery incurs for one of the most popular baked goods- Cinnamon Buns. Annual business license fee Utilities for bakery Sugar Costs Rent for bakery Flour Yeast Butter Vegetable Oil (spraying pans) Wages - Baker Wages - Counter sales staff Eggs Accounting Consultant Wages - Dish Washer Insurance for baker Sydney's Bakery has received an order for 50 dozen cinnamon buns to be delivered to a local post- secondary institution. Following is information relevant to this order. Materials Traceable Materials Non-traceable materials * $28 - Flour Water $12-sugar Yeast $8-milk Ground cinnamon $5 - Butter Brown Sugar $3-eggs Oil for baking pans *Note: The non-traceable materials have a total estimated cost of $27 for this order. Labour Following is information for the staff working on the day the order is produced & sold. All staff support the production, sales and delivery of all baked products except the baker whose work time is dedicated to this order. Baker - $35/hr for 6 hours Support staff dishwasher, counter sales) - $15/hour for 8 hours Delivery staff - $15/hour - 3 hours Manager - $260/day Other Expenses Rent and insurance for the bakery total $3500/month. Utilities $1280/month. Tip: daily calculations are based on the following calculation: cost * 12/365-round to the whole dollar Operational information Sydney's Bakery applies overhead on the basis of Baker's Direct Labour hours. The estimated Baker DL hours for the year are 1,500 hours. The estimated manufacturing overhead is $126,000. For the reporting period, the actual overhead costs totalled $132,480 and actual Baker DL hours were recorded as 1,560. Operational results Sydney's Bakery has provided you with activity and respective costs for three months below. 3 January February March Sales in units 2,800 per unit 3,400 per unit 3,000 per unit Sales revenue $ 18,480 $ 6.60 $ 22,440 $ 6.60 $ 19,800 6.60 Less: COGS $ (6,160) $ (2.20) $ (7,480) $ (2.20) $ (6,600) $ (2.20) Gross Margin $ 12,320 $ 14,960 $ 13,200 Less Operating XP Insurance $ 800 $ 0.29 $ 800 $ 0.24 $ 800 0.27 Rent $ 1,800 $ 0.64 $ 1,800 $ 0.53 $ 1,800 0.60 Dep'n $ 700 $ 0.25 $ 700 $ 0.21 $ 700 0.23 Advertising $ 640 $ 0.23 $ 670 $ 0.20 $ 650 0.22 Salaries $ 7,100 $ 2.54 $ 7,850 $ 2.31 $ 7,350 2.45 Total Oper XP $(11,040) $(11,820) $(11,300) Net Income $ 1,280 $ 3,140 $ 1,900 Case Assignment Requirements Requirement #1 For this requirement, you will analyze and classify costs that have been reported in Sydney Bakery's financial statements. 1. Classify the various costs in relation to the production and sale of cinnamon buns (one of several goods produced and sold). Any one of the costs may be classified under several classification types. A table has been included at the end of this document which you can copy and past into your response for convenience. Place an "x" in the respective cell representing the classification type. Be sure to refer back to the case details provided for details on the costs and the classification types. Requirement #2 This requirement focuses on the special order of 50 dozen cinnamon buns. Based on the information presented in the case: 1. Determine the total manufacturing costs for the order of 50 dozen cinnamon buns. 2. Calculate the total manufacturing cost on a per dozen basis 3. Calculate the total manufacturing costs on a per cinnamon bun basis. Requirement #3: Based on the "Operational Information provided in the case: 1. Calculate the pre-determined overhead rate (PDOHR) 2. Determine if manufacturing overhead (MOH) was over or under applied. 3. Develop the Journal Entry necessary to close out the manufacturing overhead account. Requirement #4: Based on the "Operational Results" information presented for January, February, and March, complete the following: 1. Identify the variable, fixed and mixed costs 2. Develop the cost formula for each of the mixed costs using the high-low method? 3. Calculate the total cost for each mixed cost at an activity level of 3,600? 4. Prepare a contribution margin format income statement for the month of March (3,000 units). Requirement #5: Based on the Contribution Margin format income statement you created in requirement #4, calculate the following: 1. Total Contribution Margin 2. Contribution Margin per unit 3. Contribution Margin ratio 4. Break even point in $ and in units 5. Number of units and sales $ required to achieve monthly profits of $4,200. Requirement #6 Below are 2 separate proposals being considered. Create a contribution margin format income statement for the following using the March information as the base for each proposal to support your analysis and recommendations: 1. The Baker believes that if she uses pecans and raisins in the basic cinnamon bun recipe, that sales volume will increase by 25%. The additional cost per cinnamon bun for the pecans and raisins will be $.20. What will be the new net income under this proposal? Would you recommend proceeding with this proposal? 2. Sydney believes that if she increases the monthly advertising cost by $300 that the bakery will experience a 15% sales volume increase. What will the new net income be under this proposal? Would you recommend proceeding with this proposal? Tip: use the following format for the CM Income Statement 1) Total 1) per unit Revenue/cost 2) Total 2) per unit Introduction: Sydney's Bakery operates a small business that bakes and sells a variety of goods within a major city. Sydney is trying to gain a better understanding of the business's profits with the goal of identifying opportunities. Sydney has hired you to examine the operations and the respective financial data and to provide your expertise and recommendations. Analysis of business operations and profitability requires an understanding of the types of costs that are incurred. Sydney has not had the opportunity to evaluate costs from a management accounting perspective. Recall that classifying costs on the basis of the following, can be very beneficial to support decision making. 