URGENT PLEASE HELP! Financial Accounting Problem with deadline soon!

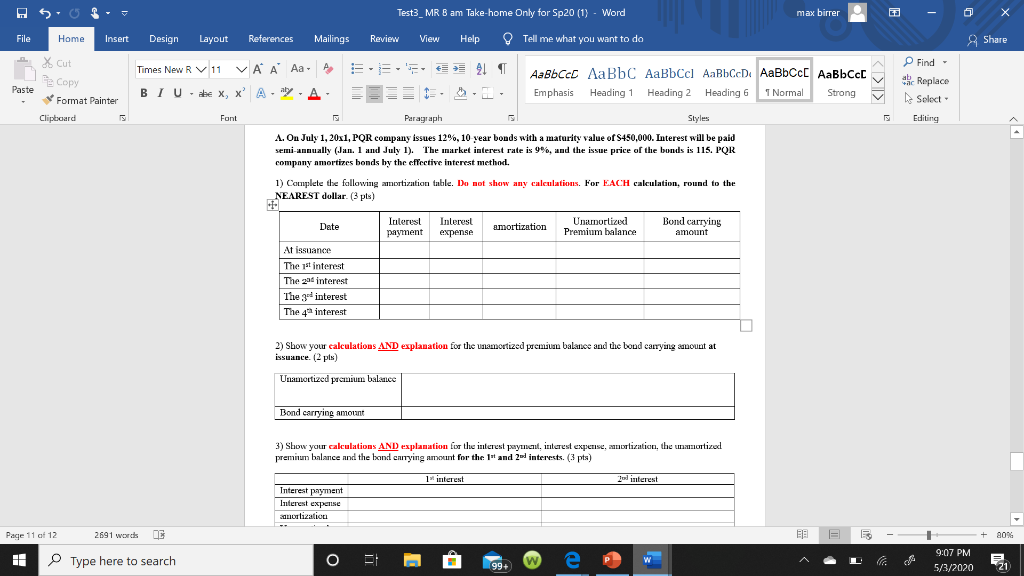

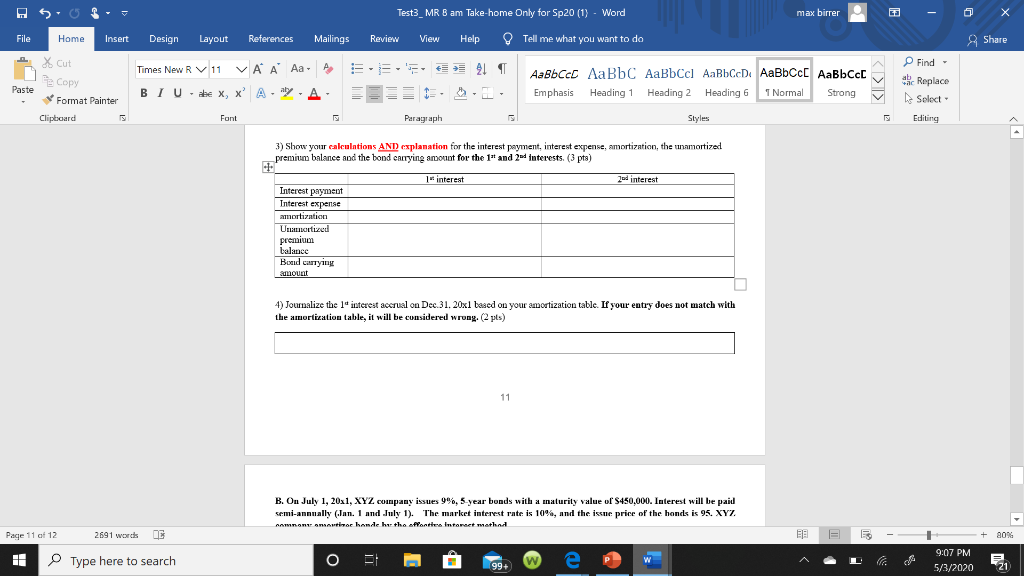

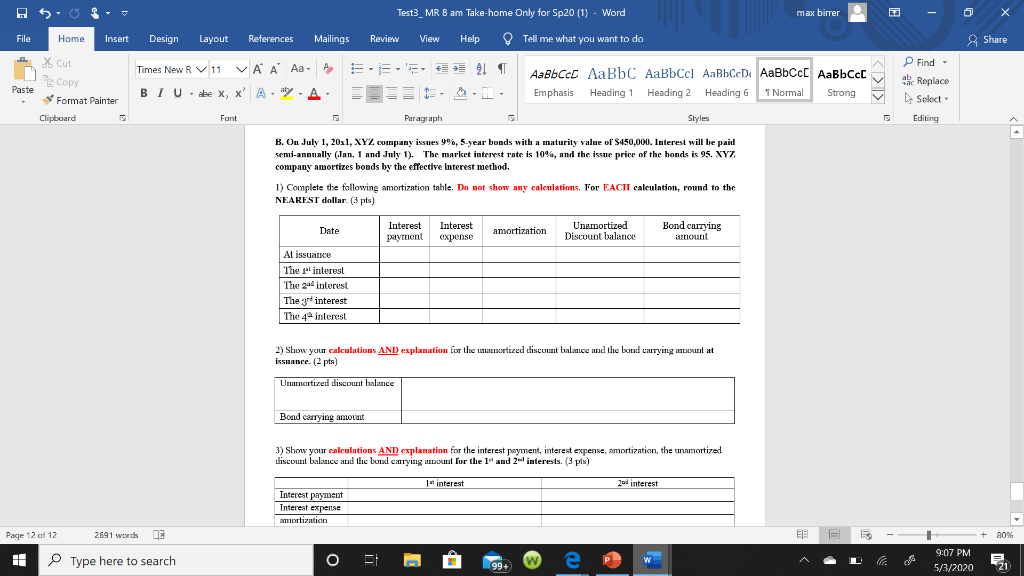

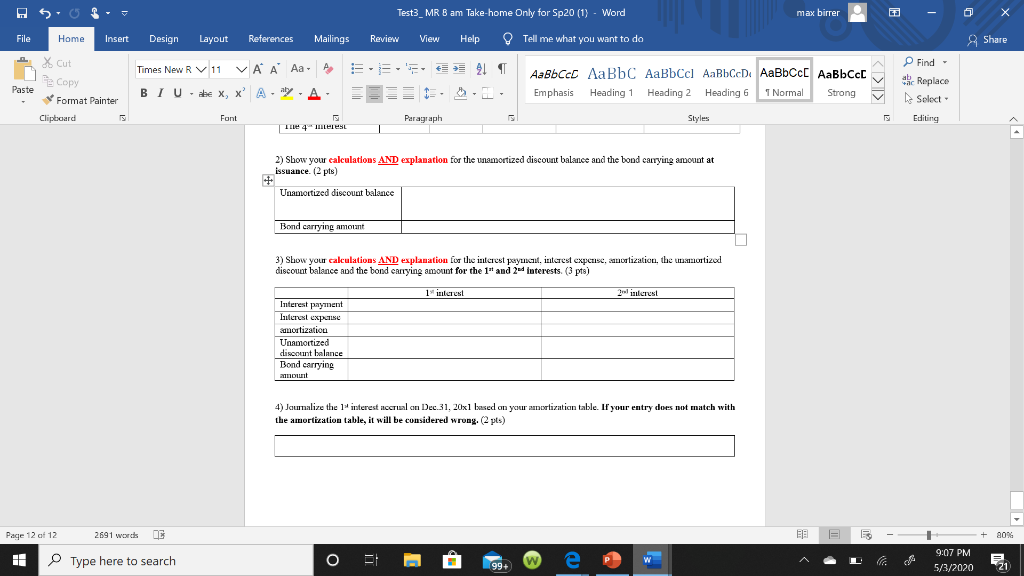

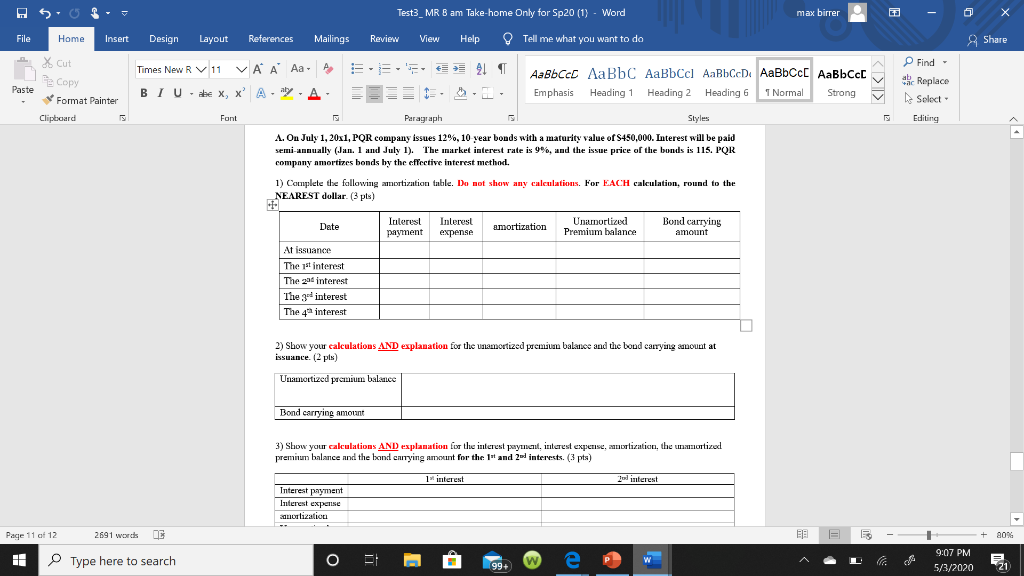

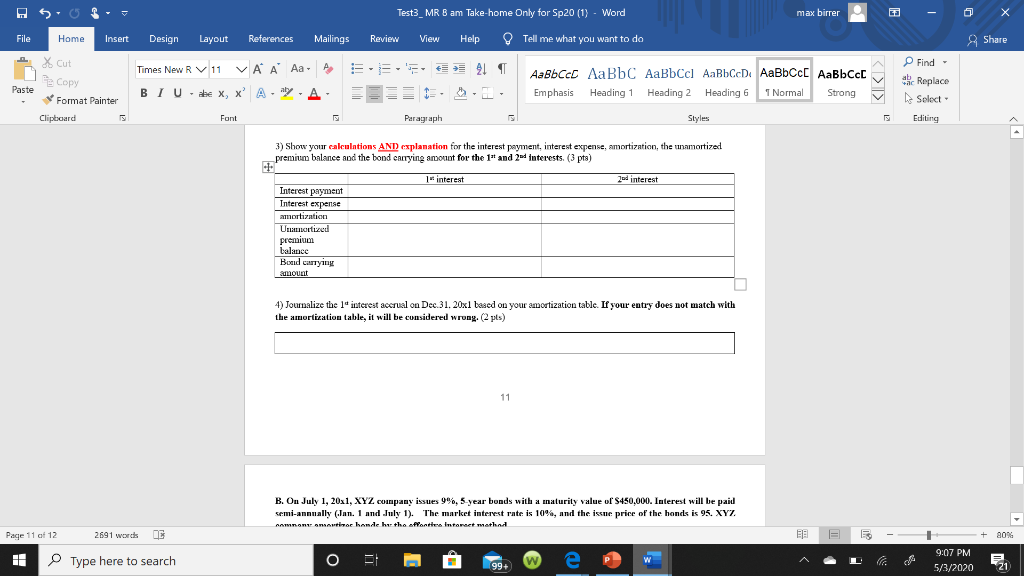

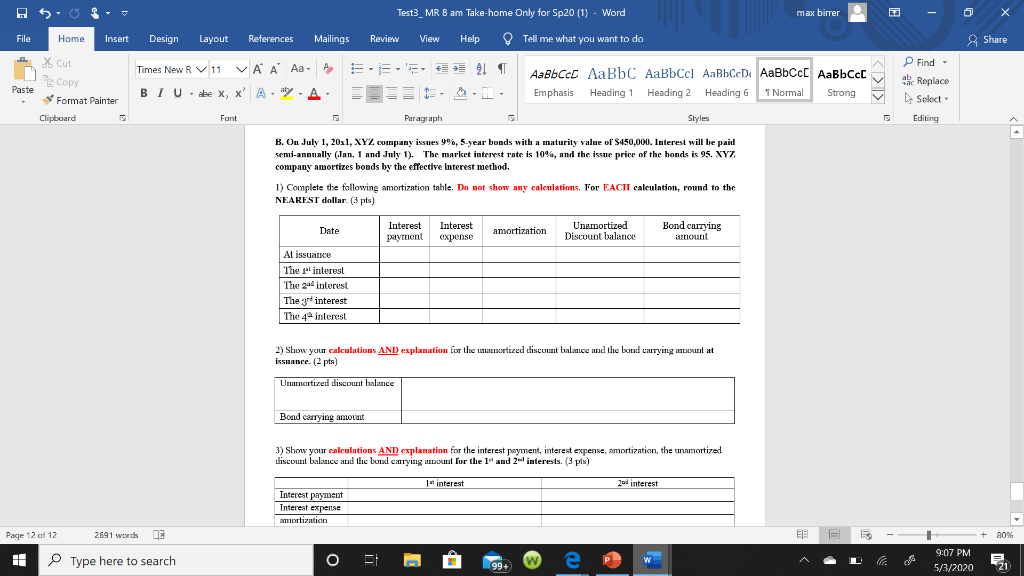

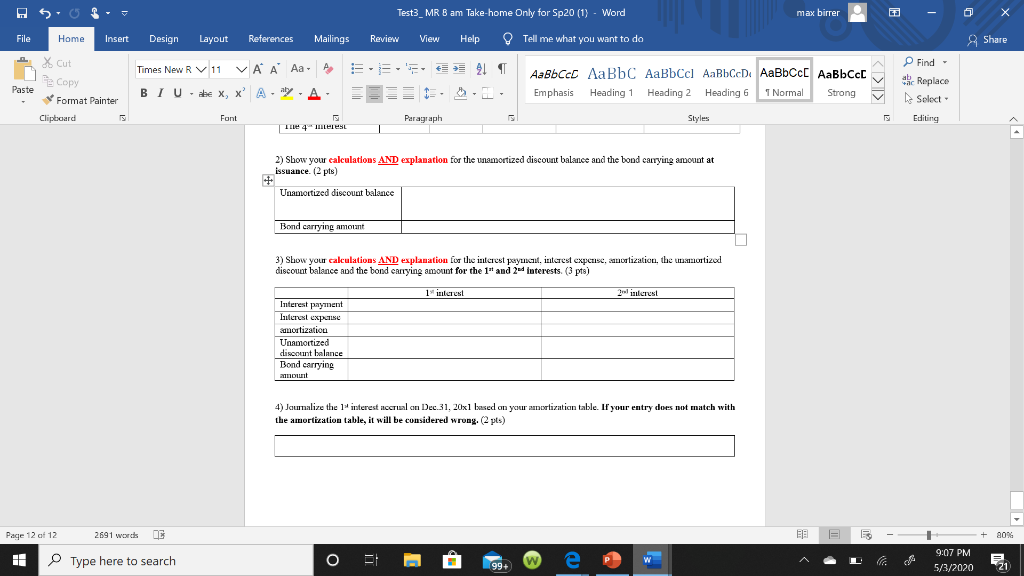

Test3_MR B am Take-home Only for Sp20 (1) - Word max birrer - 0 X Share Insert Design Layout References Mailings Review View Help Tell me what you want to do File - Paste Home X Cut 3.' 41 P Find - e Copy Times New R V 11 VA A Aa. BIU - *ex, x' Aaly - A AaBbcec Aa Bbc AaBbCcl AaBbcc AaBbccc AaBbccc Emphasis Heading 1 Heading 2 Heading 6 T Normal Strong - Select Format Painter Clipboard Font Paragraph Styles 5 Editing A. On July 1, 20x1, POR company issues 12%, 10 year bonds with a maturity value of S450,000. Interest will be paid semiannually (Jan. 1 and July 1). The market interest rate is 9%, and the issue price of the bonds is 115. PQR company amortizes bonds by the effective interest method. 