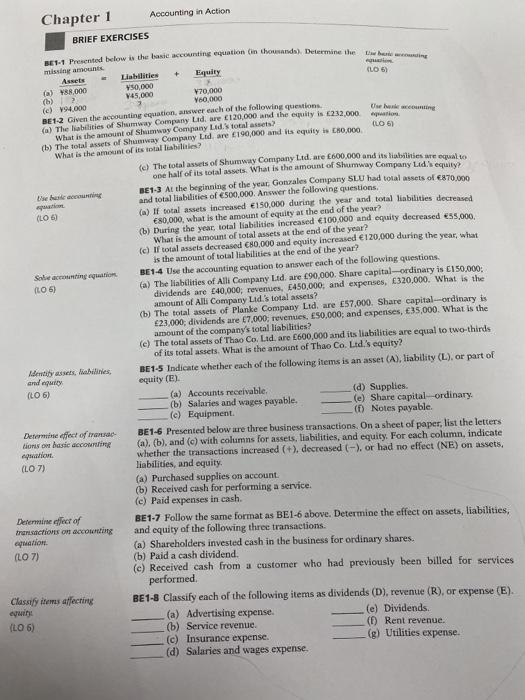

Une come Chapter 1 Accounting in Action BRIEF EXERCISES BE-1 Presented below is the basic accounting equation in hotada). Determine the missing amounts Assets Liabilities ) Equity (LO 5) (RR 000 V50.000 V45,000 V70,000 (h) VOO 000 (c) 94.000 BE12 Given the accounting equation, answer each of the following questions. a) The abilities of Shumway Company Lade 120.000 and the equity is 232,000 (106 (b) The total asets of Shumway Company Ltd. are 6190,000 and its equity is 180,000 What is the amount of its total liabilities? The total assets of Shumway Company Ltd. are 600.000 and its abilities are equal to one half of its total assets. What is the amount of Shumway Company Lade equity 361-3 At the beginning of the year, Goturales Company SLU had total assets of 870.000 te be and total liabilities of 500,000. Answer the following questions. (L 6) (a) If total assets increased 150,000 during the year and total liabilities decreased 80,000, what is the amount of equity at the end of the year? (b) During the year, total liabilities increased 100.000 and equity decreased 55,000 What is the amount of total assets at the end of the year? (c) af total assets decreased 80.000 and equity increased 120,000 during the year, what is the amount of total liabilities at the end of the year? Solarning qation BE1-4 Use the accounting equation to answer each of the following questions. (LO) (a) The liabilities of All Company Ltd. are 90,000. Share capital-ordinary is 150,000; dividends are 40,000; revenues, 450,000, and expenses, E320.000. What is the amount of All Company Lad's total assets? (b) The total assets of Planke Company Ltd, are 57.000. Share capital-ordinary is 23,000; dividends are 17.000, revenues, 50,000; and expenses, 35,000. What is the amount of the company's total liabilities? (e) The total assets of Thao Co. Ltd. are 600,000 and its liabilities are equal to two-thirds of its total assets. What is the amount of Thao Co. Ltd.'s equity? Identity assets, liabilines, BE1-5 Indicate whether each of the following items is an asset (A), liability (L), or part of and equity equity (E) (LO 6) (a) Accounts receivable, (d) Supplies (b) Salaries and wages payable. (e) Share capital-ordinary. (c) Equipment ( Notes payable Dette effect of transac- BE1-6 Presented below are three business transactions. On a sheet of paper, list the letters tions on basic accounting (a), (b), and (c) with columns for assets, Liabilities, and equity. For each column, indicate sation whether the transactions increased (+), decreased (-). or had no effect (NE) on assets, (LO 7) liabilities, and equity, (a) Purchased supplies on account. (b) Received cash for performing a service. (c) Paid expenses in cash. Determine efect of BE1-7 Follow the same format as BE 1-6 above. Determine the effect on assets, liabilities, transactions on accounting and equity of the following three transactions. wallon. (a) Shareholders invested cash in the business for ordinary shares. (LO 7) (b) Paid a cash dividend. (e) Received cash from a customer who had previously been billed for services performed Classify items affecting BE1-8 Classify each of the following items as dividends (D), revenue (R) or expense (E). wit (a) Advertising expense. (e) Dividends (LO 6) (b) Service revenue. (1) Rent revenue. (c) Insurance expense. (d) Salaries and wages expense. (g) Utilities expense