Question

Update dates CASE 5: FUNKY FURNITURE COMPANY The Funky Furniture Company (Funky FC), manufacturer of fine home furniture in Cape Town, Western Cape, distributed its

Update dates CASE 5: FUNKY FURNITURE COMPANY

The Funky Furniture Company (Funky FC), manufacturer of fine home furniture in Cape Town, Western Cape, distributed its products directly to department stores, independent home furnishing retailers, and a few small regional furniture chains. Early in March, 2023, the credit manager of the Funky FC, Mr. Gary Wiltshire, received from his assistant, Mr. Gus Smith, pertinent information on two accounts, Class Act and Basic Stuff in the Western Cape. Mr. Smith believed changes in these companies warranted Garys attention.

Class Acts retailed quality home furnishings from four locations, one in the downtown section of Cape Town and the others in nearby suburban areas. The company also manufactured custom upholstered furniture on special order. Since Class Act handled a complete line of home furnishings, sales were fairly steady throughout the year. Both Class Act and Basic Stuff have approximately 50% of their sales to customers in cash and 50% on 12 month installment terms. Class Act had been established in 1980 as a partnership and was incorporated in 1992. In June, 2022, two of the four original partners sold their shares in the company to the two remaining owners. Class Act had been a customer of the Funky FC since 1983 and had previously handled its affairs in a most satisfactory manner.

Basic Stuff was a comparatively new customer of Funky FC having been sold to since 2021. A medium-sized department store in Parow, it was well known for its extensive lines of home furnishings. Its account with Funky FC had been satisfactory through 2018. Both accounts were sold on terms of 1/10, net 30 and, although not discounting, had been paying invoices promptly until December, 2022. Mr. Wiltshire had previously established a R2,0 million limit on Class Act and a R3,0 million limit on Basic Stuff.

Funky FC advertised its lines nationally and attempted to maintain intensive coverage of trading areas by distributing through stores strategically located within a particular marketing area. Beginning in 2022, activity in the furniture market had become sufficiently spotty that quality of product and service were not the only bases for competition among manufacturers for outlets. Credit terms and financing of dealers became equally important; thus, Funky FC, in Garys words, was backed into the position of supporting numerous customers in order to maintain adequate distribution for its products.

Because of this requirement for the extension of fairly liberal credit, Gary had since 2021 adhered strictly to a policy of obtaining current reports on the financial status of customers. These reports, obtained as annual Statements of Financial Position and Comprehensive Income for customers that were considered satisfactory risks, were supplied directly by the customers. Under certain circumstances, wherein Funky FC was working very closely with a particular customer who was trading actively on a small investment, Gary received quarterly and at times monthly statements in order to keep on top of the credit situation.

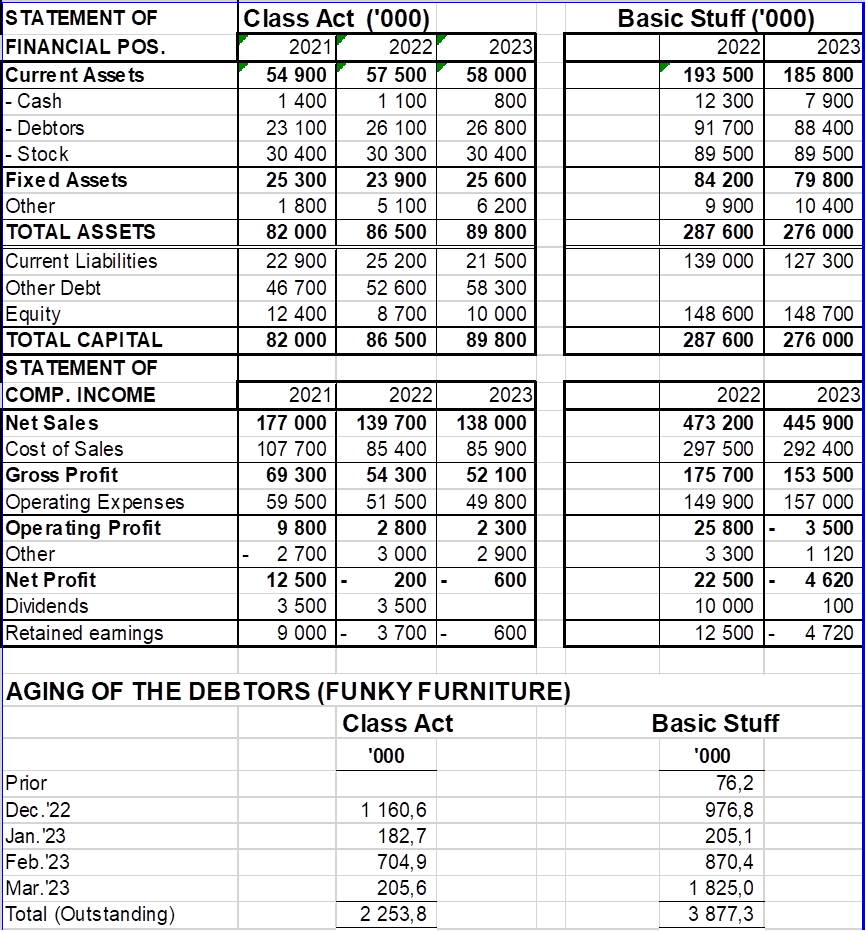

In early March 2023, Gus Smith, assistant credit manager of the Funky FC, received the annual reports of Class Act and Basic Stuff. After reviewing these statements and checking the accounts receivable ledger for both customers, Gus felt that the accounts should be reviewed by Gary. Accordingly, he furnished Gary with the information found in the following Exhibits.

When reviewing the accounts, Gus kept in mind that 202/23 had not been a particularly good year for retail furniture stores. It was generally known that stores such as Basic Stuff, carrying low-priced furniture lines, were the first to suffer the declines that had come in the late summer and early fall. This situation was followed by signs of a relaxing demand for furniture of higher quality and higher price toward the end of 2022. The drop in volume and the subsequent price cutting hit the profit margins of some retailers to such an extent that their losses in the latter part of the year equalled or more than offset profits gained in the earlier part of the year.

In the early months of 2023 the softness of the furniture business continued. Although there was no severe drop in the buying of furniture at retail level, there was an indication of declining buying and purchasing in anticipation of potential over-stocking. Accordingly, retail stores reduced orders of new lines and reorders of established lines in January, February and March. Throughout the country, orders for shipment in March were down about 30% from February; February had itself shown a drop of about 10% from January. Thus, credit managers among furniture manufacturing concerns were placed in the unhappy position of trying to please sales managers who wanted to maintain volume, while they were aware that the shipment of furniture to customers who had already overextended their financial positions was potentially dangerous in such a period.

You have to advice Gary as to what to do in terms of Class Act and Basic Stuff. Should they keep on granting credit to both, one of them or not to one of the two debtors? Motivate your answer using ratio analysis. You also have to choose one of the two as the best to keep on giving credit to. (40)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started