1) Complete the following amortization table. Do not show any calculations. For EACH calculation, round to the NEAREST dollar. (3 pts) Date laterest payment Interest expense amortization Unamorlized Premium balance Bond carrying amount At issuance The interest The ad interest The 3rd interest The interest 2) Show your calculations AND explanation for the namortized premium balance and the boud carrying issuance. (2 pts) out at Unamortized premium balzace Bond carrying amount 3) Show your calculations AND explanation for the interest payment interest expense, muutlization, the mantized premium balance and the band carrying amount for the 1st and 20 interests. (3 pts) 1 interest el interest Interest payment Interest expense anonlization 2691 words E 9 - + 20% Page 11 of 12 11 Type here to search A . L 5/3/2020 21 Test3_MR B am Take-home Only for Sp20 (1) - Word max birrer - 0 X Share File Insert Design Layout References Mailings Review View Help Tell me what you want to do Home X Cut 3.' 41 P Find - Copy Times New R V 11 VA A Aa. BIU - *ex, x Aaly - A AaBbcc AaBbc AaBbcc AaBbce. AaBbCcc AaBbccc Emphasis Heading 1 Heading 2 Heading 6 T Normal Strong Paste COPY - Select Format Painter Clipboard Font Paragraph Styles 5 Editing amortized 3) Show