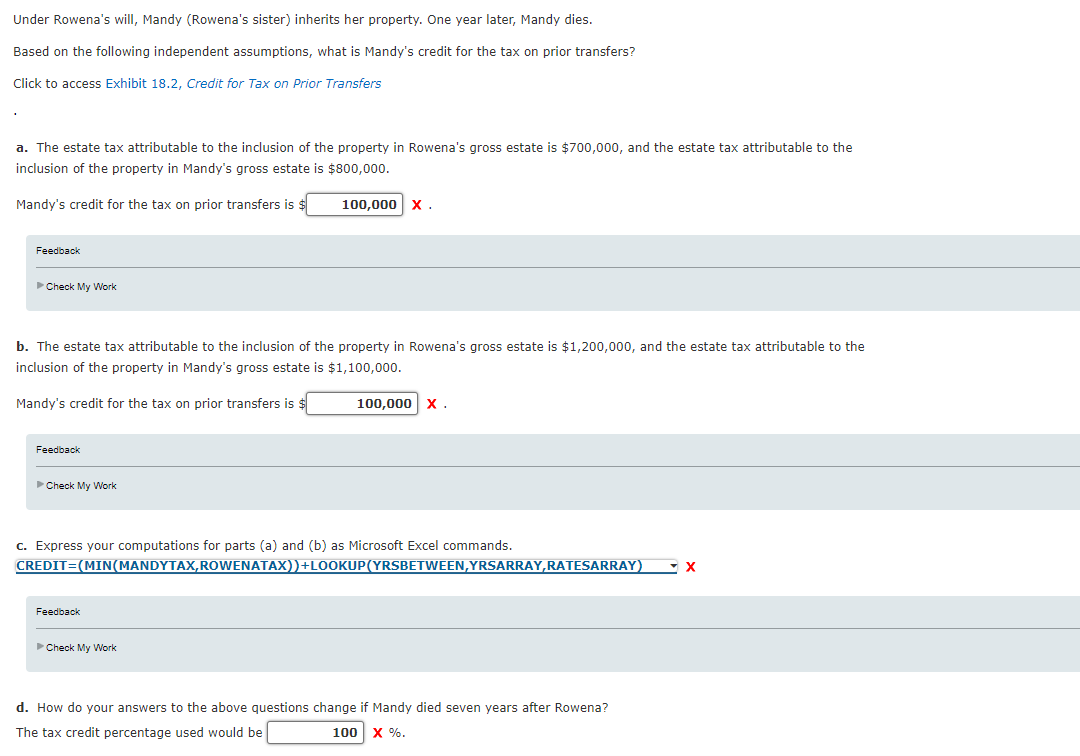

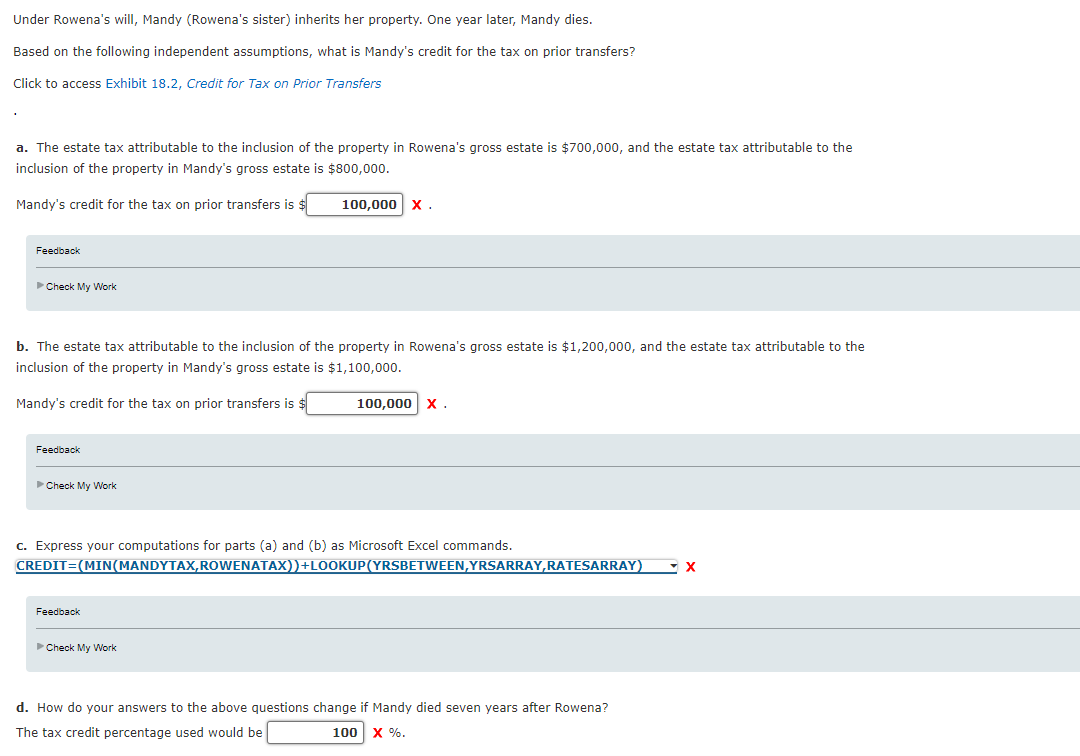

Under Rowena's will, Mandy (Rowena's sister) inherits her property. One year later, Mandy dies. Based on the following independent assumptions, what is Mandy's credit for the tax on prior transfers? Click to access Exhibit 18.2, Credit for Tax on Prior Transfers a. The estate tax attributable to the inclusion of the property in Rowena's gross estate is $700,000, and the estate tax attributable to the inclusion of the property in Mandy's gross estate is $800,000. Mandy's credit for the tax on prior transfers is X. Feedback Check My Work b. The estate tax attributable to the inclusion of the property in Rowena's gross estate is $1,200,000, and the estate tax attributable to the inclusion of the property in Mandy's gross estate is $1,100,000. Mandy's credit for the tax on prior transfers is $ X Feedback Check My Work C. Express your computations for parts (a) and (b) as Microsoft Excel commands. CREDIT =( MIN(MANDYTAX,ROWENATAX ))+ LOOKUP(YRSBETWEEN,YRSARRAY,RATESARRAY) X Feedback Check My Work d. How do your answers to the above questions change if Mandy died seven years after Rowena? The tax credit percentage used would be X%. Under Rowena's will, Mandy (Rowena's sister) inherits her property. One year later, Mandy dies. Based on the following independent assumptions, what is Mandy's credit for the tax on prior transfers? Click to access Exhibit 18.2, Credit for Tax on Prior Transfers a. The estate tax attributable to the inclusion of the property in Rowena's gross estate is $700,000, and the estate tax attributable to the inclusion of the property in Mandy's gross estate is $800,000. Mandy's credit for the tax on prior transfers is X. Feedback Check My Work b. The estate tax attributable to the inclusion of the property in Rowena's gross estate is $1,200,000, and the estate tax attributable to the inclusion of the property in Mandy's gross estate is $1,100,000. Mandy's credit for the tax on prior transfers is $ X Feedback Check My Work C. Express your computations for parts (a) and (b) as Microsoft Excel commands. CREDIT =( MIN(MANDYTAX,ROWENATAX ))+ LOOKUP(YRSBETWEEN,YRSARRAY,RATESARRAY) X Feedback Check My Work d. How do your answers to the above questions change if Mandy died seven years after Rowena? The tax credit percentage used would be X%