Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Urgent!! b) Lotuss Stores (Malaysia) Sdn Bhd (formerly known as Tesco Stores (Malaysia) Sdn Bhd) (Lotus's Malaysia) is planning to raise a 5-year borrowing for

Urgent!!

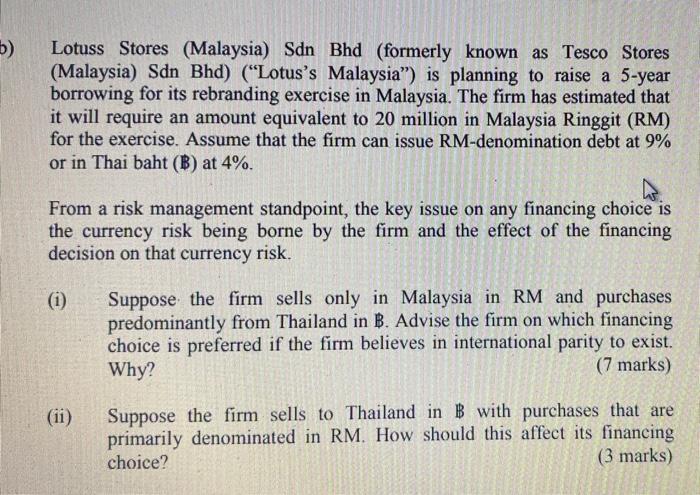

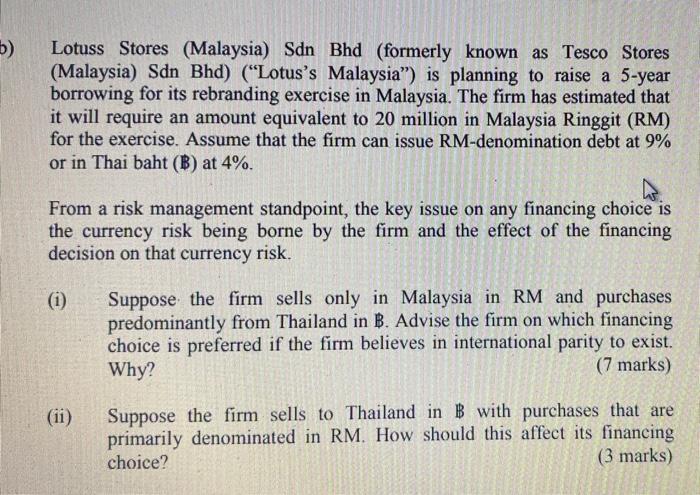

b) Lotuss Stores (Malaysia) Sdn Bhd (formerly known as Tesco Stores (Malaysia) Sdn Bhd) (Lotus's Malaysia") is planning to raise a 5-year borrowing for its rebranding exercise in Malaysia. The firm has estimated that it will require an amount equivalent to 20 million in Malaysia Ringgit (RM) for the exercise. Assume that the firm can issue RM-denomination debt at 9% or in Thai baht (B) at 4%. From a risk management standpoint, the key issue on any financing choice is the currency risk being borne by the firm and the effect of the financing decision on that currency risk. (i) Suppose the firm sells only in Malaysia in RM and purchases predominantly from Thailand in B. Advise the firm on which financing choice is preferred if the firm believes in international parity to exist. Why? (7 marks) (ii) Suppose the firm sells to Thailand in B with purchases that are primarily denominated in RM. How should this affect its financing choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started