Answered step by step

Verified Expert Solution

Question

1 Approved Answer

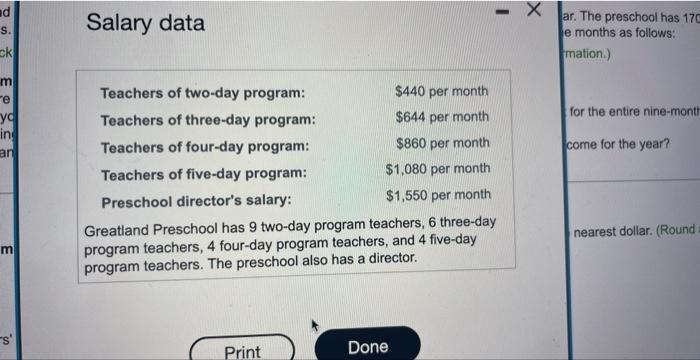

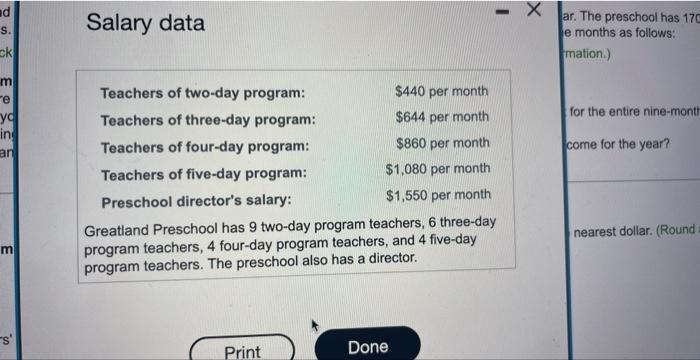

Urgent friend- I give thumbs up Salary data ar. The preschool has 170 e months as follows: mation.) for the entire nine-monts come for the

