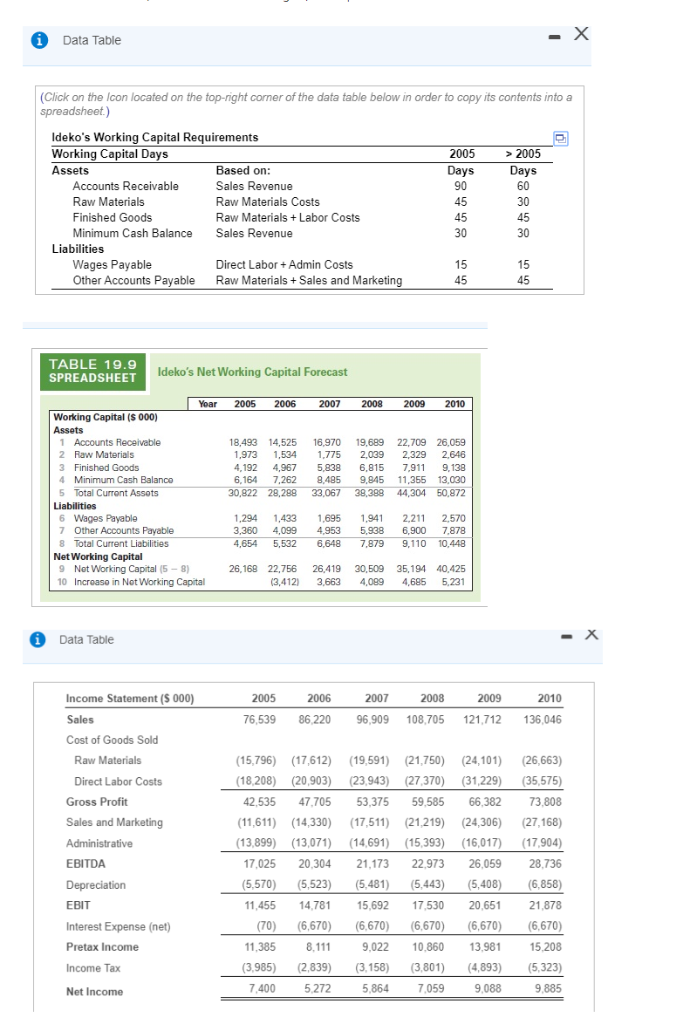

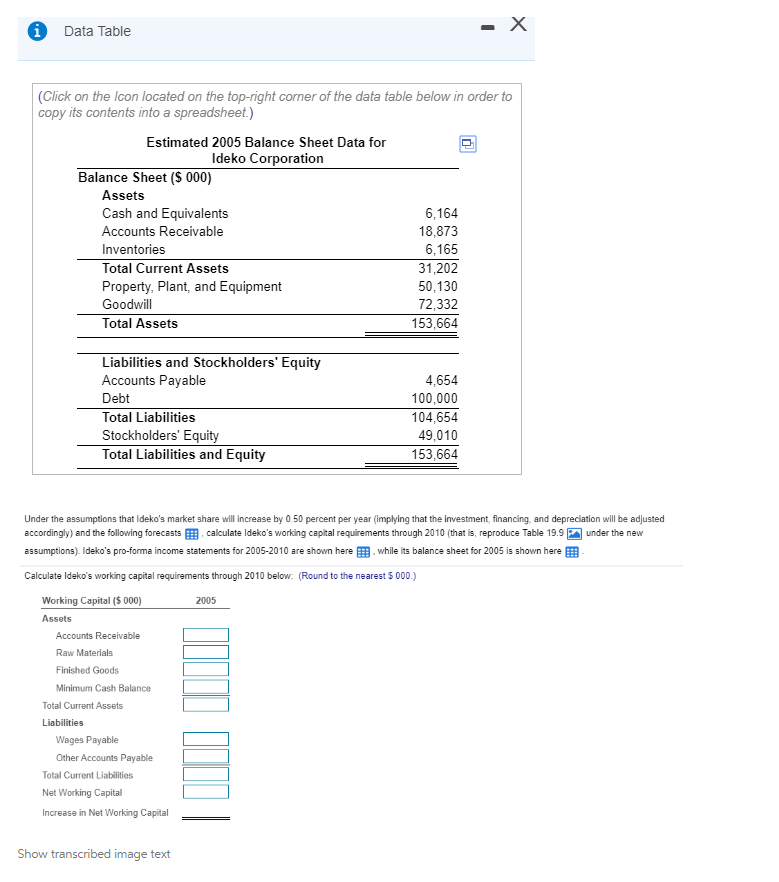

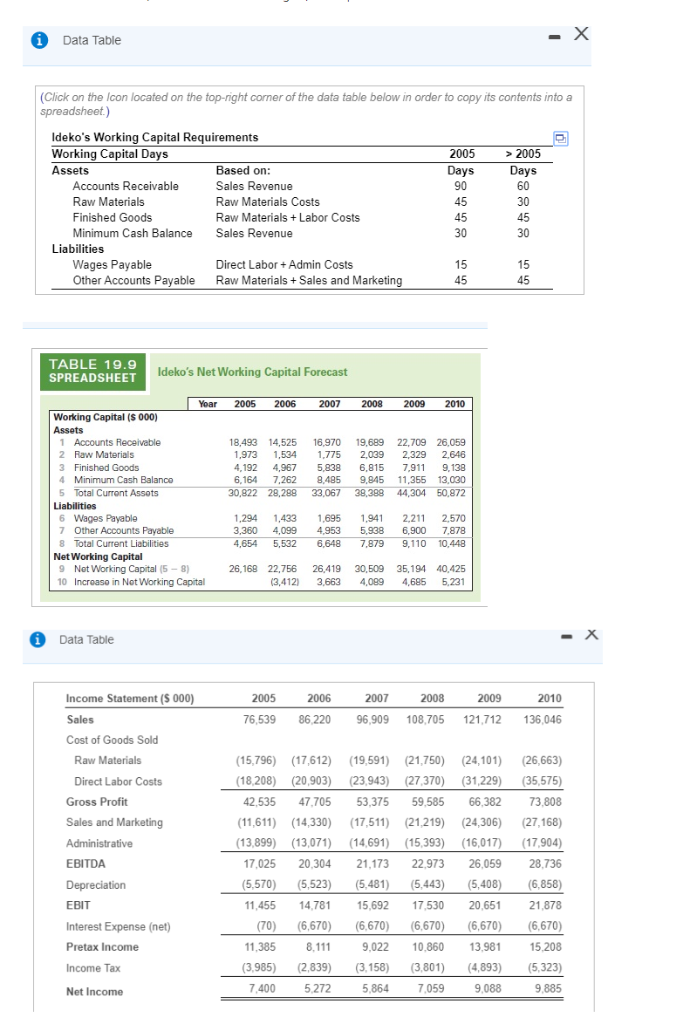

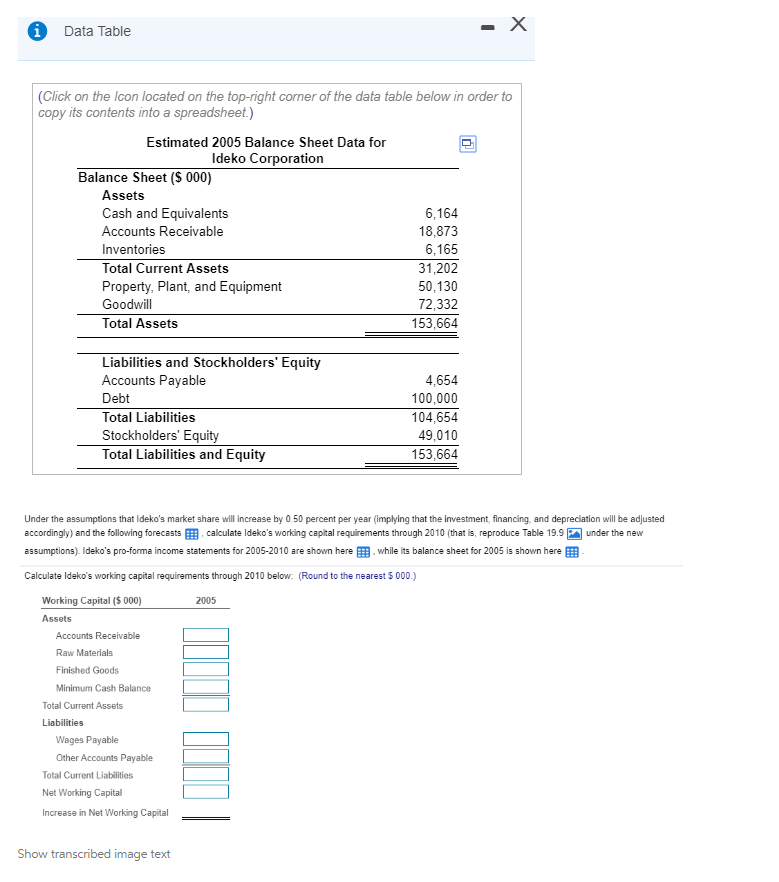

Under the assumptions that Ideko's market share will increase by 0.50 percent per year (implying that the investment, financing, and depreciation will be adjusted accordingly) and the following forecasts calculate Ideko's working capital requirements through 2010 (that is, reproduce Table 19.9 under the new assumptions). Ideko's pro-forma income statements for 2005-2010 are shown here while its balance sheet for 2005 is shown here, Calculate Ideko's working capital requirements from 2005 to 2010 below

