Question

URGENT please use Roll No.: 9171121 in missing places Q. 2: You expect a risk free rate of return (KRF) of 6% and the market

URGENT please use Roll No.: 9171121 in missing places

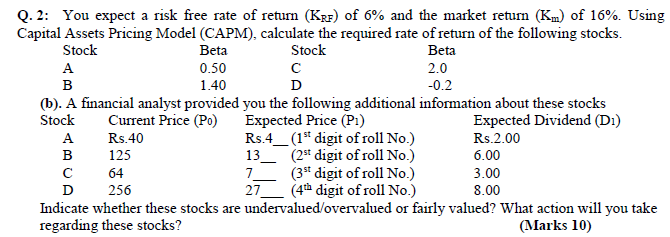

Q. 2: You expect a risk free rate of return (KRF) of 6% and the market return (Km) of 16%. Using Capital Assets Pricing Model (CAPM), calculate the required rate of return of the following stocks. Stock Beta Stock Beta A 0.50 C 2.0 B 1.40 D -0.2 (b). A financial analyst provided you the following additional information about these stocks Stock Current Price (P0) Expected Price (P1) Expected Dividend (D1) A Rs.40 Rs.4__ (1st digit of roll No.) Rs.2.00 B 125 13__ (2st digit of roll No.) 6.00 C 64 7___ (3st digit of roll No.) 3.00 D 256 27___ (4th digit of roll No.) 8.00 Indicate whether these stocks are undervalued/overvalued or fairly valued? What action will you take regarding these stocks?

Will definitely Like your answer!

Q.2: You expect a risk free rate of return (KrF) of 6% and the market return (Km) of 16%. Using Capital Assets Pricing Model (CAPM), calculate the required rate of return of the following stocks. Stock Beta Stock Beta A 0.50 C 2.0 B 1.40 D -0.2 6). A financial analyst provided you the following additional information about these stocks Stock Current Price (Po) Expected Price (Pi) Expected Dividend (D.) A Rs.40 Rs.4_(1st digit of roll No.) Rs.2.00 B 125 (2st digit of roll No.) 6.00 7 (39 digit of roll No.) D 256 27 (4th digit of roll No.) 8.00 Indicate whether these stocks are undervalued/overvalued or fairly valued? What action will you take regarding these stocks? (Marks 10) 13 64 3.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started