urgent!

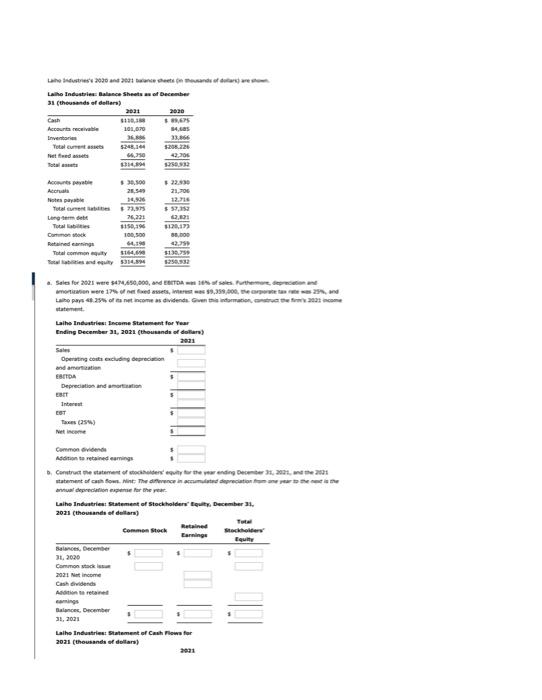

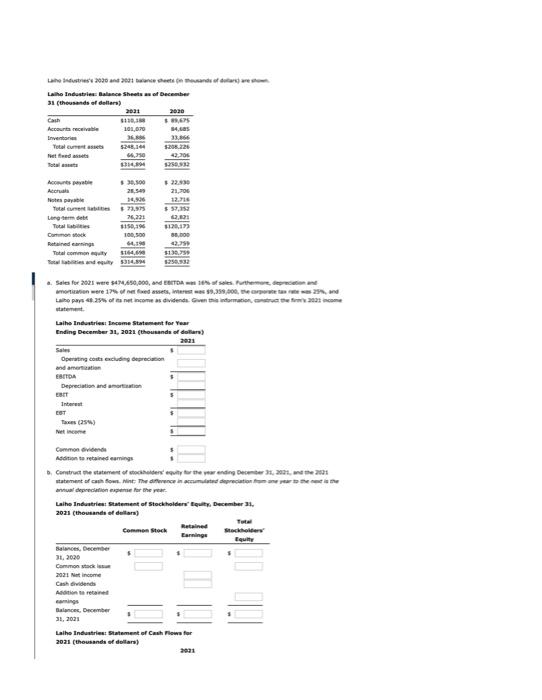

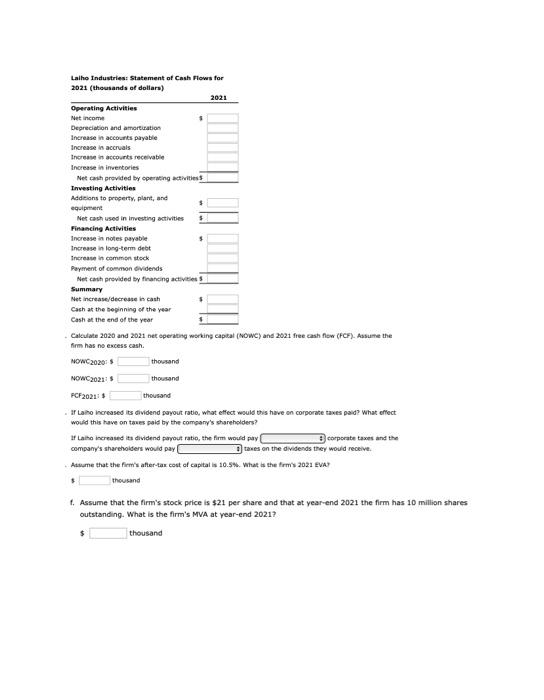

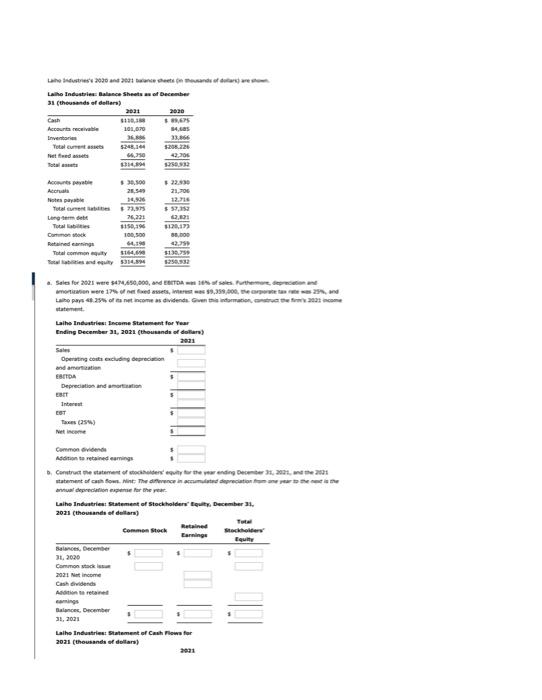

Lava Stotras - 2030 204 2001 hararao teets go f , Lathe Industries Balance Sheets of December 31 (thousands of dollars) 130,00 101,00 Cash Accountive Inventor Total current het feed 5248.16 20.226 2.30 1250,982 22.30 21.70 12.16 $57.150 Aco 20.54 Notes payable 24,500 Tutat e 73,97 Langermet 26.231 1150,19 Canon Rated 64.196 Total $164.00 112017) 36.000 25 11.30 Sales for 2003 were S44,450,000, and EBITDA soles. Turthermore, moration were 1,59,388,000, e porte Lalho pays 4.29 oftanet Income as dividende normation 200cm Laihe Industries Income Statement for your Ending December 31, 2021 (thousands of dollars) Operating costs excluding depreciation and amer EBITDA Depreciation and more ERIT EST Toes (259 Netice 201 Common dividende Addition to read aming Construct the statement of stockholder equity for the year ending December 3, 2001, statement of cow. The difference is depreciation annual depreciation expense for the year Laine Industries Statement of Stockholdere Equity, December 31. 2021 (thousands of dollars) Retained Common Stock Earning Equity Betances, December 31, 2020 Commonsta 2021 Net Income Cash dividends Addition to retained camins Balancer, December 31, 2021 Laihe Industries Statement of Cash Flows for 2021 (thousands of dollars) 2021 Lalho Industries: Statement of Cash Flows for 2021 (thousands of dollars) 2021 Operating Activities Net Income Depreciation and amortization Increase in accounts payable Increase is accruals Increase in accounts receivable Increase in inventories Net cash provided by operating activities Investing Activities Additions to property, plant, and equipment Net cash used in Investing activities 5 Financing Activities Increase in notes payable Increase in long-term debt Increase in common stock Payment of common vidends Net cash provided by financing active Summary Net increase/decretis cash Cash at the topinning of the year Cash at the end of the year Calculate 2020 and 2021 net operating working capital (nowC) and 2021 free cash flow (FCF). Aasume the firm has no excess cash. NOWC2020: thousand NOWC2021 thousand PCF202111 thousand if Lain increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taas paid by the company's shareholders? Laiho increased its dividend payout ratio, the firm would pay corporate taxes and the company's shareholders would pay taxes on the dividends they would receive Assume that the firm's after-tar cost of capital is 10.54. What is the firm's 2021 EVA thousand t. Assume that the firm's stock price is $21 per share and that at year-end 2021 the firm has 10 million shares