your calculations ANT explanation for the interest payment interest expense, amortization, the premium balance and the bond carrying amount for the 1st and 2nd Interests. (3 pts) 1" interest 2od interest Interest payment Interest expense amortization Unitized premium balance Bead carrying mount 4) Journalize the l'interest accrual on Dec.31. 20x1 based on your amortization table. If your entry does not match with the amortization table, it will be considered wrong. C2 pls) B. On July 1, 20x1, XYZ company issues 9%, 5 year bonds with a maturity value of $450,000. Interest will be paid semi-annually (Jan. 1 and July 1). The market interest rate is 10%, and the issue price of the hond is 95. XY7. Am maior handle her the contes interact method 2691 words E 9 - + 20% Page 11 of 12 11 Type here to search O EL 99. W e P A . L 5/3/2020 21 Test3_MR B am Take-home Only for Sp20 (1) - Word max birrer - 0 X Share File Insert Design Layout References Mailings Review View Help Tell me what you want to do Home X Cut 3.' 41 Copy Times New R V 11 VA A Aa. BIU - *ex, x' Aaly - A AaBbccc AaBb C AaBbCcl AaBCD AaBbccc AaBbCcc Emphasis Heading 1 Heading 2 Heading 6 T Normal Strong P Find - ab Replace Select Paste - Format Painter Clipboard Font Paragraph Styles 5 Editing B. On July 1, 20x1, XYZ company issues 9%, 5-year bonds with a maturity value of $450,000. Interest will be paid semi-annually (Jan. 1 and July 1). The market interest rate is 10%, and the issue price of the honds is 95. XYZ company amortizes bonds by the effective Interest method. 1) Complete the following amortization table. Do not show any calenlations. For EACH calculation, round to the NEAREST dollar. (3 pts) Date Interest payment Interest expense amortization namortized Discount balance Bond carrying arount Al issuance The interest The 24 interest The go interest The 4 interest 2) Show your calculations AND explanation for the namortized discount balance and the Ixud carrying atau issuance. (2 pts) Uramatized discount balance Bond carrying amount amortized 3) Show your calculations ANT explanation for the interest payment interest expense, amortization, the discount balance and the band carrying out for the 1 and 2 interests. (3 pts) 1 interest Zod interest Interest payment Interest expense amortization 2691 words E 9 - + 20% Page 12 of 12 11 Type here to search A . L 5/3/2020 21 Test3_MR B am Take-home Only for Sp20 (1) - Word max birrer - 0 X Share File Insert Design Layout References Mailings Review View Help Tell me what you want to do Home X Cut A 3. 21 P Find - Copy Times New R V 11 VA A Aa BIU - * X, X Aay. A AaBbcec AaBbC AaBbCcl AaBbcc AaBbCcc AaBbccc Emphasis Heading 1 Heading 2 Heading 6 T Normal Strong Paste Select Format Painter Clipboard Font Paragraph Styles 5 Editing T interest 2) Show your calculations AND explanation for the namortized discount balance and the bood carrying amount at issuance. (2 pts) Unamortized discount balance Bond carrying amount mortized 3) Show your calculations AND explanation for the interest paymcat. intcrest expense, amortization, the discount balance and the bond carrying amount for the 1st and 2 interests. (3 pts) 1 interest interest Interest payment Laurent expose mortization Unapoitized discount balance Bond carrying 4) Jamalize the interest nccrual on Dec 31, 20x1 based on your amortization table. If your entry does not match with the amortization table, it will be considered wrong. (2 pts) 2691 words E 9 - + 20% Page 12 of 12 11 9:07 PM Type here to search o ! O g. w e P A. L 5/3/202021