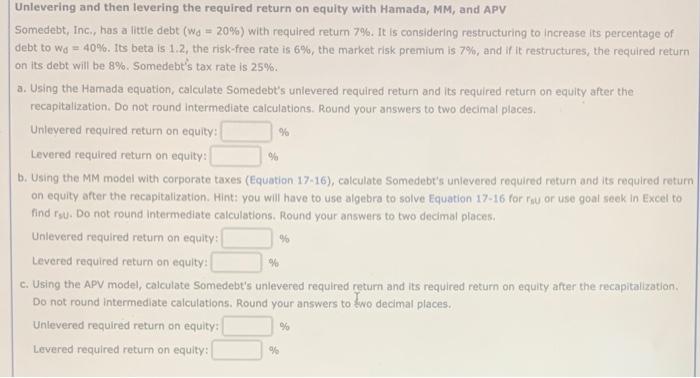

Unlevering and then levering the required return on equity with Hamada, MM, and APV Somedebt, Inc., has a little debt (ws = 20%) with required return 7%. It is considering restructuring to increase its percentage of debt to wo = 40%. Its beta is 1.2, the risk-free rate is 6%, the market risk premium is 7%, and if it restructures, the required return on its debt will be 8%. Somedebt's tax rate is 25%. a. Using the Hamada equation, calculate Somedebt's unlevered required return and its required return on equity after the recapitalization. Do not round Intermediate calculations. Round your answers to two decimal places Unlevered required return on equity: % Levered required return on equity % b. Using the MM model with corporate taxes (Equation 17:16), calculate Somedebt's unlevered required return and its required return on equity after the recapitalization. Hint: you will have to use algebra to solve Equation 17-16 for ou or use goal seek in Excel to find is. Do not round Intermediate calculations. Round your answers to two decimal places Unlevered required return on equity: % Levered required return on equity: c. Using the APV model, calculate somedebe's unlevered required return and its required return on equity after the recapitalization, Do not round Intermediate calculations. Round your answers to bwo decimal places. Unlevered required return on equity: % Levered required return on equity: % % Unlevering and then levering the required return on equity with Hamada, MM, and APV Somedebt, Inc., has a little debt (ws = 20%) with required return 7%. It is considering restructuring to increase its percentage of debt to wo = 40%. Its beta is 1.2, the risk-free rate is 6%, the market risk premium is 7%, and if it restructures, the required return on its debt will be 8%. Somedebt's tax rate is 25%. a. Using the Hamada equation, calculate Somedebt's unlevered required return and its required return on equity after the recapitalization. Do not round Intermediate calculations. Round your answers to two decimal places Unlevered required return on equity: % Levered required return on equity % b. Using the MM model with corporate taxes (Equation 17:16), calculate Somedebt's unlevered required return and its required return on equity after the recapitalization. Hint: you will have to use algebra to solve Equation 17-16 for ou or use goal seek in Excel to find is. Do not round Intermediate calculations. Round your answers to two decimal places Unlevered required return on equity: % Levered required return on equity: c. Using the APV model, calculate somedebe's unlevered required return and its required return on equity after the recapitalization, Do not round Intermediate calculations. Round your answers to bwo decimal places. Unlevered required return on equity: % Levered required return on equity: % %