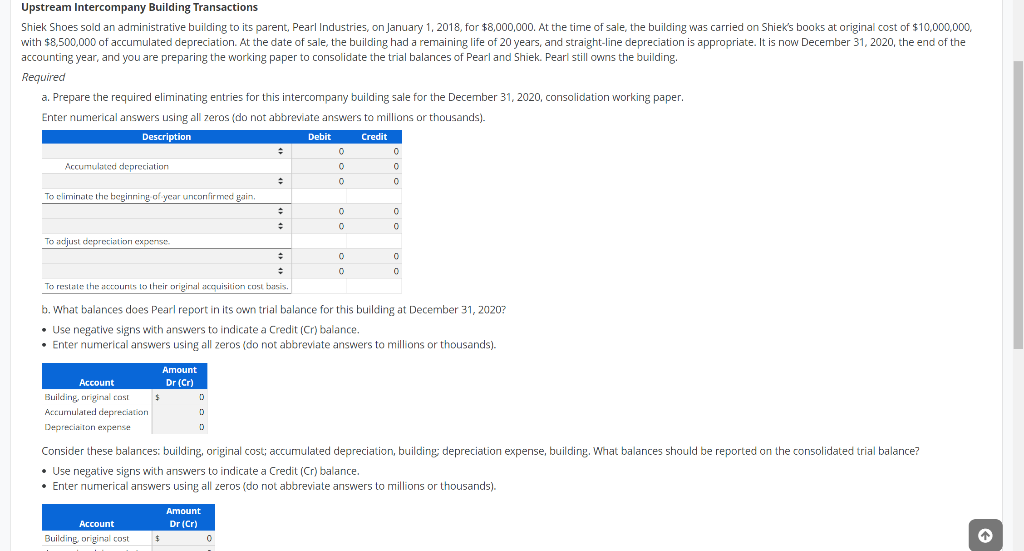

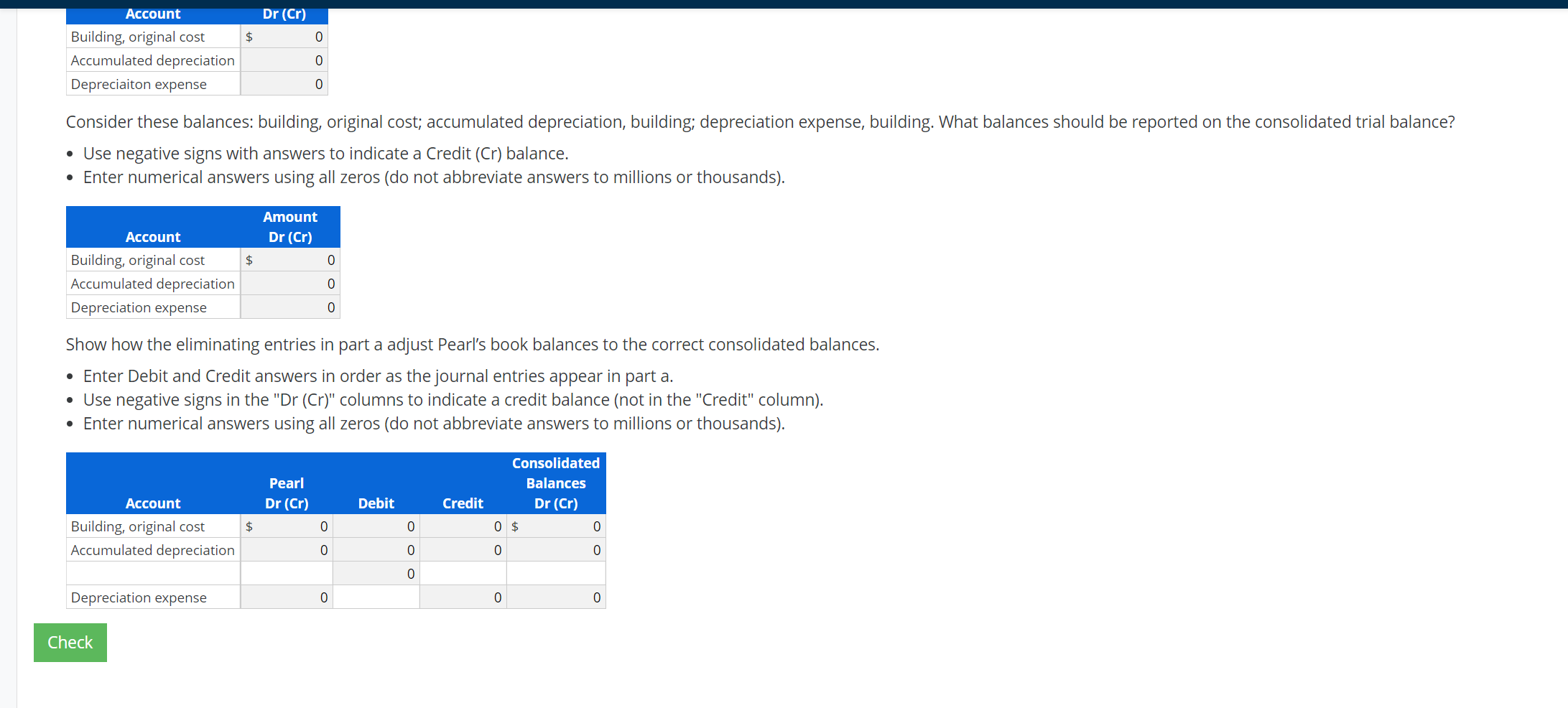

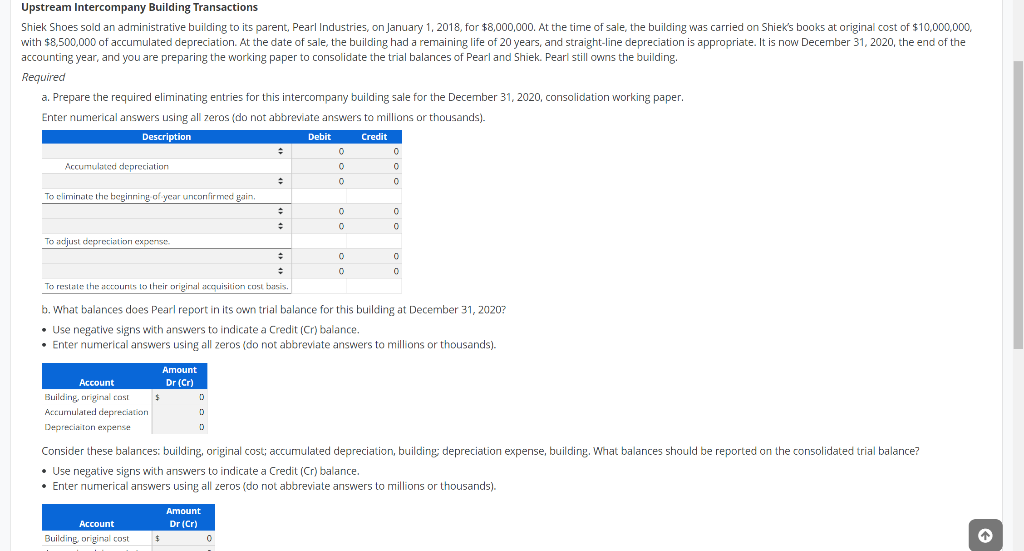

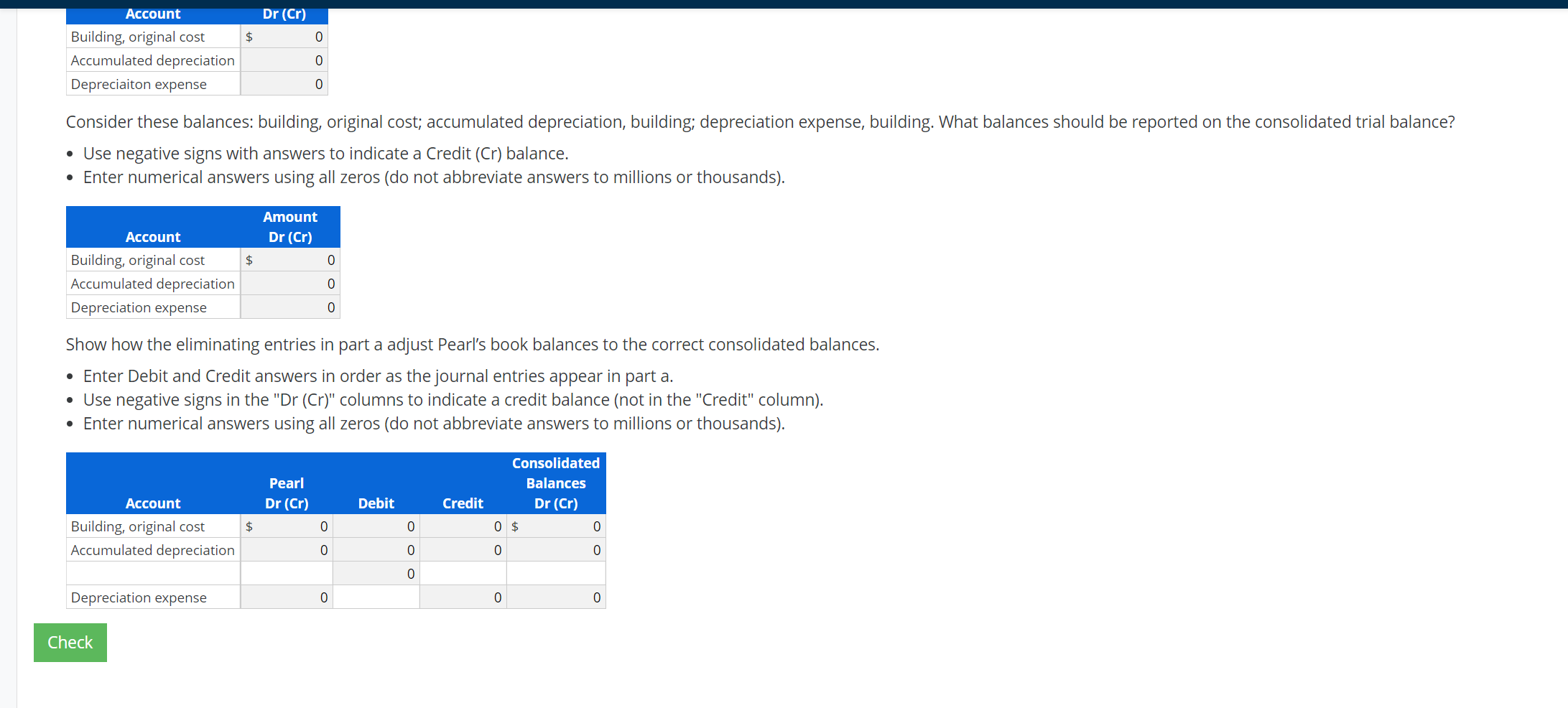

Upstream Intercompany Building Transactions Shiek Shoes sold an administrative building to its parent, Pearl Industries, on January 1, 2018, for $8,000,000. At the time of sale, the building was carried on Shiek's books at original cost of $10,000,000, with $8,500,000 of accumulated depreciation. At the date of sale, the building had a remaining life of 20 years, and straight-line depreciation is appropriate. It is now December 31, 2020, the end of the accounting year, and you are preparing the working paper to consolidate the trial balances of Pearl and Shiek. Pearl still owns the building, Required a. Prepare the required eliminating entries for this intercompany building sale for the December 31, 2020, consolidation working paper. Enter numerical answers using all zeros (do not abbreviate answers to millions or thousands). Description Debit Credit Accumulated depreciation 0 0 0 To eliminate the beginning of year unconfirmed gain 0 0 To adjust depreciation expense. 0 0 To restate the accounts to their original acquisition cost basis b. What balances does Pearl report in its own trial balance for this building at December 31, 2020? Use negative signs with answers to indicate a Credit (Cr) balance. Enter numerical answers using all zeros (do not abbreviate answers to millions or thousands). Amount Dr (Cr) $ Account Building, original cost Accumulated depreciation Deprecia ton expense Consider these balances: building, original cost; accumulated depreciation, building depreciation expense, building. What balances should be reported on the consolidated trial balance? Use negative signs with answers to indicate a Credit (Cr) balance. Enter numerical answers using all zeros (do not abbreviate answers to millions or thousands). Amount Dr (Cr) Account Building original cost $ Dr (Cr) $ 0 Account Building, original cost Accumulated depreciation Depreciaiton expense 0 0 Consider these balances: building, original cost; accumulated depreciation, building; depreciation expense, building. What balances should be reported on the consolidated trial balance? Use negative signs with answers to indicate a Credit (Cr) balance. Enter numerical answers using all zeros (do not abbreviate answers to millions or thousands). Amount Dr (Cr) Account $ 0 Building, original cost Accumulated depreciation Depreciation expense 0 0 Show how the eliminating entries in part a adjust Pearl's book balances to the correct consolidated balances. Enter Debit and Credit answers in order as the journal entries appear in part a. Use negative signs in the "Dr (Cr)" columns to indicate a credit balance (not in the "Credit" column). Enter numerical answers using all zeros (do not abbreviate answers to millions or thousands). Pearl Dr (Cr) Debit Credit Account Building, original cost Accumulated depreciation