1. Behaviour - fixed or variable 1. Traceability - direct or indirect 2. Financial reporting - product or period 3. For product costs classify as DM, DL, MOH Following is a list of costs that Sydney's Bakery incurs for one of the most popular baked goods- Cinnamon Buns. Annual business license fee Utilities for bakery Sugar Costs Rent for bakery Flour Yeast Butter Vegetable Oil (spraying pans) Wages - Baker Wages - Counter sales staff Eggs Accounting Consultant Wages - Dish Washer Insurance for baker Sydney's Bakery has received an order for 50 dozen cinnamon buns to be delivered to a local post- secondary institution. Following is information relevant to this order. Materials Traceable Materials Non-traceable materials * $28 - Flour Water $12-sugar Yeast $8-milk Ground cinnamon $5 - Butter Brown Sugar $3-eggs Oil for baking pans *Note: The non-traceable materials have a total estimated cost of $27 for this order. Labour Following is information for the staff working on the day the order is produced & sold. All staff support the production, sales and delivery of all baked products except the baker whose work time is dedicated to this order. Baker - $35/hr for 6 hours Support staff dishwasher, counter sales) - $15/hour for 8 hours Delivery staff - $15/hour - 3 hours Manager - $260/day Other Expenses Rent and insurance for the bakery total $3500/month. Utilities $1280/month. Tip: daily calculations are based on the following calculation: cost * 12/365-round to the whole dollar Operational information Sydney's Bakery applies overhead on the basis of Baker's Direct Labour hours. The estimated Baker DL hours for the year are 1,500 hours. The estimated manufacturing overhead is $126,000. For the reporting period, the actual overhead costs totalled $132,480 and actual Baker DL hours were recorded as 1,560. Operational results Sydney's Bakery has provided you with activity and respective costs for three months below. 3 January February March Sales in units 2,800 per unit 3,400 per unit 3,000 per unit Sales revenue $ 18,480 $ 6.60 $ 22,440 $ 6.60 $ 19,800 6.60 Less: COGS $ (6,160) $ (2.20) $ (7,480) $ (2.20) $ (6,600) $ (2.20) Gross Margin $ 12,320 $ 14,960 $ 13,200 Less Operating XP Insurance $ 800 $ 0.29 $ 800 $ 0.24 $ 800 0.27 Rent $ 1,800 $ 0.64 $ 1,800 $ 0.53 $ 1,800 0.60 Dep'n $ 700 $ 0.25 $ 700 $ 0.21 $ 700 0.23 Advertising $ 640 $ 0.23 $ 670 $ 0.20 $ 650 0.22 Salaries $ 7,100 $ 2.54 $ 7,850 $ 2.31 $ 7,350 2.45 Total Oper XP $(11,040) $(11,820) $(11,300) Net Income $ 1,280 $ 3,140 $ 1,900 Case Assignment Requirements Requirement #1 For this requirement, you will analyze and classify costs that have been reported in Sydney Bakery's financial statements. 1. Classify the various costs in relation to the production and sale of cinnamon buns (one of several goods produced and sold). Any one of the costs may be classified under several classification types. A table has been included at the end of this document which you can copy and past into your response for convenience. Place an "x" in the respective cell representing the classification type. Be sure to refer back to the case details provided for details on the costs and the classification types. Requirement #2 This requirement focuses on the special order of 50 dozen cinnamon buns. Based on the information presented in the case: 1. Determine the total manufacturing costs for the order of 50 dozen cinnamon buns. 2. Calculate the total manufacturing cost on a per dozen basis 3. Calculate the total manufacturing costs on a per cinnamon bun basis. Requirement #3: Based on the "Operational Information provided in the case: 1. Calculate the pre-determined overhead rate (PDOHR) 2. Determine if manufacturing overhead (MOH) was over or under applied. 3. Develop the Journal Entry necessary to close out the manufacturing overhead account. Requirement #4: Based on the "Operational Results" information presented for January, February, and March, complete the following: 1. Identify the variable, fixed and mixed costs 2. Develop the cost formula for each of the mixed costs using the high-low method? 3. Calculate the total cost for each mixed cost at an activity level of 3,600? 4. Prepare a contribution margin format income statement for the month of March (3,000 units). Requirement #5: Based on the Contribution Margin format income statement you created in requirement #4, calculate the following: 1. Total Contribution Margin 2. Contribution Margin per unit 3. Contribution Margin ratio 4. Break even point in $ and in units 5. Number of units and sales $ required to achieve monthly profits of $4,200. Requirement #6 Below are 2 separate proposals being considered. Create a contribution margin format income statement for the following using the March information as the base for each proposal to support your analysis and recommendations: 1. The Baker believes that if she uses pecans and raisins in the basic cinnamon bun recipe, that sales volume will increase by 25%. The additional cost per cinnamon bun for the pecans and raisins will be $.20. What will be the new net income under this proposal? Would you recommend proceeding with this proposal? 2. Sydney believes that if she increases the monthly advertising cost by $300 that the bakery will experience a 15% sales volume increase. What will the new net income be under this proposal? Would you recommend proceeding with this proposal? Tip: use the following format for the CM Income Statement 1) Total 1) per unit Revenue/cost 2) Total 2) per unit

undefined

undefined