Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT HELP PLEASE E5-34!! Thank you $360 million in 2020 . a. Compute the revenue, expense, and income for both 2019 and 2020, and for

URGENT HELP PLEASE E5-34!! Thank you

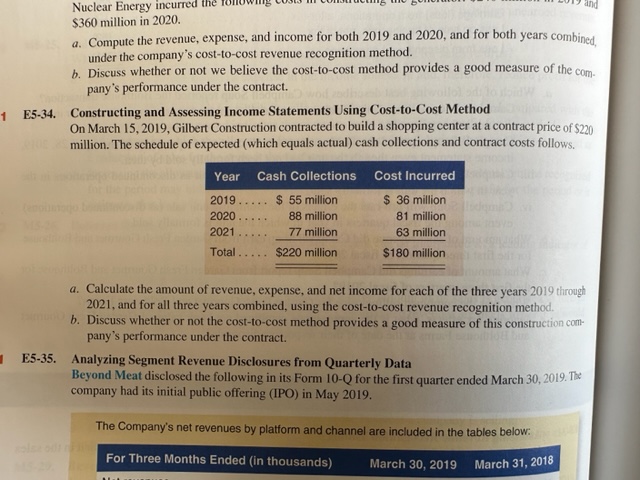

$360 million in 2020 . a. Compute the revenue, expense, and income for both 2019 and 2020, and for both years combined, under the company's cost-to-cost revenue recognition method. b. Discuss whether or not we believe the cost-to-cost method provides a good measure of the company's performance under the contract. E5-34. Constructing and Assessing Income Statements Using Cost-to-Cost Method On March 15, 2019, Gilbert Construction contracted to build a shopping center at a contract price of $220 million. The schedule of expected (which equals actual) cash collections and contract costs follows. a. Calculate the amount of revenue, expense, and net income for each of the three years 2019 through 2021, and for all three years combined, using the cost-to-cost revenue recognition method. b. Discuss whether or not the cost-to-cost method provides a good measure of this construction company's performance under the contract. E5-35. Analyzing Segment Revenue Disclosures from Quarterly Data Beyond Meat disclosed the following in its Form 10-Q for the first quarter ended March 30, 2019. The company had its initial public offering (IPO) in May 2019. The Company's net revenues by platform and channel are included in the tables belowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started