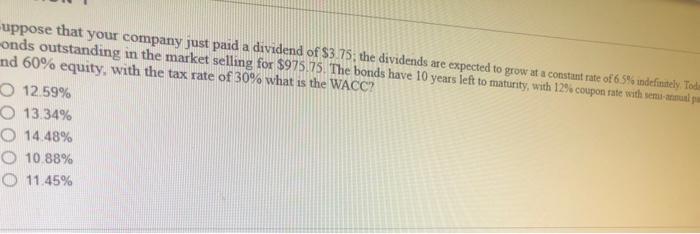

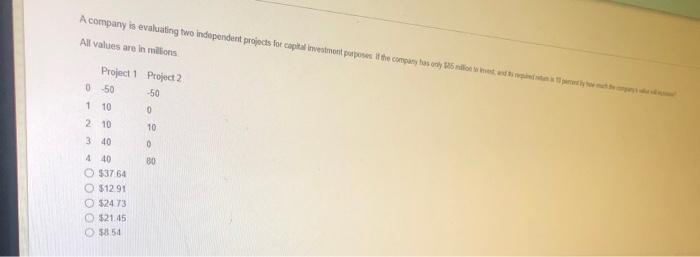

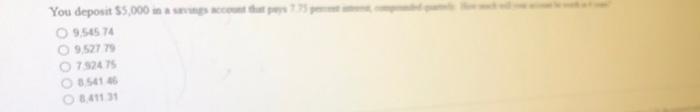

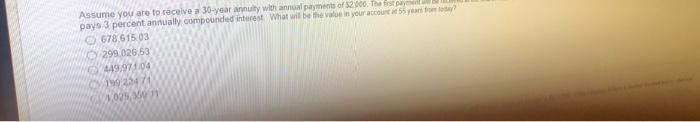

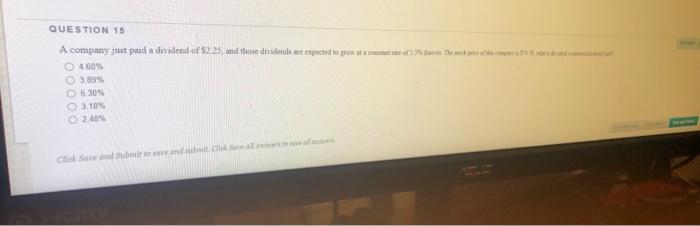

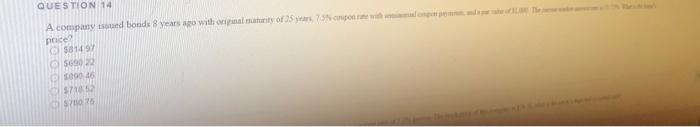

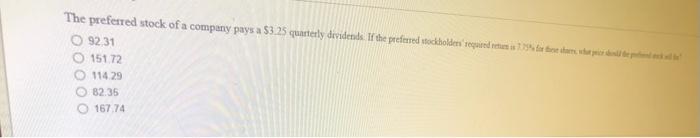

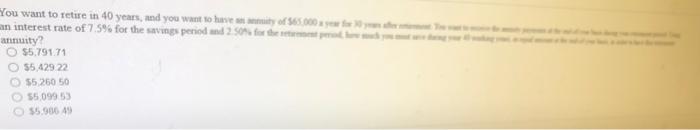

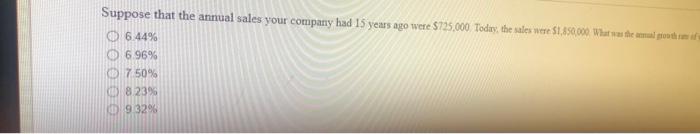

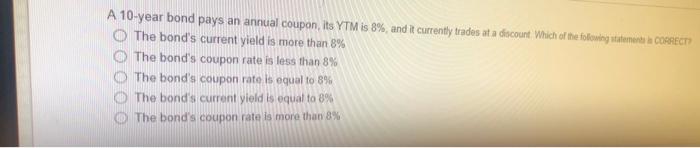

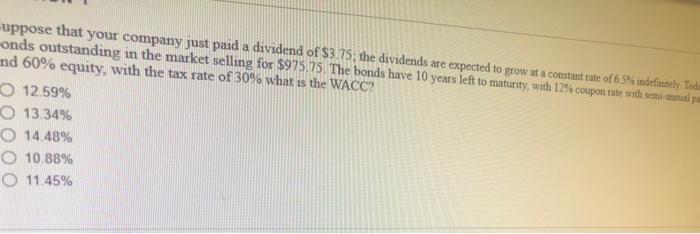

-uppose that your company just paid a dividend of $3.75 the dividends are expected to grow at a constant rate of 65% indefinitely Toda onds outstanding in the market selling for $975.75. The bonds have 10 years left to maturity, with 12%. coupon rate with simula nd 60% equity, with the tax rate of 30% what is the WACC? O 12.59% O 13.34% 14.48% 10.88% O 11.45% A company is evaluating two independent projects for capas investment purposes it the company has only 125 rellot let the register to jest ty how All values are in millions Project 1 Project 2 0-50 -50 1 10 0 210 3 40 10 0 80 440 $37 64 $12.91 $2473 $21.45 0.550 You deposit $5,000 in court 9,54574 9.527 752475 35416 36113 Assume you are to receive a 30-year annuity with annual payment of 2000. The Day pays 3 percent annually compounded interest What will be the value in your account at 55 years to 678.615.03 299.026.53 449.971.04 19923478 1,025, 11 QUESTION 15 A company just paid a dividend of $2.25, and the dividendes expected to pow.com 460% 3.89% 5.30% 3.18% 20 Che Sand Submit QUESTION 14 A company tud bond years with spinal maturity of 5 year, Sampon the price 581494 569022 06 571 S726 341 14111 QUESTION The preferred stock of a company pays a $3.25 quarterly dividends. If the preferred toddholdes seguid tu is 15% de carte 92 31 15172 114.29 82.35 167.74 You want to retire in 40 years, and you want to have any of 365.000 an interest rate of 75% for the savings period and for the annuity? 55.791.71 55.429 22 55 250 50 55 099 53 $5.906 49 Suppose that the annual sales your company had 15 years ago were 5725.000. Today, the sales were $1,850,000 What was the amul modif 6.44% 6.96% 7 50% 82395 93298 A 10-year bond pays an annual coupon its YTM is 8%, and it currently trades at a discount Which of the following statement a CORRECTO The bond's current yield is more than 8% The bond's coupon rate is less than 8% The bond's coupon rate is equal to 8% The bond's current yield is equal to 8% The bond's coupon rate is more than 8% -uppose that your company just paid a dividend of $3.75 the dividends are expected to grow at a constant rate of 65% indefinitely