Answered step by step

Verified Expert Solution

Question

1 Approved Answer

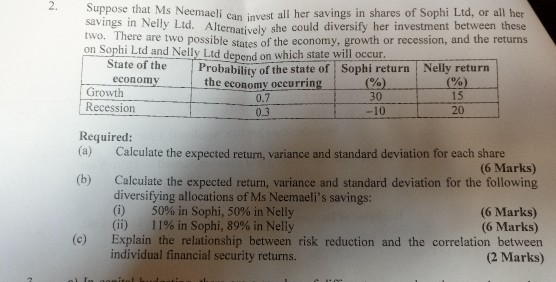

uppose that Ms Neemaeli can invest all her savings in shares of Sophi Ltd, or all her Savings i Nelly Ltd. Alternatively she could diversify

uppose that Ms Neemaeli can invest all her savings in shares of Sophi Ltd, or all her Savings i Nelly Ltd. Alternatively she could diversify her investment between these Ther are two possible states of the economy, growth or recession, and the returns on Sophi Ltd and Nelly Ltd depend on which state will occur. te of theProbability of the state of Sophi return Nelly return econony Growth Recession the economy occurring 0.7 0.3 30 10 15 20 Required: (a) Calculate the expected return, variance and standard deviation for each share (6 Marks) (b) Calculate the expected return, variance and standard deviation for the following diversifying allocations of Ms Neemaeli's savings: (i) 50% in Sophi, 50% in Nelly (ii) 1 1% in Sophi, 89% in Nelly Explain the relationship between risk reduction and the correlation between individual financial security returns. (6 Marks) (6 Marks) (c) (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started