Data Table (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a Ideko's Working Capital Requirements Working Capital Days Assets 2005 > 2005 Based on: Sales Revenue Raw Materials Costs Raw MaterialsLabor Costs Sales Revenue Days Days Accounts Receivable Raw Materials Finished Goods Minimum Cash Balance 90 45 45 30 30 45 30 Liabilities Wages Payable Other Accounts Payable Direct LaborAdmin Costs Raw Materials+Sales and Marketing 45 45 TABLE 19.9 SPREADSHEET Ideko's Net Working Capital Forecast Yoar 2005 2006 207 2008 2009 2010 Working Capital (S 000) 1 Accounts Receivable 2 Raw Materials 3 Finished Goods 18,493 14,525 16,970 19,689 22,709 26,059 1,973 1,534 775 2,039 2,329 2,646 4,192 4,967 5,838 6,815 7,911 9,138 6,164 7,262 8,485 9,845 11,355 13,030 30,822 28,288 33,067 38,399 44,304 50,872 Minimum Cash Balanco 5 Total Curent Assots 6 Wages Payable 7 Other Accounts Payable 8 Total Current Liabilities ,294 1,433 1,695 194 2,211 2,570 3,360 4,099 4,953 5,938 6,900 7,878 4,654 5,532 6,648 7,879 9,110 10,448 Net Working Capital 9 Not Working Capital (5-8) 10 Incroaso in Not Working Capital 26,168 22,756 26,419 30,509 35,194 40.425 (3,412 3,663 ,099 4,685 5,231 Data Table Income Statement (S 000) 2005 2006 2007 2008 2009 2010 76,539 86,220 96,909 108,705 121,712 136,046 Cost of Goods Sold Raw Materials Direct Labor Costs Gross Profit Sales and Marketing Administrative EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income 15,796) (17,612) (19,591) 21,750) (24,101) 26,663) (18,208) 0,03 (23,943) (27,370) 31,229) (35,575) 42,535 47,705 53,375 59,585 66,382 73,808 11,611) (14,330) 17,51 (21,219) (24,306) (27,168) 13,899) 13,071) 14,691) 15,393) 16,017) (17,904) 17,025 20,304 21,173 22,973 26,059 28,736 5,570 5,523) 5,481) 5,443) 5,408) 6,858) ,455 14,78115,692 17,530 20,651 21,878 (70) (6,670) (6,670 6,670 6,670 6,670) 9,022 10,860 13,981 15.208 (3,985) 2,839 3,158) 3,801) (4,893) (5,323) 9,885 11,385 8,111 7.400 5,272 5,864 7,059 9,088 Data Table (Click on the Icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Estimated 2005 Balance Sheet Data for Ideko Corporation Balance Sheet (S 000) Assets Cash and Equivalents Accounts Receivable Inventories Total Current Assets Property, Plant, and Equipment Goodwill Total Assets 6,164 18,873 6,165 31,202 50,130 72,332 153,664 Liabilities and Stockholders' Equity Accounts Payable Debt Total Liabilities Stockholders' Equity Total Liabilities and Equity 4,654 100,000 104,654 49,010 153,664 Under the assumptions that Ideko's market share will increase by 0 50 percent per year (implying that the investment, financing, and depreclation will be adjusted accordingly) and the following forecasts calculate ldeko's working capital requirements through 2010 that is, reproduce Table 19.9 under the new assumptions ldeko's pro forma income statements for 2005-2010 are shown here while its balance sheet for 2005 is shown here Calculate ldakos working capital requirements through 2010 below (Round to the nearest 000.) Working Capital ($ 000) 2005 Assets Accounts Receivable Raw Materials Finished Goods Minimum Cash Balance Total Current Assets Liabilities Wages Payable Other Accounts Payable Total Current Liabilities Net Working Capital Increase in Net Working Capital Show transcribed image text