Answered step by step

Verified Expert Solution

Question

1 Approved Answer

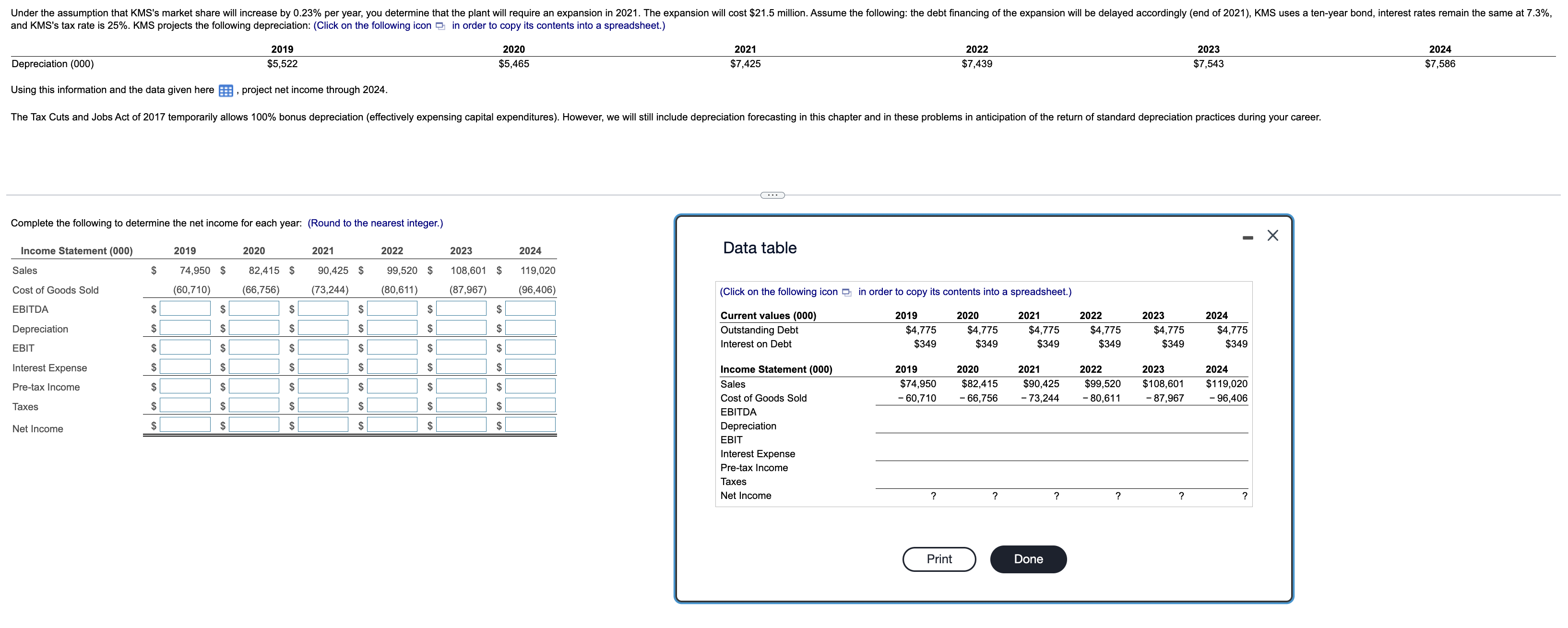

Under the assumption that KMS ' s market share will increase by 0 . 2 3 % per year, you determine that the plant will

Under the assumption that KMSs market share will increase by per year, you determine that the plant will require an expansion in The expansion will cost $ million. Assume the following: the debt financing of the expansion will be delayed accordinglyend of KMS uses a tenyear bond, interest rates remain the same at and KMSs tax rate is KMS projects the following depreciation: Click on the following icon in order to copy its contents into a spreadsheet.

Depreciation

$ comma

$ comma

$ comma

$ comma

$ comma

$ comma

Using this information and the data given here LOADING... project net income through

The Tax Cuts and Jobs Act of temporarily allows bonus depreciationeffectively expensing capital expenditures However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career.

Question content area bottom

Part

Complete the following to determine the net income for each year: Round to the nearest integer.

Income Statement

Sales

$

$

$

$

$

$

Cost of Goods Sold

EBITDA

$

$

$

$

$

$

Depreciation

$

$

$

$

$

$

EBIT

$

$

$

$

$

$

Interest Expense

$

$

$

$

$

$

Pretax Income

$

$

$

$

$

$

Taxes

$

$

$

$

$

$

Net Income

$

$

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started