undefined

undefined

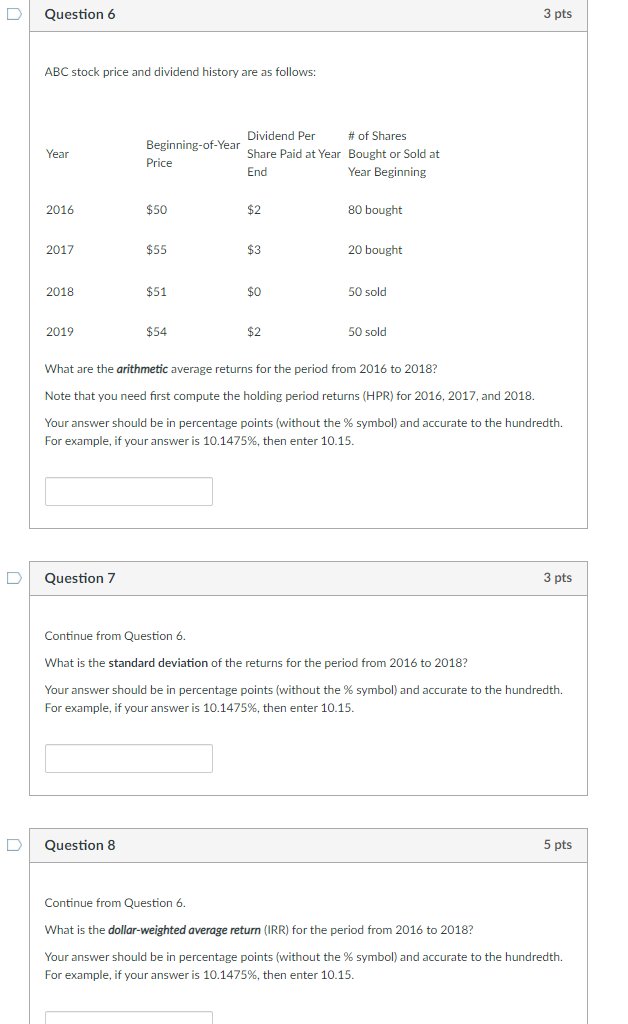

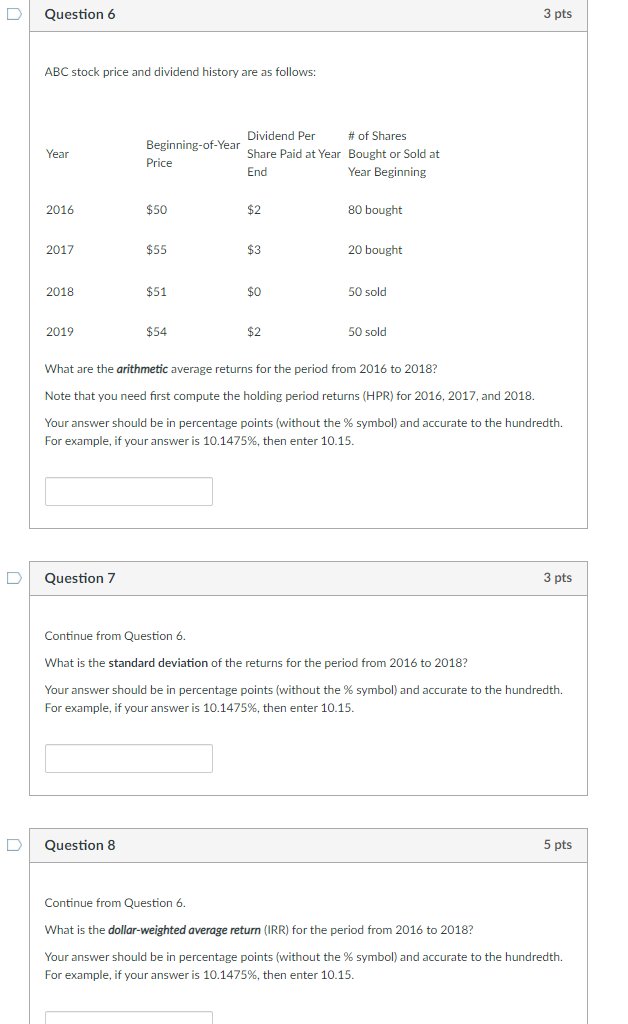

Question 6 3 pts ABC stock price and dividend history are as follows: Year Dividend Per # of Shares Beginning-of-Year Share Paid at Year Bought or Sold at Price End Year Beginning 2016 $50 $2 80 bought 2017 $55 $3 20 bought 2018 $51 $0 50 sold 2019 $54 $2 50 sold What are the arithmetic average returns for the period from 2016 to 2018? Note that you need first compute the holding period returns (HPR) for 2016, 2017, and 2018. Your answer should be in percentage points (without the % symbol) and accurate to the hundredth. For example, if your answer is 10.1475%, then enter 10.15. Question 7 3 pts Continue from Question 6. What is the standard deviation of the returns for the period from 2016 to 2018? Your answer should be in percentage points (without the % symbol) and accurate to the hundredth. For example, if your answer is 10.1475%, then enter 10.15. Question 8 5 pts Continue from Question 6. . What is the dollar-weighted average return (IRR) for the period from 2016 to 2018? Your answer should be in percentage points (without the % symbol) and accurate to the hundredth. For example, if your answer is 10.1475%, then enter 10.15. Question 6 3 pts ABC stock price and dividend history are as follows: Year Dividend Per # of Shares Beginning-of-Year Share Paid at Year Bought or Sold at Price End Year Beginning 2016 $50 $2 80 bought 2017 $55 $3 20 bought 2018 $51 $0 50 sold 2019 $54 $2 50 sold What are the arithmetic average returns for the period from 2016 to 2018? Note that you need first compute the holding period returns (HPR) for 2016, 2017, and 2018. Your answer should be in percentage points (without the % symbol) and accurate to the hundredth. For example, if your answer is 10.1475%, then enter 10.15. Question 7 3 pts Continue from Question 6. What is the standard deviation of the returns for the period from 2016 to 2018? Your answer should be in percentage points (without the % symbol) and accurate to the hundredth. For example, if your answer is 10.1475%, then enter 10.15. Question 8 5 pts Continue from Question 6. . What is the dollar-weighted average return (IRR) for the period from 2016 to 2018? Your answer should be in percentage points (without the % symbol) and accurate to the hundredth. For example, if your answer is 10.1475%, then enter 10.15

undefined

undefined