outstanding. What is the firm's MVA at year-end 2021? thousand Lava Stotras - 2030 204 2001 hararao teets go f , Lathe Industries Balance Sheets of December 31 (thousands of dollars) 130,00 101,00 Cash Accountive Inventor Total current het feed 5248.16 20.226 2.30 1250,982 22.30 21.70 12.16 $57.150 Aco 20.54 Notes payable 24,500 Tutat e 73,97 Langermet 26.231 1150,19 Canon Rated 64.196 Total $164.00 112017) 36.000 25 11.30 Sales for 2003 were S44,450,000, and EBITDA soles. Turthermore, moration were 1,59,388,000, e porte Lalho pays 4.29 oftanet Income as dividende normation 200cm Laihe Industries Income Statement for your Ending December 31, 2021 (thousands of dollars) Operating costs excluding depreciation and amer EBITDA Depreciation and more ERIT EST Toes (259 Netice 201 Common dividende Addition to read aming Construct the statement of stockholder equity for the year ending December 3, 2001, statement of cow. The difference is depreciation annual depreciation expense for the year Laine Industries Statement of Stockholdere Equity, December 31. 2021 (thousands of dollars) Retained Common Stock Earning Equity Betances, December 31, 2020 Commonsta 2021 Net Income Cash dividends Addition to retained camins Balancer, December 31, 2021 Laihe Industries Statement of Cash Flows for 2021 (thousands of dollars) 2021 Lalho Industries: Statement of Cash Flows for 2021 (thousands of dollars) 2021 Operating Activities Net Income Depreciation and amortization Increase in accounts payable Increase is accruals Increase in accounts receivable Increase in inventories Net cash provided by operating activities Investing Activities Additions to property, plant, and equipment Net cash used in Investing activities 5 Financing Activities Increase in notes payable Increase in long-term debt Increase in common stock Payment of common vidends Net cash provided by financing active Summary Net increase/decretis cash Cash at the topinning of the year Cash at the end of the year Calculate 2020 and 2021 net operating working capital (nowC) and 2021 free cash flow (FCF). Aasume the firm has no excess cash. NOWC2020: thousand NOWC2021 thousand PCF202111 thousand if Lain increased its dividend payout ratio, what effect would this have on corporate taxes paid? What effect would this have on taas paid by the company's shareholders? Laiho increased its dividend payout ratio, the firm would pay corporate taxes and the company's shareholders would pay taxes on the dividends they would receive Assume that the firm's after-tar cost of capital is 10.54. What is the firm's 2021 EVA thousand t. Assume that the firm's stock price is $21 per share and that at year-end 2021 the firm has 10 million shares outstanding. What is the firm's MVA at year-end 2021? thousand