Consolidated Balances Dr (Cr) 0 $ 0 0 0 $ 0 0 ooo Depreciation expense 0 0 0 Check Upstream Intercompany Building Transactions Shiek Shoes sold an administrative building to its parent, Pearl Industries, on January 1, 2018, for $8,000,000. At the time of sale, the building was carried on Shiek's books at original cost of $10,000,000, with $8,500,000 of accumulated depreciation. At the date of sale, the building had a remaining life of 20 years, and straight-line depreciation is appropriate. It is now December 31, 2020, the end of the accounting year, and you are preparing the working paper to consolidate the trial balances of Pearl and Shiek. Pearl still owns the building, Required a. Prepare the required eliminating entries for this intercompany building sale for the December 31, 2020, consolidation working paper. Enter numerical answers using all zeros (do not abbreviate answers to millions or thousands). Description Debit Credit Accumulated depreciation 0 0 0 To eliminate the beginning of year unconfirmed gain 0 0 To adjust depreciation expense. 0 0 To restate the accounts to their original acquisition cost basis b. What balances does Pearl report in its own trial balance for this building at December 31, 2020? Use negative signs with answers to indicate a Credit (Cr) balance. Enter numerical answers using all zeros (do not abbreviate answers to millions or thousands). Amount Dr (Cr) $ Account Building, original cost Accumulated depreciation Deprecia ton expense