Question

Up Town Enterprises is a registered vat vendor. Uptown Enterprises purchased Machinery on 1 June 2021 for R45 885 inclusive of vat. This machinery

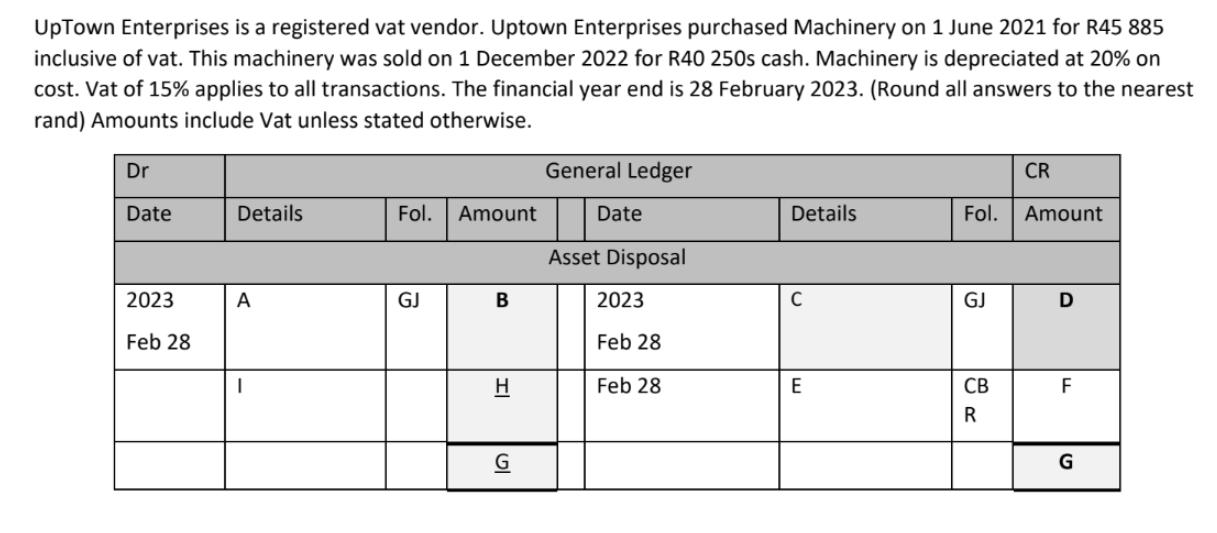

Up Town Enterprises is a registered vat vendor. Uptown Enterprises purchased Machinery on 1 June 2021 for R45 885 inclusive of vat. This machinery was sold on 1 December 2022 for R40 250s cash. Machinery is depreciated at 20% on cost. Vat of 15% applies to all transactions. The financial year end is 28 February 2023. (Round all answers to the nearest rand) Amounts include Vat unless stated otherwise. Dr Date 2023 Feb 28 Details A Fol. Amount GJ B H G General Ledger Date Asset Disposal 2023 Feb 28 Feb 28 Details C E Fol. GJ CB R CR Amount D F G

Step by Step Solution

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Asset disposal account Asset disposal account is prepared for the asset which has been sold off duri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit

7th Edition

1485112117, 9781485112112

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App