Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Urgent Problem 6: (18pts) Suppose you invest in two assets whose dollar prices at the beginning of six consecutive years are shown in the table

Urgent

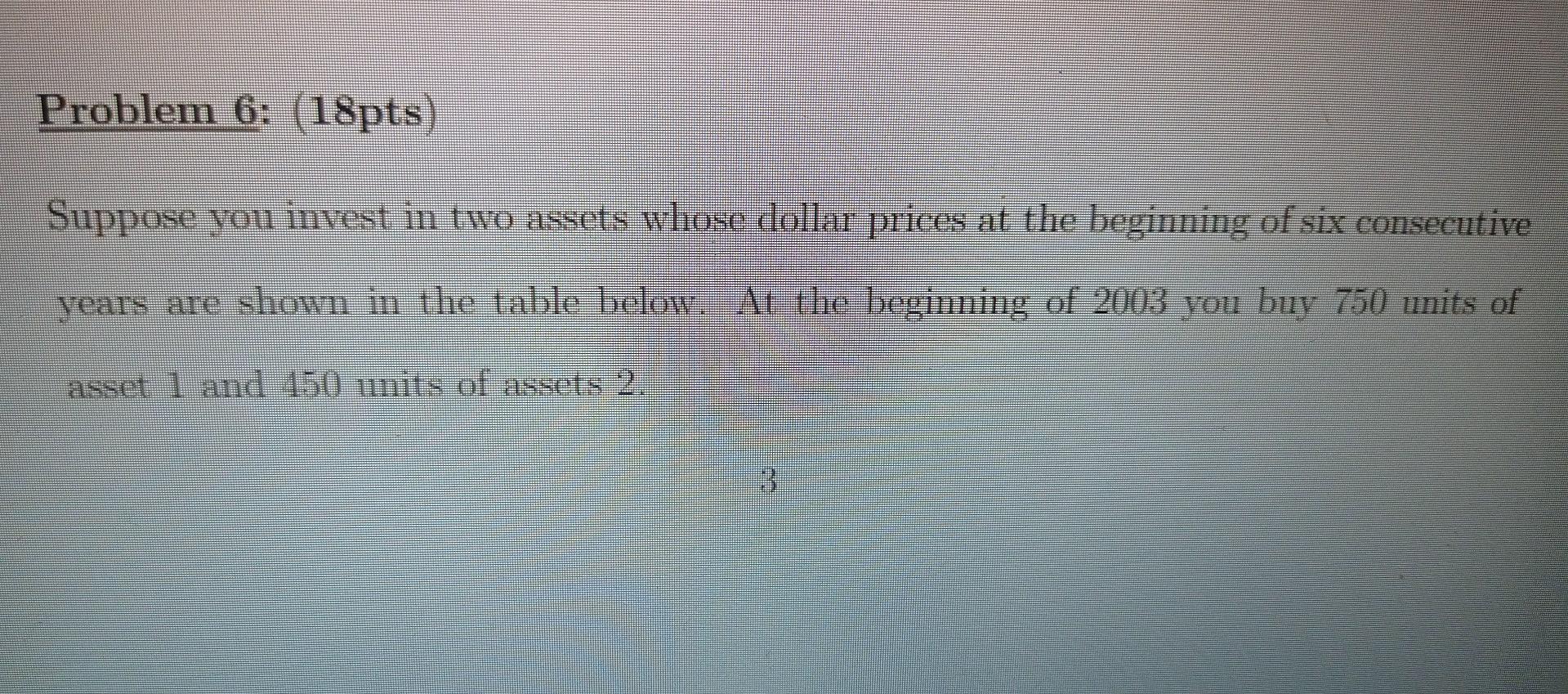

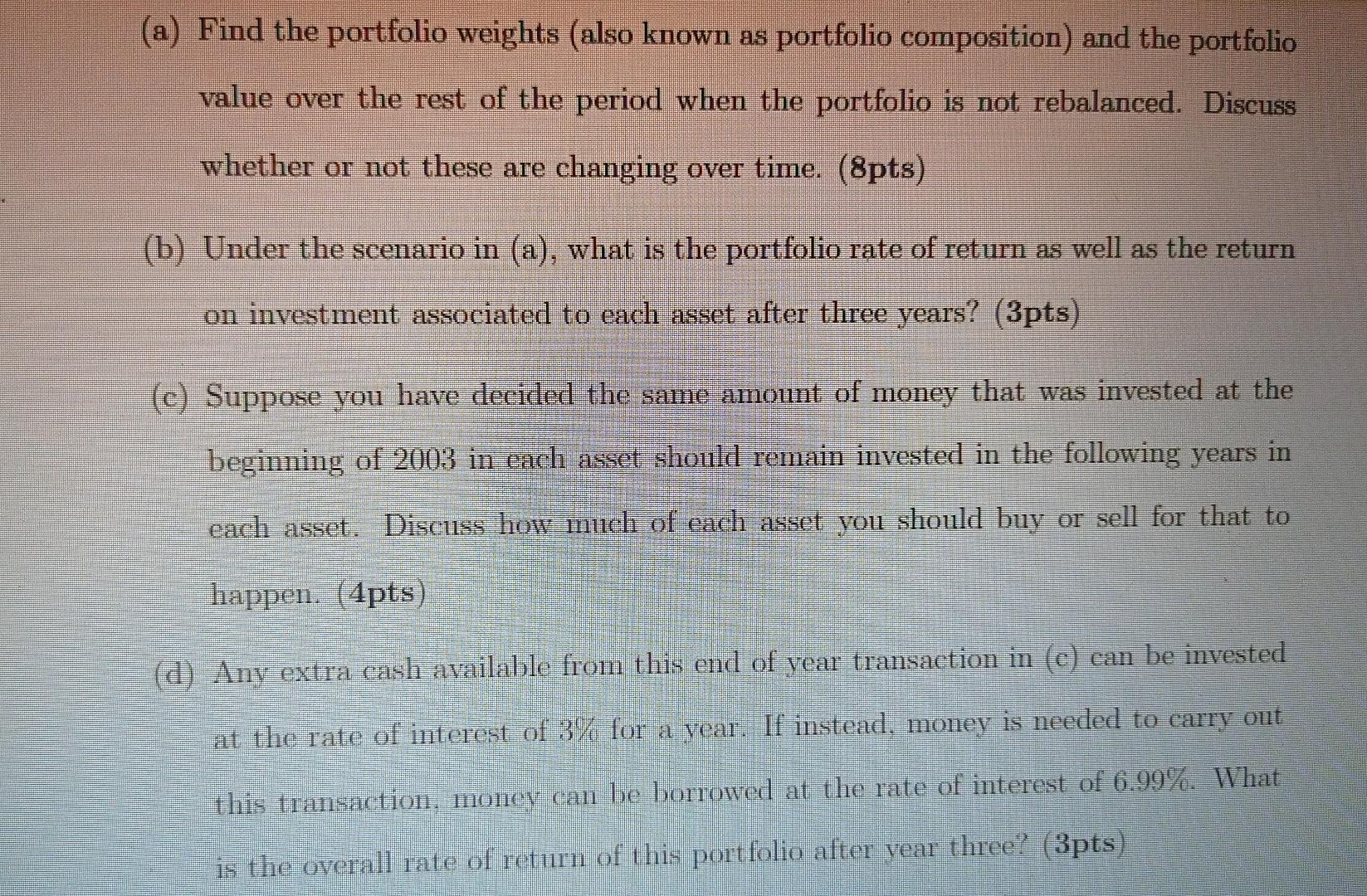

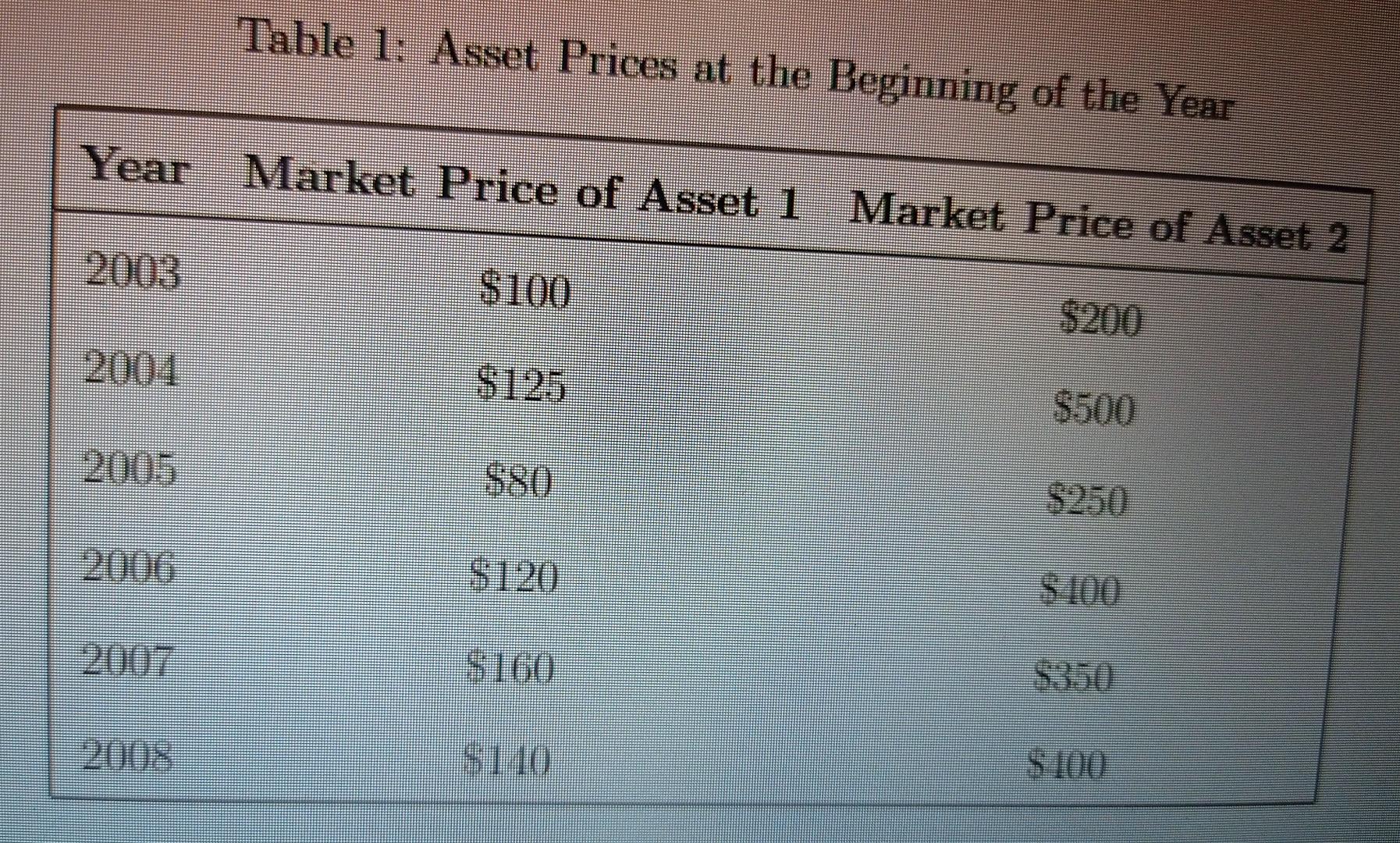

Problem 6: (18pts) Suppose you invest in two assets whose dollar prices at the beginning of six consecutive years are shown in the table below. At the beginning of 2003 you buy 750 units of asset 1 and 150 units of assets 2. (a) Find the portfolio weights (also known as portfolio composition) and the portfolio value over the rest of the period when the portfolio is not rebalanced. Discuss whether or not these are changing over time. (8pts) (b) Under the scenario in (a), what is the portfolio rate of return as well as the return on investment associated to each asset after three years? (3pts) (c) Suppose you have decided the same amount of money that was invested at the beginning of 2003 in each asset