Consider these balances: building, original cost; accumulated depreciation, building depreciation expense, building. What balances should be reported on the consolidated trial balance? Use negative signs with answers to indicate a Credit (Cr) balance. Enter numerical answers using all zeros (do not abbreviate answers to millions or thousands). Amount Dr (Cr) Account Building original cost $ Dr (Cr) $ 0 Account Building, original cost Accumulated depreciation Depreciaiton expense 0 0 Consider these balances: building, original cost; accumulated depreciation, building; depreciation expense, building. What balances should be reported on the consolidated trial balance? Use negative signs with answers to indicate a Credit (Cr) balance. Enter numerical answers using all zeros (do not abbreviate answers to millions or thousands). Amount Dr (Cr) Account $ 0 Building, original cost Accumulated depreciation Depreciation expense 0 0 Show how the eliminating entries in part a adjust Pearl's book balances to the correct consolidated balances. Enter Debit and Credit answers in order as the journal entries appear in part a. Use negative signs in the "Dr (Cr)" columns to indicate a credit balance (not in the "Credit" column). Enter numerical answers using all zeros (do not abbreviate answers to millions or thousands). Pearl Dr (Cr) Debit Credit Account Building, original cost Accumulated depreciation Consolidated Balances Dr (Cr) 0 $ 0 0 0 $ 0 0 ooo Depreciation expense 0 0 0 Check