Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT, please help!! consider a projecg that has an initial investment cost of $1.5million, and in one year, will generate $2million if things go well(

URGENT, please help!!

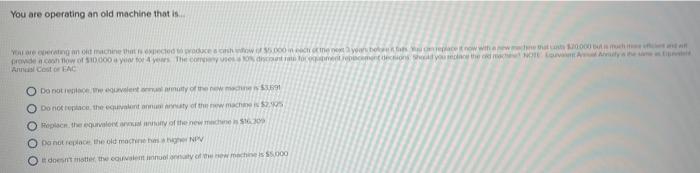

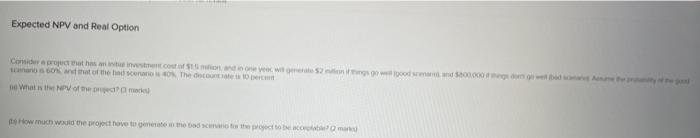

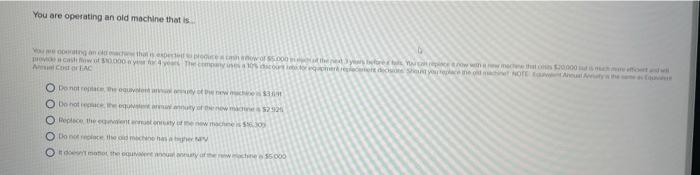

consider a projecg that has an initial investment cost of $1.5million, and in one year, will generate $2million if things go well( good scenario), and $800000 if things don't go well (bad scenario). assume the probability of the good scenario is 60% and that of the bad scenario is 40%. the discount rate is 10 percent

a. what is the NPV of the project. ( 3 marks)

b. how much would the project have to generate in the bad scenario for the project to be acceptable?

i sent you question by typing manually, still it is not visible!!!!!!

Expected NPV and Real Option Wood cost of wood the Other With the world You are operating an old machine that is You gone to reach.000 in each other wet 2000 wivide chow od 1.000 a year for the company.com Switch NOTEA An Cost EN Do not replacement of the machine Do not replace the quality of two place any of the Do not the old nach It domates many of the new S000 Expected NPV and Real Option Contract with Window, were gewoond 00hweite Wat of the bad 40%. The coupec What is the Now much would the school You are operating an old machine that is Vachine de cine wowww De acontowo 50.000 a yow to The common con the Love Arnul costo FC O Do not get mully of the Do not replace the quantity of the machine O place the only of the new machines Do not replace the old machine NPV does not the coulent innowmaches S5.000 Expected NPV and Real Option Con properthes and investment of money wit 800.000 What of them How much would the prodhave to go to bad the com You are operating an old machine that is Wenn Sie weet wet 300004 Theme ACEAC O Do not the Do notice to 2924 ce the way the O Doch manot the che 55.000 Expected NPV and Real Option Wood cost of wood the Other With the world You are operating an old machine that is You gone to reach.000 in each other wet 2000 wivide chow od 1.000 a year for the company.com Switch NOTEA An Cost EN Do not replacement of the machine Do not replace the quality of two place any of the Do not the old nach It domates many of the new S000 Expected NPV and Real Option Contract with Window, were gewoond 00hweite Wat of the bad 40%. The coupec What is the Now much would the school You are operating an old machine that is Vachine de cine wowww De acontowo 50.000 a yow to The common con the Love Arnul costo FC O Do not get mully of the Do not replace the quantity of the machine O place the only of the new machines Do not replace the old machine NPV does not the coulent innowmaches S5.000 Expected NPV and Real Option Con properthes and investment of money wit 800.000 What of them How much would the prodhave to go to bad the com You are operating an old machine that is Wenn Sie weet wet 300004 Theme ACEAC O Do not the Do notice to 2924 ce the way the O Doch manot the che 55.000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started