Answered step by step

Verified Expert Solution

Question

1 Approved Answer

urgent answer please A. Prepare general journal entries to record the four transactions and to adjust the Allowance for Doubtful Debts account. B. Show how

urgent answer please

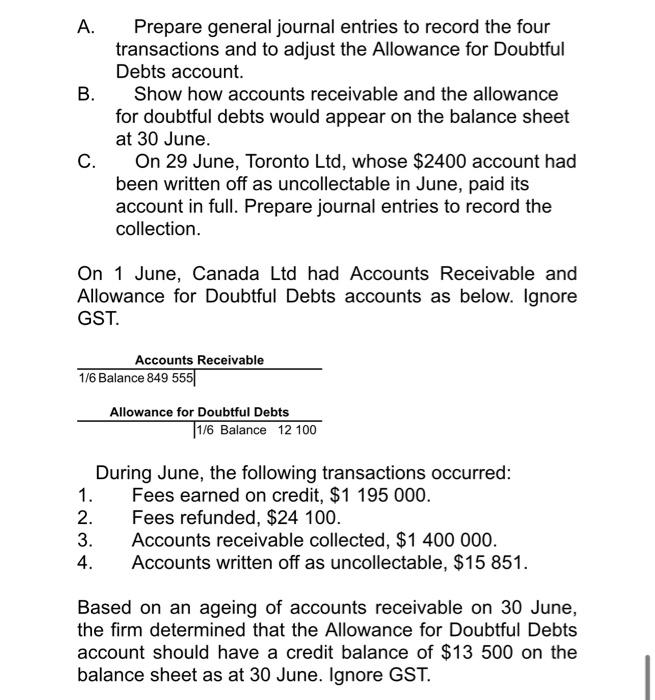

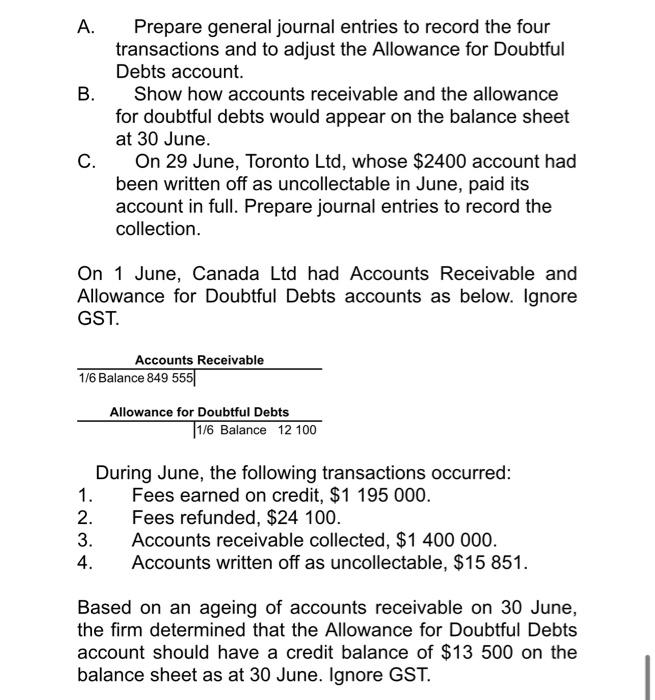

A. Prepare general journal entries to record the four transactions and to adjust the Allowance for Doubtful Debts account. B. Show how accounts receivable and the allowance for doubtful debts would appear on the balance sheet at 30 June. C. On 29 June, Toronto Ltd, whose $2400 account had been written off as uncollectable in June, paid its account in full. Prepare journal entries to record the collection. On 1 June, Canada Ltd had Accounts Receivable and Allowance for Doubtful Debts accounts as below. Ignore GST. Accounts Receivable 1/6 Balance 849 555 Allowance for Doubtful Debts 1/6 Balance 12 100 1. During June, the following transactions occurred: Fees earned on credit, $1 195 000. Fees refunded, $24 100. 2. 3. 4. Accounts receivable collected, $1 400 000. Accounts written off as uncollectable, $15 851. Based on an ageing of accounts receivable on 30 June, the firm determined that the Allowance for Doubtful Debts account should have a credit balance of $13 500 on the balance sheet as at 30 June. Ignore GST. 123

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started