Question

*URGENT* please use id number: 6226981 in missing places Q. 3: Following are prices and No. of Shares Outstanding of different companies from day1 through

*URGENT* please use id number: 6226981 in missing places

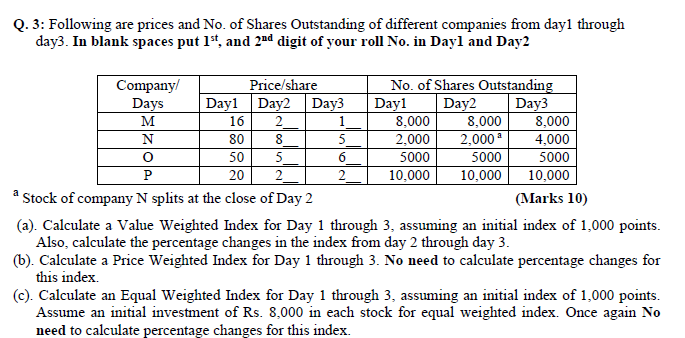

Q. 3: Following are prices and No. of Shares Outstanding of different companies from day1 through day3. In blank spaces put 1st, and 2nd digit of your roll No. in Day1 and Day2 Company/ Days Price/share No. of Shares Outstanding Day1 Day2 Day3 Day1 Day2 Day3 M 16 2__ 1__ 8,000 8,000 8,000 N 80 8__ 5__ 2,000 2,000 a 4,000 O 50 5__ 6__ 5000 5000 5000 P 20 2__ 2__ 10,000 10,000 10,000 a Stock of company N splits at the close of Day 2 (Marks 10) (a). Calculate a Value Weighted Index for Day 1 through 3, assuming an initial index of 1,000 points. Also, calculate the percentage changes in the index from day 2 through day 3. (b). Calculate a Price Weighted Index for Day 1 through 3. No need to calculate percentage changes for this index. (c). Calculate an Equal Weighted Index for Day 1 through 3, assuming an initial index of 1,000 points. Assume an initial investment of Rs. 8,000 in each stock for equal weighted index. Once again No need to calculate percentage changes for this index.

Will definitely LIKE your answer!

Q. 3: Following are prices and No. of Shares Outstanding of different companies from day through day3. In blank spaces put 1st, and 2nd digit of your roll No. in Dayl and Day2 8 5 a Company Price/share No. of Shares Outstanding Days Dayl Day2 Day3 Day1 Day2 Day3 M 16 2 1 8,000 8,000 8,000 N 80 2,000 2,000 4,000 o 50 5 6 5000 5000 5000 P 20 2 2 10,000 10,000 10,000 Stock of company N splits at the close of Day 2 (Marks 10) (a). Calculate a Value Weighted Index for Day 1 through 3, assuming an initial index of 1,000 points. Also, calculate the percentage changes in the index from day 2 through day 3. (b). Calculate a Price Weighted Index for Day 1 through 3. No need to calculate percentage changes for this index (C). Calculate an Equal Weighted Index for Day 1 through 3, assuming an initial index of 1,000 points. Assume an initial investment of Rs. 8,000 in each stock for equal weighted index. Once again No need to calculate percentage changes for this index. Q. 3: Following are prices and No. of Shares Outstanding of different companies from day through day3. In blank spaces put 1st, and 2nd digit of your roll No. in Dayl and Day2 8 5 a Company Price/share No. of Shares Outstanding Days Dayl Day2 Day3 Day1 Day2 Day3 M 16 2 1 8,000 8,000 8,000 N 80 2,000 2,000 4,000 o 50 5 6 5000 5000 5000 P 20 2 2 10,000 10,000 10,000 Stock of company N splits at the close of Day 2 (Marks 10) (a). Calculate a Value Weighted Index for Day 1 through 3, assuming an initial index of 1,000 points. Also, calculate the percentage changes in the index from day 2 through day 3. (b). Calculate a Price Weighted Index for Day 1 through 3. No need to calculate percentage changes for this index (C). Calculate an Equal Weighted Index for Day 1 through 3, assuming an initial index of 1,000 points. Assume an initial investment of Rs. 8,000 in each stock for equal weighted index. Once again No need to calculate percentage changes for this indexStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started