undefined

undefined

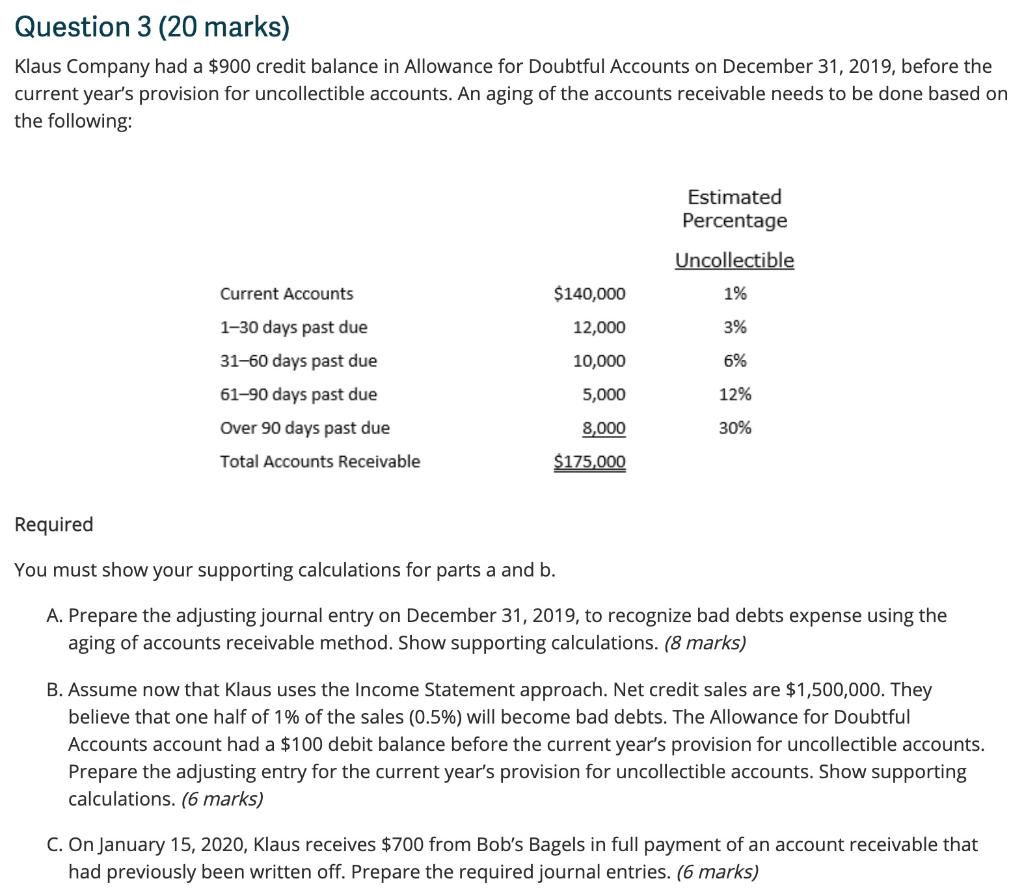

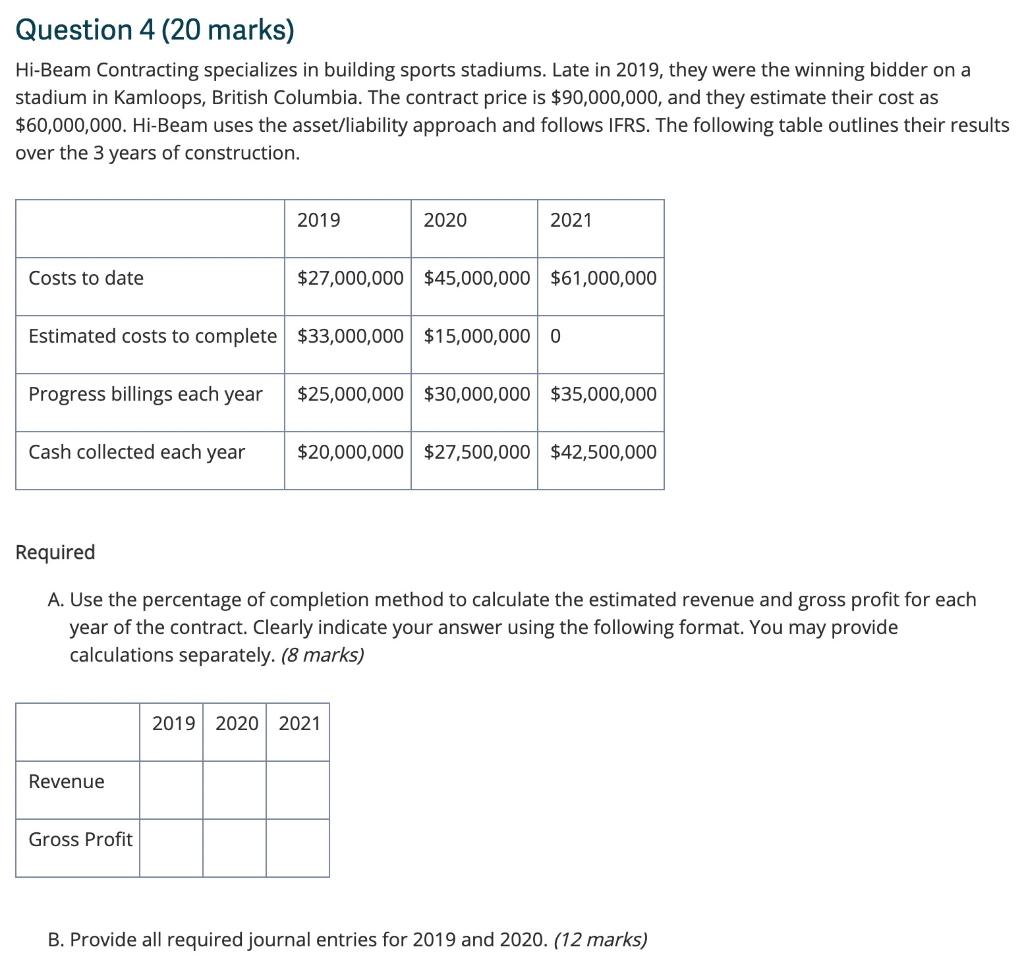

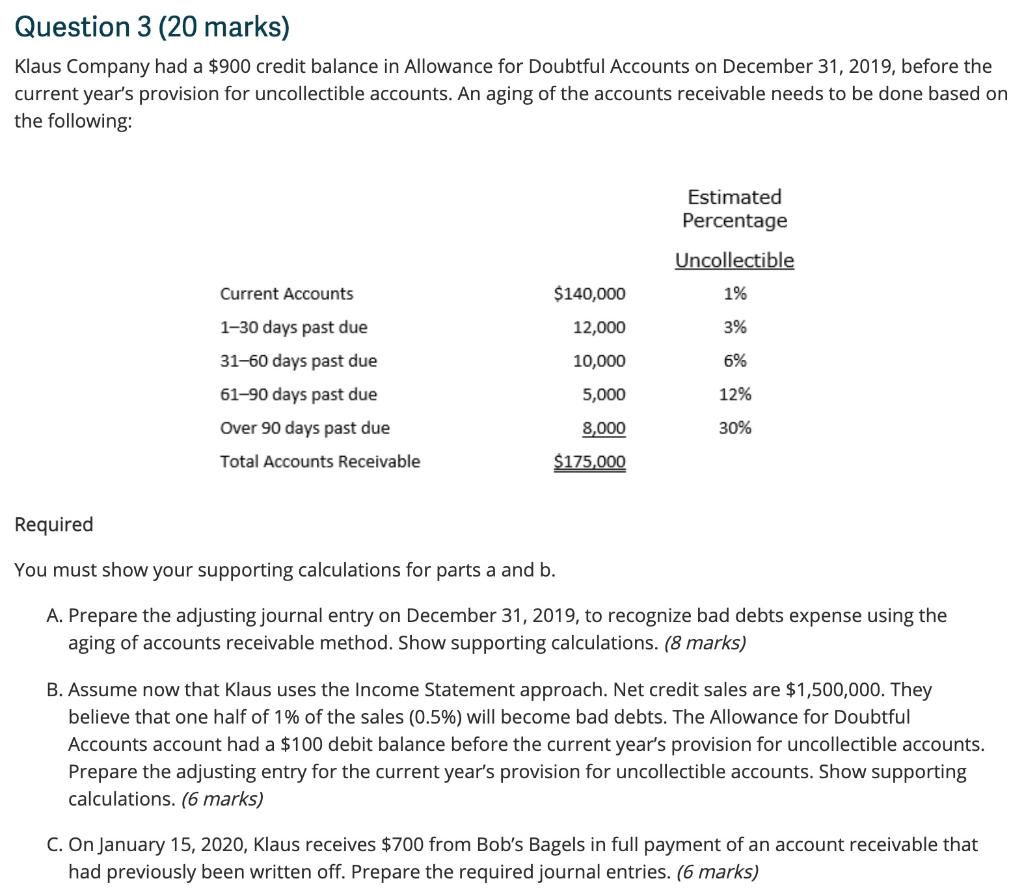

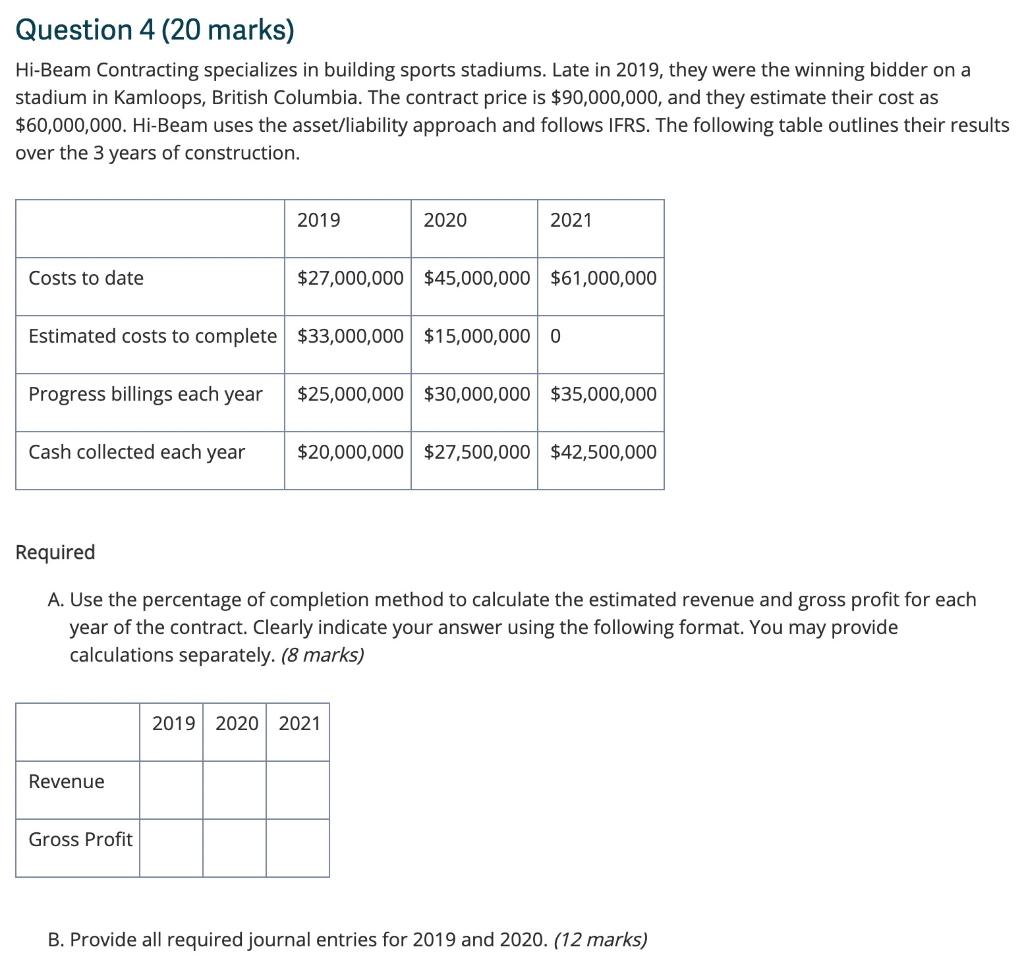

Question 3 (20 marks) Klaus Company had a $900 credit balance in Allowance for Doubtful Accounts on December 31, 2019, before the current year's provision for uncollectible accounts. An aging of the accounts receivable needs to be done based on the following: Estimated Percentage Uncollectible Current Accounts 1% $140,000 12,000 3% 10,000 6% 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due Total Accounts Receivable 5,000 12% 8,000 30% $175,000 Required You must show your supporting calculations for parts a and b. A. Prepare the adjusting journal entry on December 31, 2019, to recognize bad debts expense using the aging of accounts