Toda onds outstanding in the market selling for $975.75. The bonds have 10 years left to maturity, with 12%. coupon rate with simula nd 60% equity, with the tax rate of 30% what is the WACC? O 12.59% O 13.34% 14.48% 10.88% O 11.45% -uppose that your company just paid a dividend of $3.75 the dividends are expected to grow at a constant rate of 65% indefinitely Toda onds outstanding in the market selling for $975.75. The bonds have 10 years left to maturity, with 12%. coupon rate with simula nd 60% equity, with the tax rate of 30% what is the WACC? O 12.59% O 13.34% 14.48% 10.88% O 11.45% A company is evaluating two independent projects for capas investment purposes it the company has only 125 rellot let the register to jest ty how All values are in millions Project 1 Project 2 0-50 -50 1 10 0 210 3 40 10 0 80 440 $37 64 $12.91 $2473 $21.45 0.550 You deposit $5,000 in court 9,54574 9.527 752475 35416 36113 Assume you are to receive a 30-year annuity with annual payment of 2000. The Day pays 3 percent annually compounded interest What will be the value in your account at 55 years to 678.615.03 299.026.53 449.971.04 19923478 1,025, 11 QUESTION 15 A company just paid a dividend of $2.25, and the dividendes expected to pow.com 460% 3.89% 5.30% 3.18% 20 Che Sand Submit QUESTION 14 A company tud bond years with spinal maturity of 5 year, Sampon the price 581494 569022 06 571 S726 341 14111 QUESTION The preferred stock of a company pays a $3.25 quarterly dividends. If the preferred toddholdes seguid tu is 15% de carte 92 31 15172 114.29 82.35 167.74 You want to retire in 40 years, and you want to have any of 365.000 an interest rate of 75% for the savings period and for the annuity? 55.791.71 55.429 22 55 250 50 55 099 53 $5.906 49 Suppose that the annual sales your company had 15 years ago were 5725.000. Today, the sales were $1,850,000 What was the amul modif 6.44% 6.96% 7 50% 82395 93298 A 10-year bond pays an annual coupon its YTM is 8%, and it currently trades at a discount Which of the following statement a CORRECTO The bond's current yield is more than 8% The bond's coupon rate is less than 8% The bond's coupon rate is equal to 8% The bond's current yield is equal to 8% The bond's coupon rate is more than 8% -uppose that your company just paid a dividend of $3.75 the dividends are expected to grow at a constant rate of 65% indefinitely Toda onds outstanding in the market selling for $975.75. The bonds have 10 years left to maturity, with 12%. coupon rate with simula nd 60% equity, with the tax rate of 30% what is the WACC? O 12.59% O 13.34% 14.48% 10.88% O 11.45%