should remain invested in the following years in each asset. Discuss how much of each asset you should buy or sell for that to happen. (4pts) (d) Any extra cash available from this end of year transaction in (c) can be invested at the rate of interest of 3% for a year. If instead, money is needed to carry out this transaction, money can be borrowed at the rate of interest of 6.99%. What is the overall rate of return of this portfolio after year three? (3pts) Table 1: Asset Prices at the Beginning of the Year Year Market Price of Asset 1 Market Price of Asset 2 2003 $100 $200 2004 $125 $500 2005 $80 $250 2006 $120 S 100 2007 $160 $350 2008 $110 $100 Problem 6: (18pts) Suppose you invest in two assets whose dollar prices at the beginning of six consecutive years are shown in the table below. At the beginning of 2003 you buy 750 units of asset 1 and 150 units of assets 2. (a) Find the portfolio weights (also known as portfolio composition) and the portfolio value over the rest of the period when the portfolio is not rebalanced. Discuss whether or not these are changing over time. (8pts) (b) Under the scenario in (a), what is the portfolio rate of return as well as the return on investment associated to each asset after three years? (3pts) (c) Suppose you have decided the same amount of money that was invested at the beginning of 2003 in each asset should remain invested in the following years in each asset. Discuss how much of each asset you should buy or sell for that to happen. (4pts) (d) Any extra cash available from this end of year transaction in (c) can be invested at the rate of interest of 3% for a year. If instead, money is needed to carry out this transaction, money can be borrowed at the rate of interest of 6.99%. What is the overall rate of return of this portfolio after year three? (3pts) Table 1: Asset Prices at the Beginning of the Year Year Market Price of Asset 1 Market Price of Asset 2 2003 $100 $200 2004 $125 $500 2005 $80 $250 2006 $120 S 100 2007 $160 $350 2008 $110 $100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started