receivable method. Show supporting calculations. (8 marks) B. Assume now that Klaus uses the Income Statement approach. Net credit sales are $1,500,000. They believe that one half of 1% of the sales (0.5%) will become bad debts. The Allowance for Doubtful Accounts account had a $100 debit balance before the current year's provision for uncollectible accounts. Prepare the adjusting entry for the current year's provision for uncollectible accounts. Show supporting calculations. (6 marks) C. On January 15, 2020, Klaus receives $700 from Bob's Bagels in full payment of an account receivable that had previously been written off. Prepare the required journal entries. (6 marks) Question 4 (20 marks) Hi-Beam Contracting specializes in building sports stadiums. Late in 2019, they were the winning bidder on a stadium in Kamloops, British Columbia. The contract price is $90,000,000, and they estimate their cost as $60,000,000. Hi-Beam uses the asset/liability approach and follows IFRS. The following table outlines their results over the 3 years of construction. 2019 2020 2021 Costs to date $27,000,000 $45,000,000 $61,000,000 Estimated costs to complete $33,000,000 $15,000,000 0 Progress billings each year $25,000,000 $30,000,000 $35,000,000 Cash collected each year $20,000,000 $27,500,000 $42,500,000 Required A. Use the percentage of completion method to calculate the estimated revenue and gross profit for each year of the contract. Clearly indicate your answer using the following format. You may provide calculations separately. (8 marks) 2019 2020 2021 Revenue Gross Profit B. Provide all required journal entries for 2019 and 2020. (12 marks)

undefined

undefined