Question

Undertake your own research to obtain an organisations LATEST THREE- YEAR annual reports. You can use one from an organisation with which you are familiar

Undertake your own research to obtain an organisations LATEST THREE- YEAR annual reports. You can use one from an organisation with which you are familiar or one which is freely available on the internet (companys website) or from ASIC or ASX.

You are the Financial Planning and Analysis manager of the company you are choosing. In order to invest a project, the company is planning to apply for a loan from the bank. You was assigned by the CEO the task of advising the Board of Directors about the financial forecasts and the companys ability to meet the long-term obligations. The proposed loan details are shown as below: Proposed Loan Details Loan amount: $5,000,000 Loan term: 4 years Interest rate 6.50% Payment frequency: Monthly Required: 1. You are required to undertake your own research from the companys website, and read all the relevant information from the annual reports to understand and identify the organisational policy and procedures in regards to (not limited to) sales, inventory management, collection policy, credit, purchasing and payment policy and cost structures.

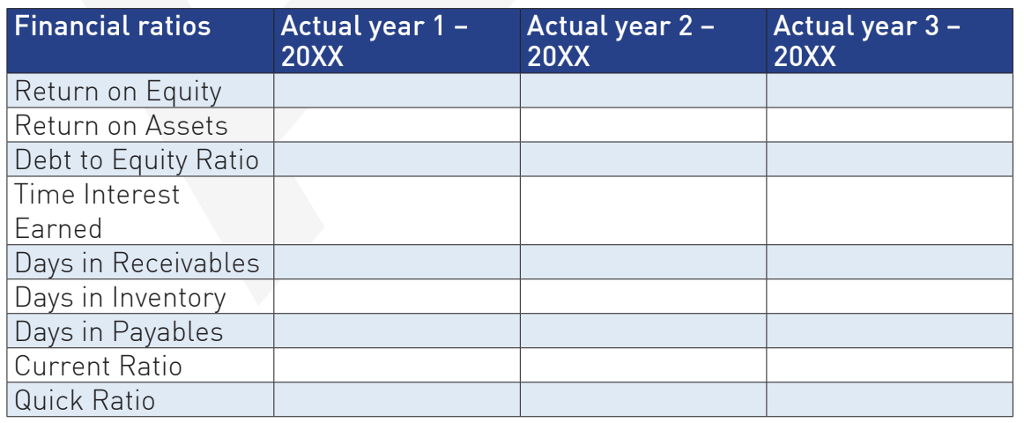

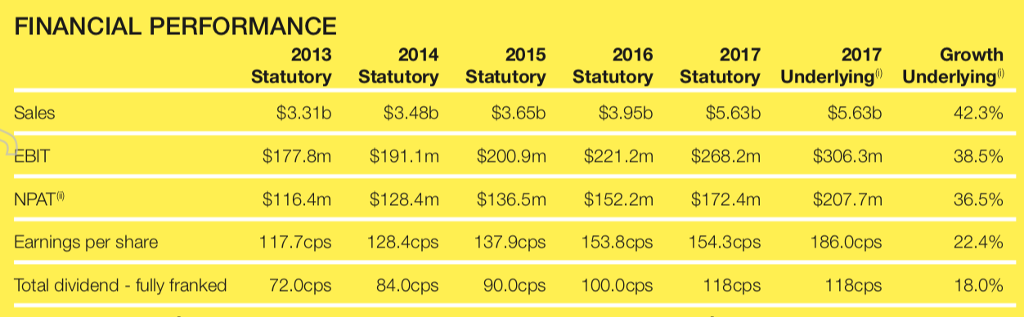

