Understanding statistical measures of risk is fundamental to understanding investing. In particular, a stock's CAPM beta coefficient (?) and R2 value are two important risk

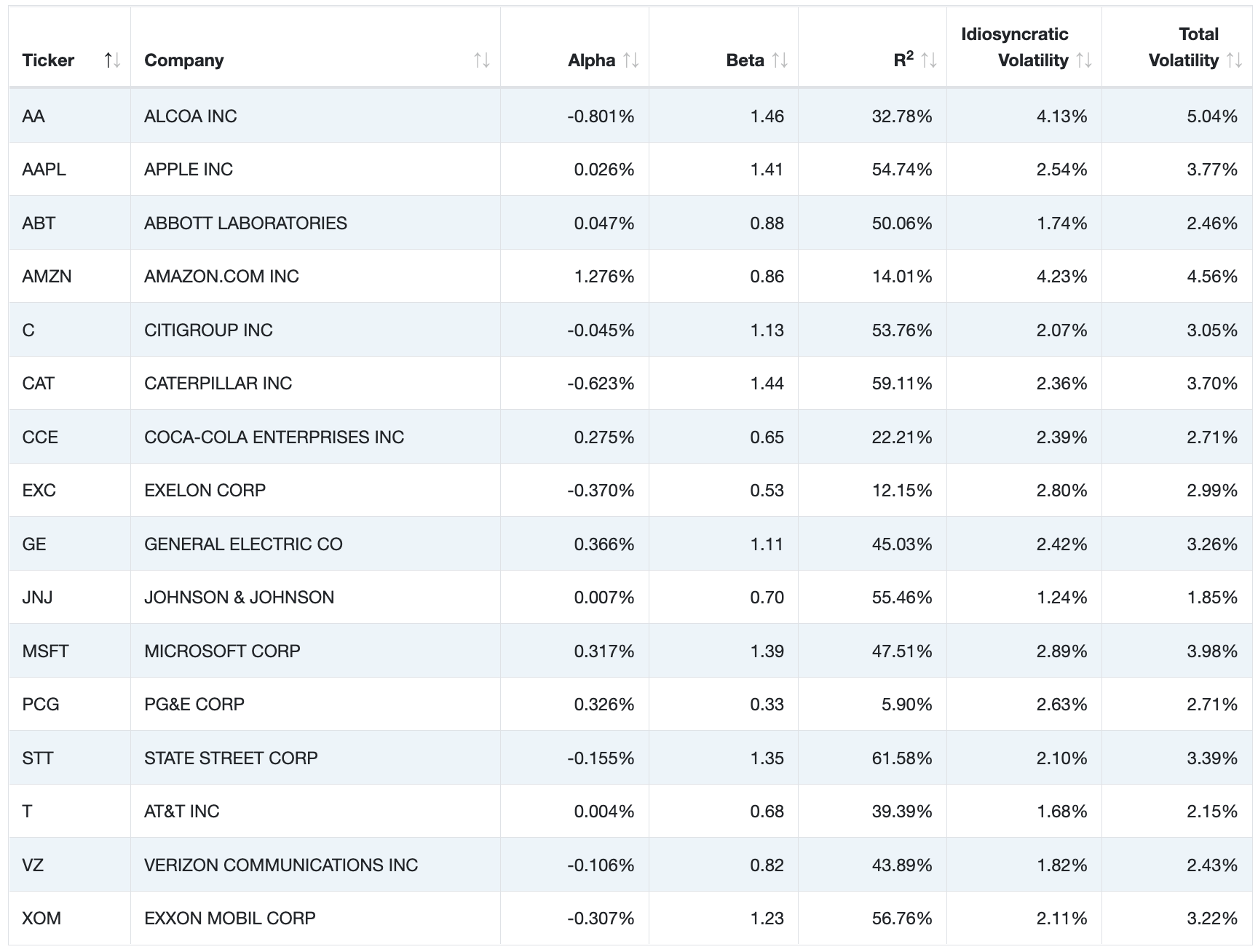

Understanding statistical measures of risk is fundamental to understanding investing. In particular, a stock's CAPM beta coefficient (?) and R2 value are two important risk measures. Beta measures the degree to which stock and benchmark returns move together, while the coefficient of determination, or R2, represents the strength of the relationship between the stock and the benchmark. The Beta Visualization application provides a rich graphical interface to help visualize and interpret the relationship between the CAPM beta coefficient and R2.

Access the Beta Visualization platform and answer the following questions:

Beta Visualization platform:

1. Find the Beta and R2 of Apple INC, what percent of Apple's stock return can be

explained by the return of the benchmark? Is Apple's stock return more volatile or less

volatile than the market return? How much more or less volatile?

Ticker Company AA AAPL ABT AMZN CAT CCE EXC GE JNJ MSFT PCG STT T VZ XOM ALCOA INC APPLE INC ABBOTT LABORATORIES AMAZON.COM INC CITIGROUP INC CATERPILLAR INC COCA-COLA ENTERPRISES INC EXELON CORP GENERAL ELECTRIC CO JOHNSON & JOHNSON MICROSOFT CORP PG&E CORP STATE STREET CORP AT&T INC VERIZON COMMUNICATIONS INC EXXON MOBIL CORP Alpha -0.801% 0.026% 0.047% 1.276% -0.045% -0.623% 0.275% -0.370% 0.366% 0.007% 0.317% 0.326% -0.155% 0.004% -0.106% -0.307% Beta 1.46 1.41 0.88 0.86 1.13 1.44 0.65 0.53 1.11 0.70 1.39 0.33 1.35 0.68 0.82 1.23 R 32.78% 54.74% 50.06% 14.01% 53.76% 59.11% 22.21% 12.15% 45.03% 55.46% 47.51% 5.90% 61.58% 39.39% 43.89% 56.76% Idiosyncratic Volatility 4.13% 2.54% 1.74% 4.23% 2.07% 2.36% 2.39% 2.80% 2.42% 1.24% 2.89% 2.63% 2.10% 1.68% 1.82% 2.11% Total Volatility 5.04% 3.77% 2.46% 4.56% 3.05% 3.70% 2.71% 2.99% 3.26% 1.85% 3.98% 2.71% 3.39% 2.15% 2.43% 3.22%

Step by Step Solution

3.45 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Based on the table Apple Inc has a beta of 141 and an Rsquared of 5474 This means that Apples stock ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started