Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT !!! Pro forma balance sheet-Basic Loonard Industries wiahes to prepare a pro forma bulance sheet for next year. The firm oxpocts salos to totai

URGENT !!!

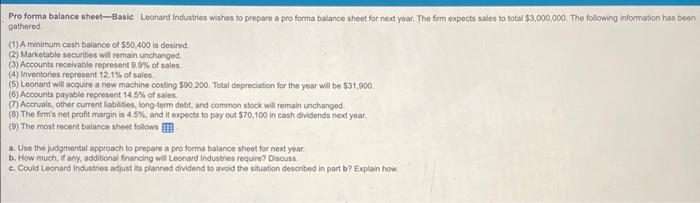

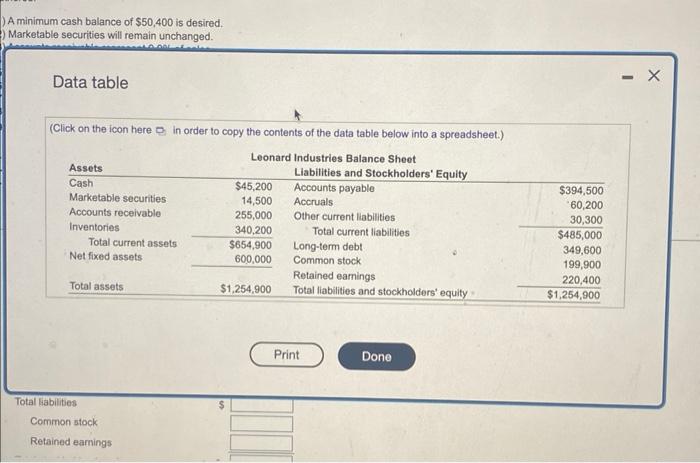

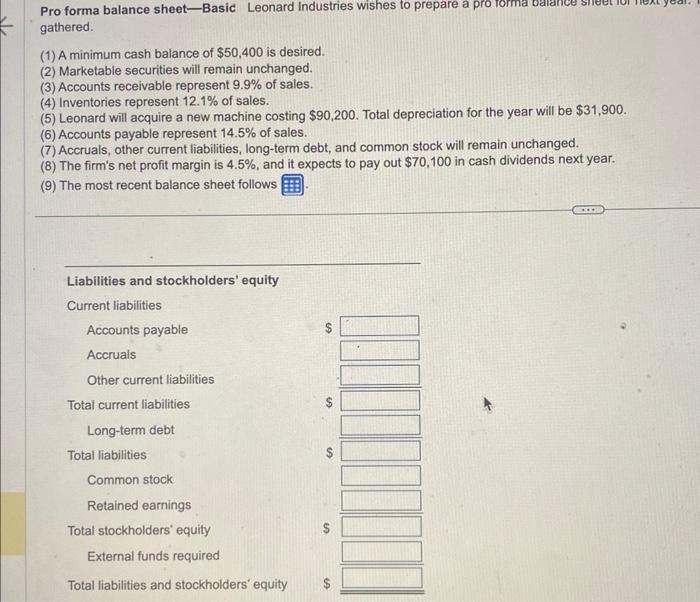

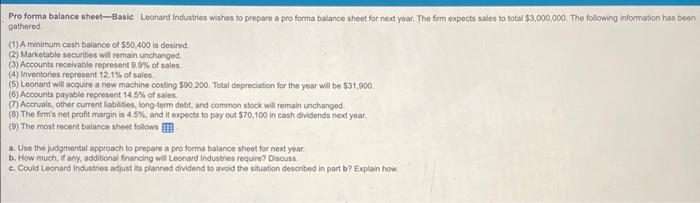

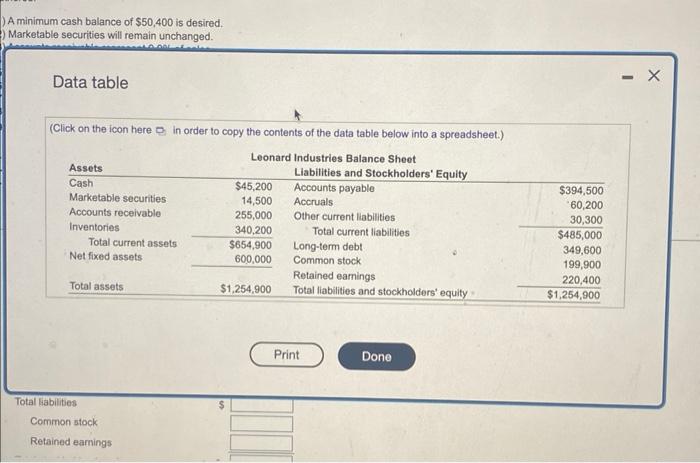

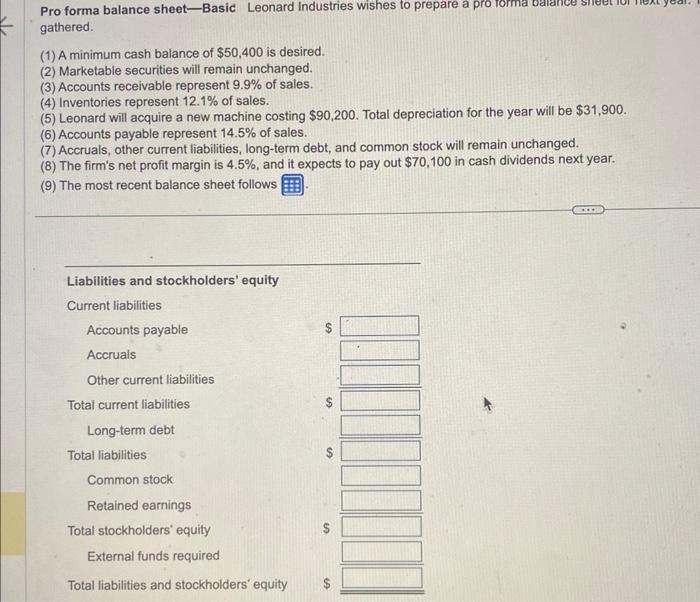

Pro forma balance sheet-Basic Loonard Industries wiahes to prepare a pro forma bulance sheet for next year. The firm oxpocts salos to totai $3,000,000. The following information has been gathered (1) A minimum cash balance of 550,400 is desired. (2) Marketable securtites will remain unchanged. (3) Accounts receivable represent 99% of sales (4) linventories represent 12.1% of sales. (5) Loonard will acquire a now machine costing $90,200. Tetal depeeciation for the year will be $31,900. (6) Accounts payable represent 14.5% of sales. (7) Accruals, other current liabilities, ilong-term debt, and common stock will remath unchanged. (B) The firmis net profit margin is 4,5%, and it expects to poy cut $70,t0 in cash didends next year: (9) The most recent balance sheet follows a. Use the judgmental approach to prepare a pro forma balance sheet for noxt year. b. How much, If ary, additional financing will Leonard tndustries require? Discuss. c. Could Leonard industies adjust as planned dividend to avoid the situation described in part b? Explain how. A minimum cash balance of $50,400 is desired. Marketable securities will remain unchanged. Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet. Pro forma balance sheet-Basic Leonard industries wishes to prepare a pro rommadidice gathered. (1) A minimum cash balance of $50,400 is desired. (2) Marketable securities will remain unchanged. (3) Accounts receivable represent 9.9% of sales. (4) Inventories represent 12.1% of sales. (5) Leonard will acquire a new machine costing $90,200. Total depreciation for the year will be $31,900. (6) Accounts payable represent 14.5% of sales. (7) Accruals, other current liabilities, long-term debt, and common stock will remain unchanged. (8) The firm's net profit margin is 4.5%, and it expects to pay out $70,100 in cash dividends next year. (9) The most recent balance sheet follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started