Urgent friend- I give thumbs up

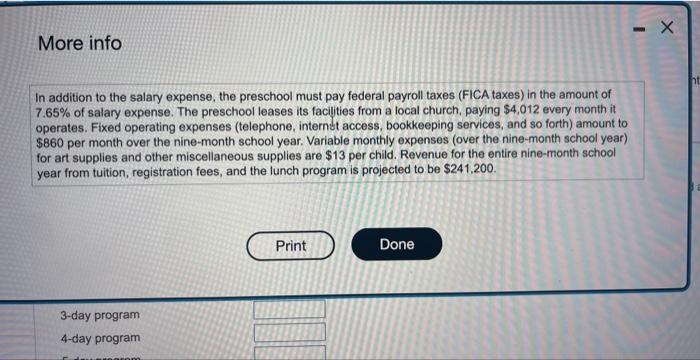

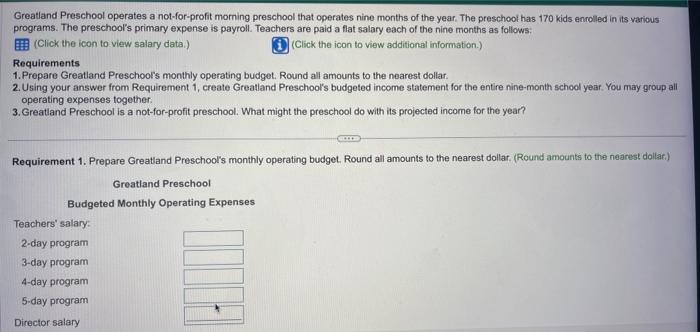

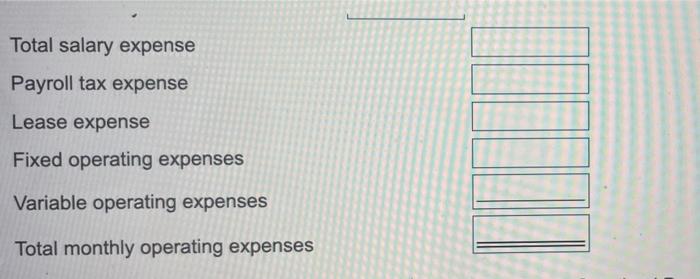

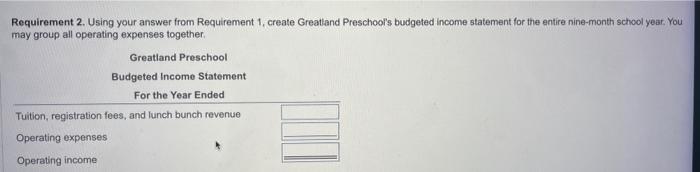

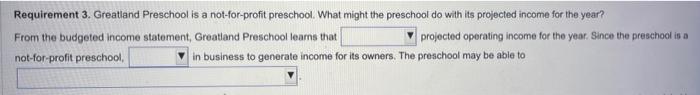

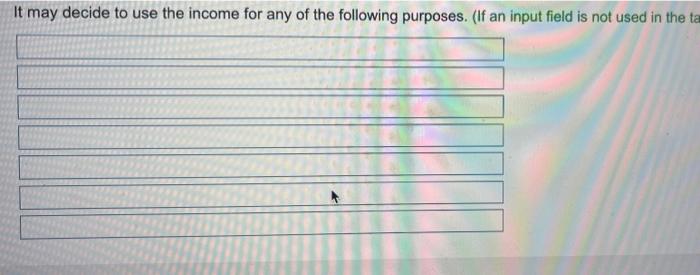

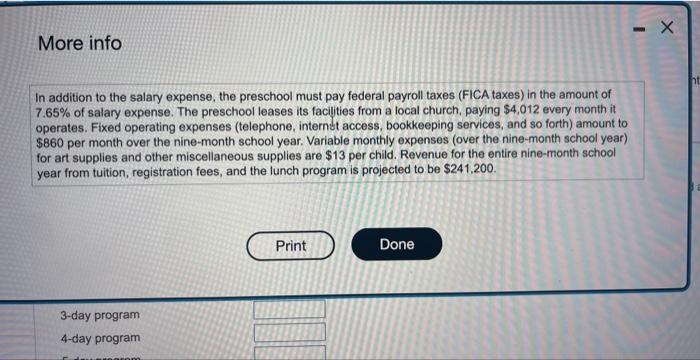

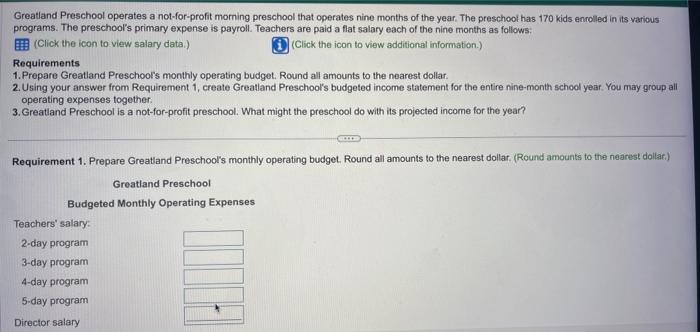

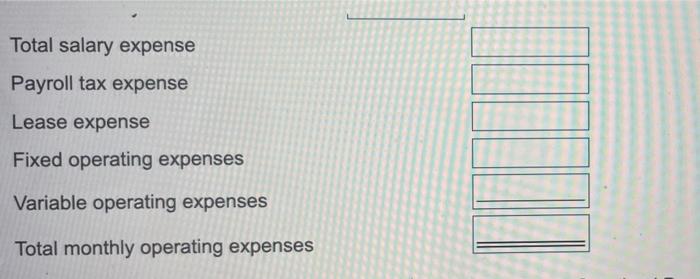

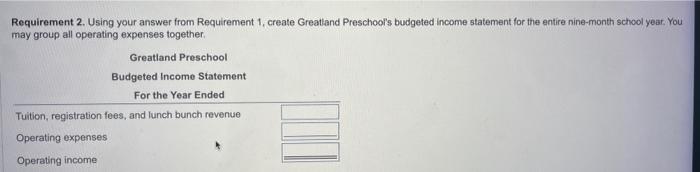

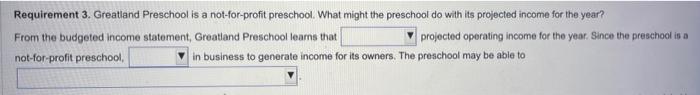

Salary data ar. The preschool has 170 e months as follows: mation.) for the entire nine-monts come for the year? nearest dollar. (Round : More info In addition to the salary expense, the preschool must pay federal payroll taxes (FiCA taxes) in the amount of 7.65% of salary expense. The preschool leases its facilities from a local church, paying $4,012 every month it operates. Fixed operating expenses (telephone, internt access, bookkeeping services, and so forth) amount to $860 per month over the nine-month school year. Variable monthly expenses (over the nine-month school year) for art supplies and other miscellaneous supplies are $13 per child. Revenue for the entire nine-month school year from tuition, registration fees, and the lunch program is projected to be $241,200. Greatland Preschool operates a not-for-profit morning preschool that operates nine months of the year, The preschool has 170 kids enrolled in its various programs. The preschool's primary expense is payroll. Teachers are paid a flat salary each of the nine months as follows: (Click the icon to view salary data,) (Click the icon to view additional information.) Requirements 1. Prepare Greatland Preschool's monthly operating budget. Round all amounts to the nearest dollar. 2. Using your answer from Requirement 1, create Greatland Preschool's budgeted income statement for the entire nine-month school year. You may group all operating expenses together: 3. Greatland Preschool is a not-for-profit preschool. What might the preschool do with its projected income for the year? Total salary expense Payroll tax expense Lease expense Fixed operating expenses Variable operating expenses Total monthly operating expenses Requirement 2. Using your answer from Requirement 1, create Greatland Preschool's budgeted income statement for the entire nine-month school year. You may group all operating expenses together. Requirement 3. Greatland Preschool is a not-for-profit preschool. What might the preschool do with its projected income for the year? From the budgeted income statement, Greatland Preschool leams that projected operating income for the year. Since the preschool is a not-for-profit preschool, in business to generate income for its owners. The preschool may be able to It may decide to use the income for any of the following purposes. (If an input field is not used in the ta

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started