Answered step by step

Verified Expert Solution

Question

1 Approved Answer

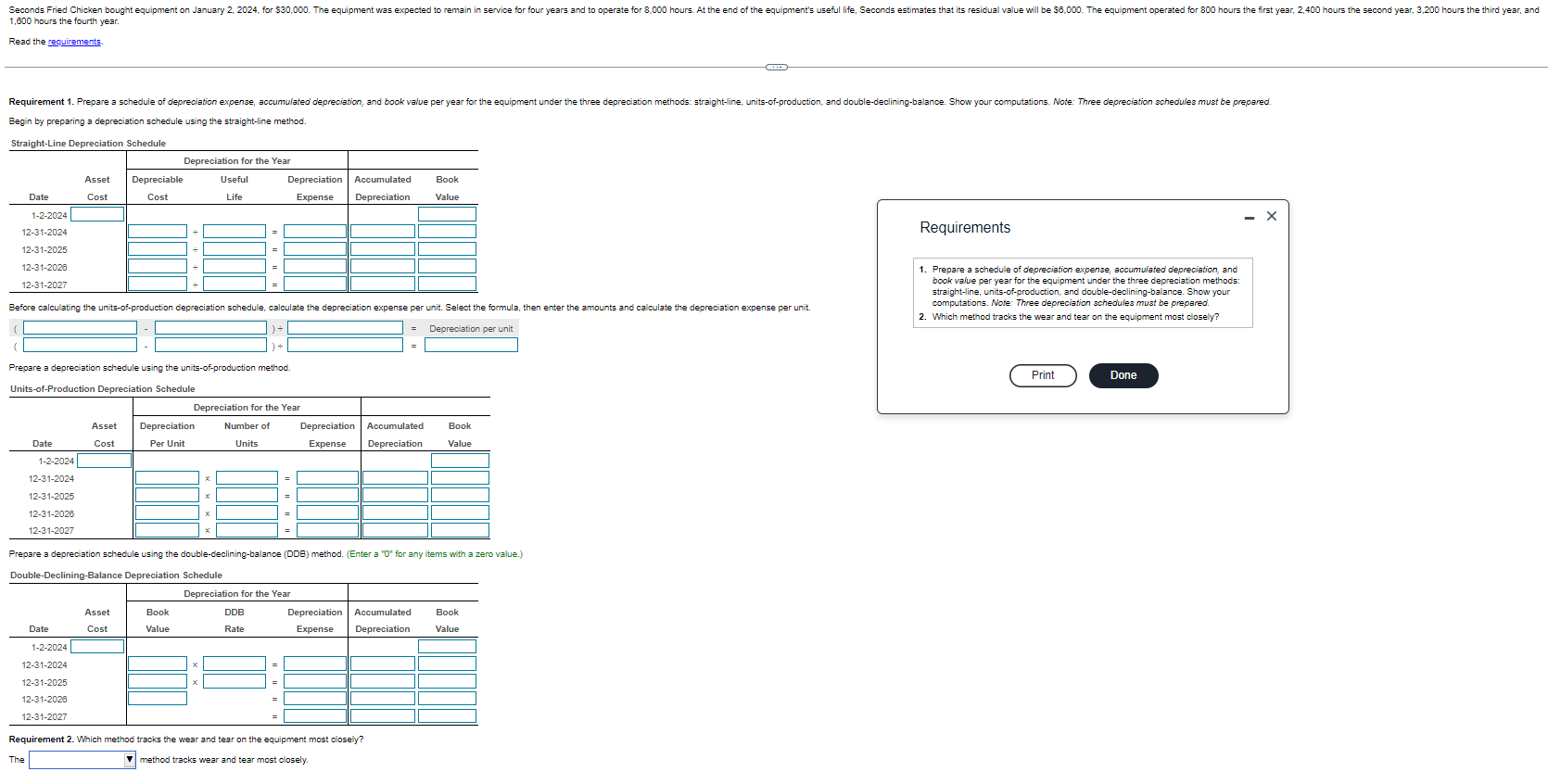

urgent please help Requirements 1. Prepare a schedule of depreciation expense, accumuiated depreciation, and book value per year for the equipment under the three depreciation

urgent please help

Requirements 1. Prepare a schedule of depreciation expense, accumuiated depreciation, and book value per year for the equipment under the three depreciation methods: straight-line, units-of-production, and double-declining-balance. Show your Before calculating the units-of-production depreciation schedule, calculate the depreciation expense per unit. Select the formula, then enter the amounts and calculate the depreciation expense per unit. computations. Note: Three depreciation scheoules must be prepared. 2. Which method tracks the wear and tear on the equipment most closely? ((())= Prepare a depreciation schedule using the units-of-production method. Units-of-Production Depreciation Schedule Prepare a depreciation schedule using the double-declining-balance (DDB) method. (Enter a "O" for any items with a zero value.) Double-Declining-Balance Depreciation Schedule Requirement 2. Which method tracks the wear and tear on the equipment most closely? The method tracks wear and tear most closely

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started