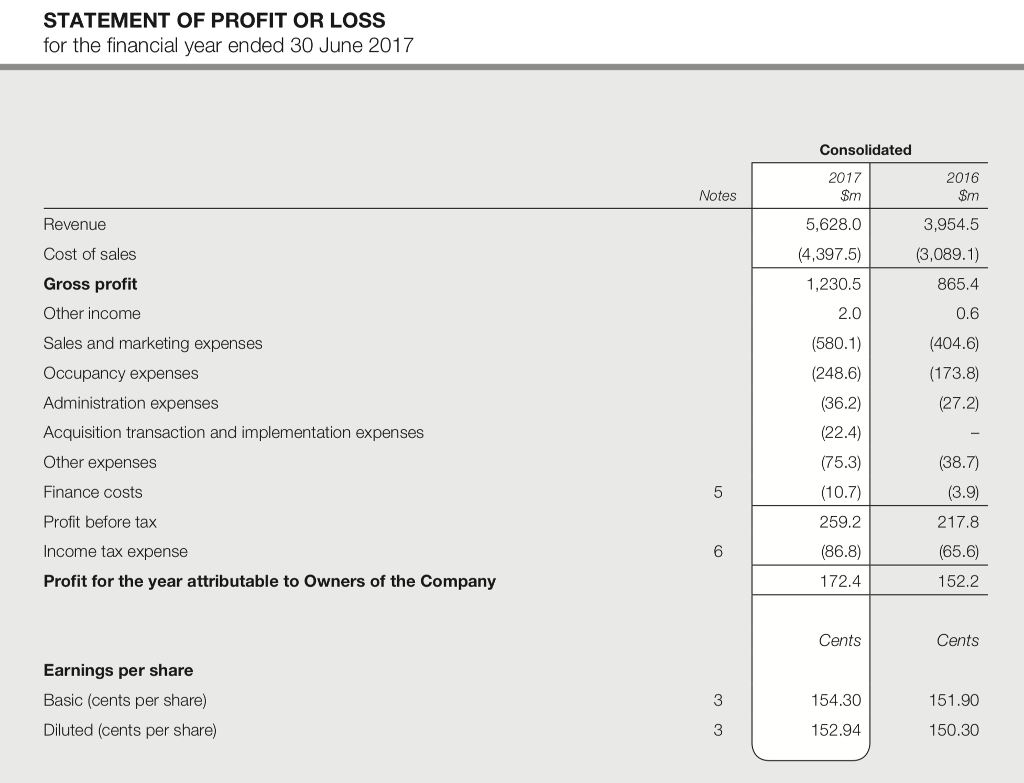

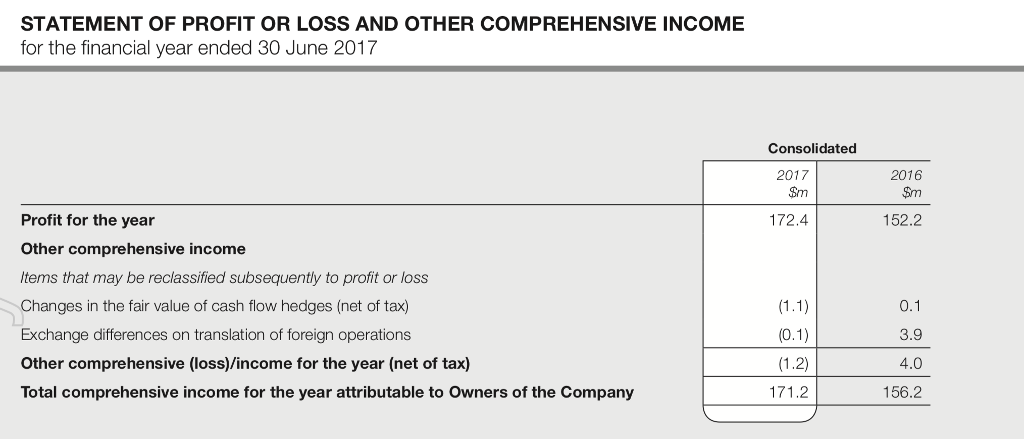

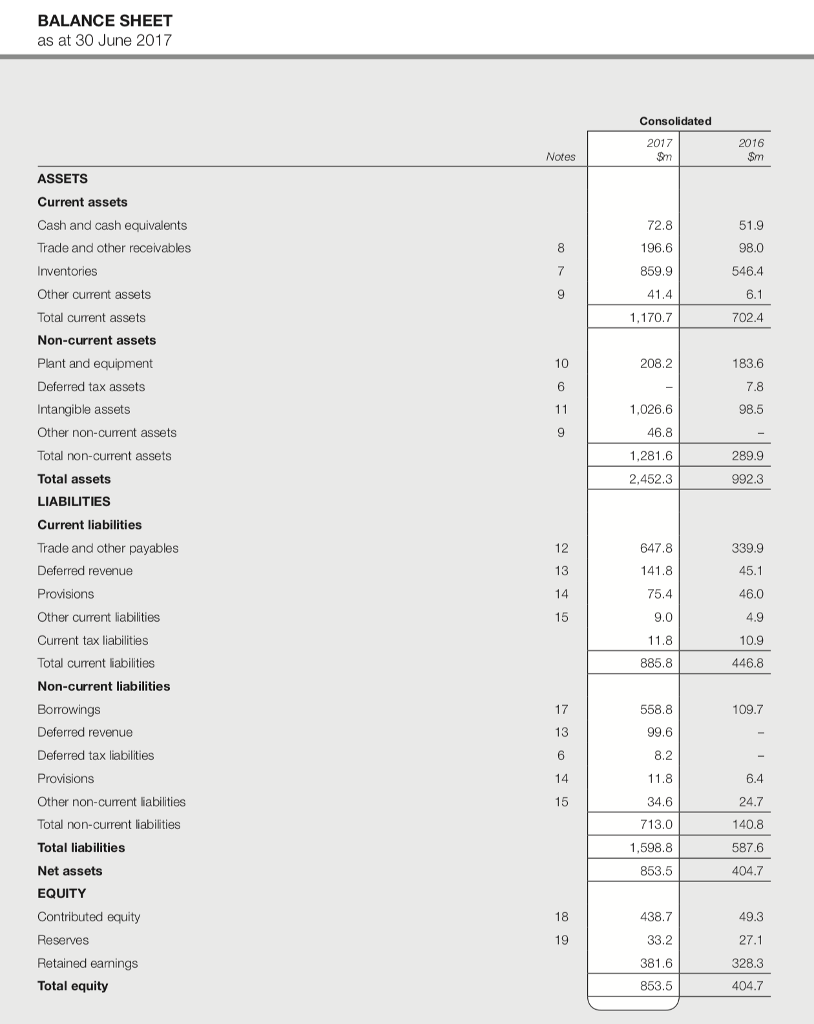

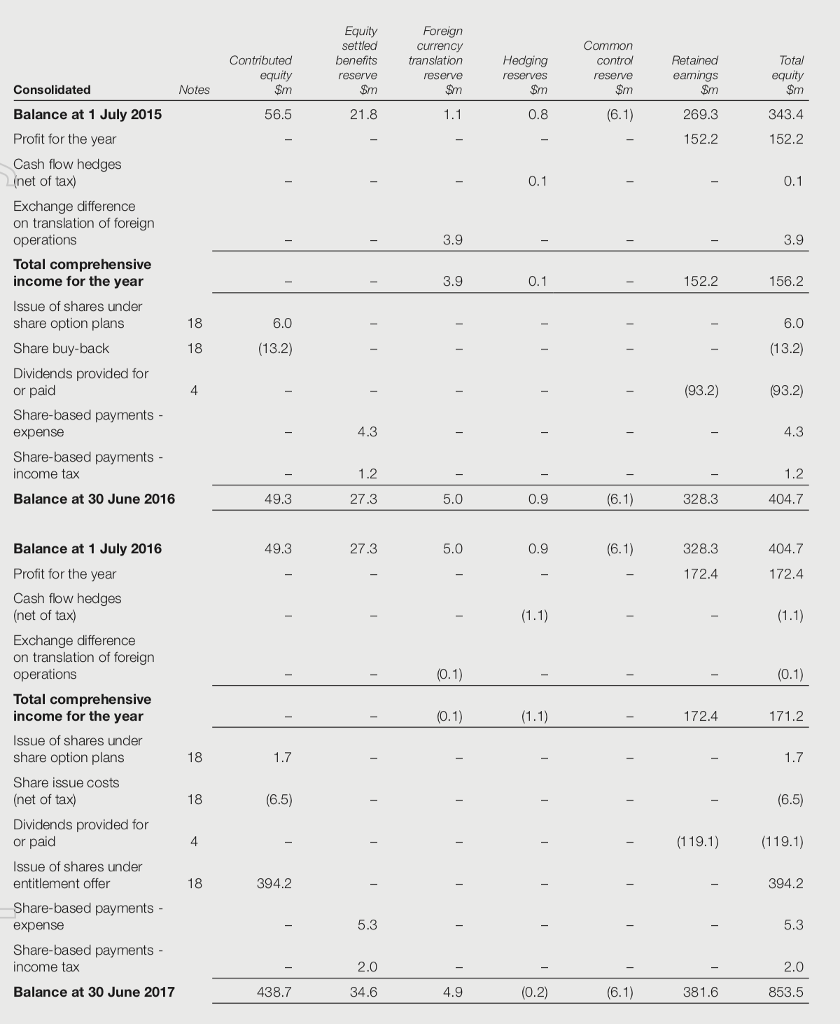

2. Calculate the financial ratios for the actual three years by using the following template. You can calculate the relevant ratios based on a year-end balance instead of the average beginning and ending year balance.

3. Briefly comment the profitability, liquidity and solvency of the company based on the financial ratios you calculated in the Part 2.

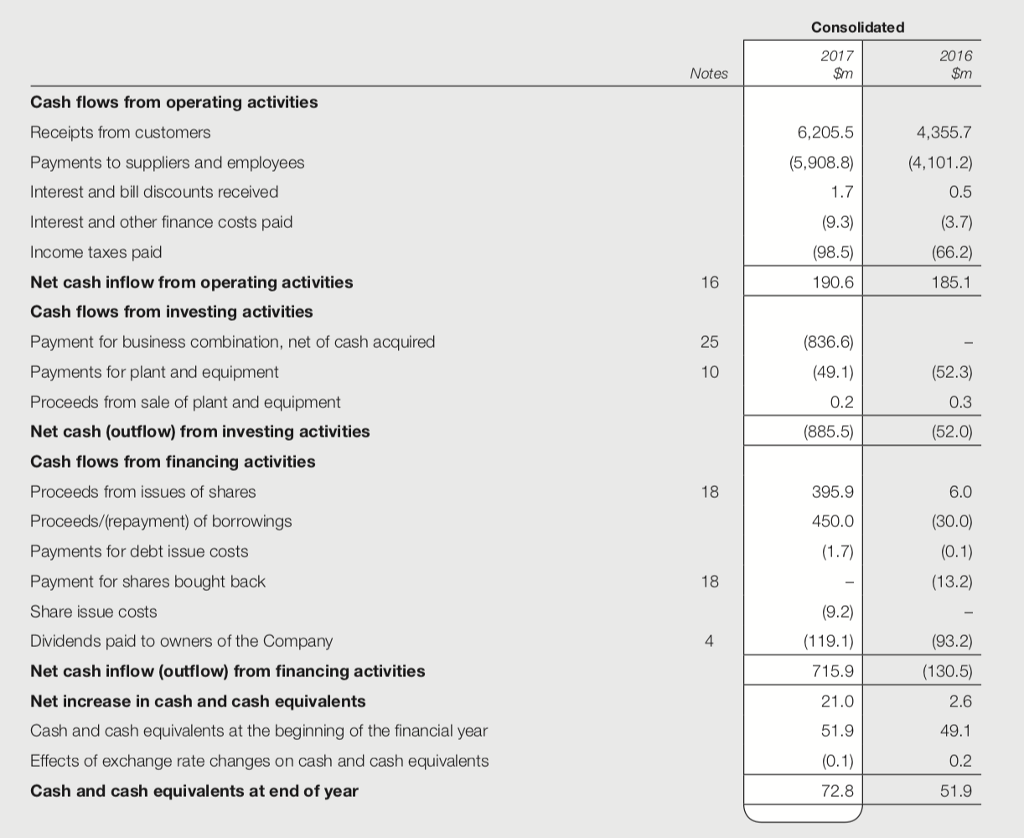

4. You are required to identify timeframes and parameters to be used for the financial forecasts.

5. You are required to use the EXCEL to include all the parameters or assumptions (i.e. key forecast drivers) used, and prepare proforma income statement and balance sheet.

6. You are required to forecast the free cash flow for the company.

7. You are required to write a REPORT (refer to Notes to the Students for more information) to include all the information and workings used in the preparation of proforma income statement and balance sheet, and free cash flow forecast.Financial Forecasts (80 marks total)

Ref : JB HiFi annual report ( https://www.jbhifi.com.au/Documents/2017%20Annual%20Report.pdf)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started