Answered step by step

Verified Expert Solution

Question

1 Approved Answer

urgent question please 1. Alford, Ltd., a British computer house, has the opportunity to issue a floating rate six-year Eurobond at LIBOR plus 1/2 percent

urgent question please

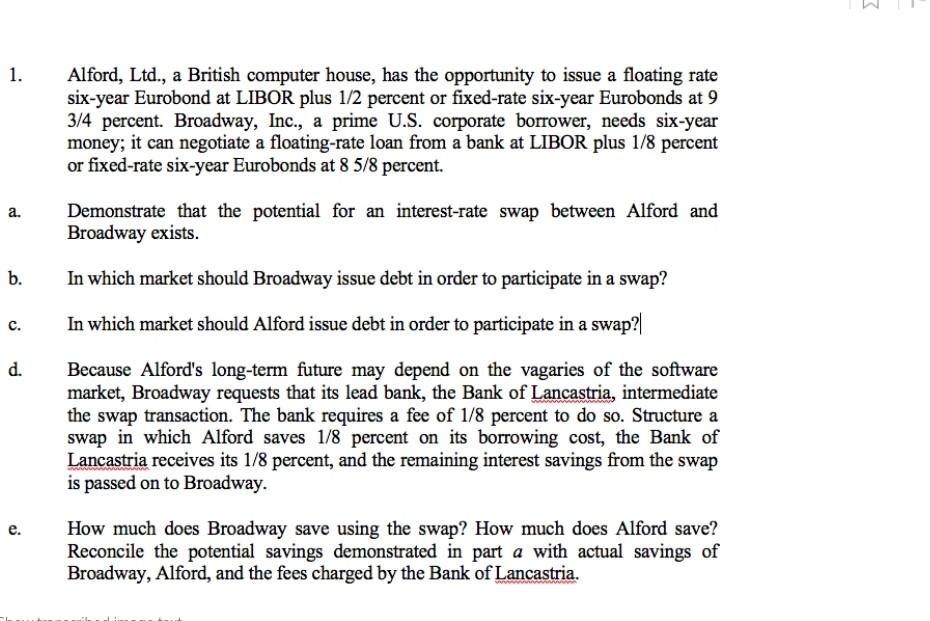

1. Alford, Ltd., a British computer house, has the opportunity to issue a floating rate six-year Eurobond at LIBOR plus 1/2 percent or fixed-rate six-year Eurobonds at 9 3/4 percent. Broadway, Inc., a prime U.S. corporate borrower, needs six-year money; it can negotiate a floating-rate loan from a bank at LIBOR plus 1/8 percent or fixed-rate six-year Eurobonds at 8 5/8 percent. a. Demonstrate that the potential for an interest-rate swap between Alford and Broadway exists. b. In which market should Broadway issue debt in order to participate in a swap? C. In which market should Alford issue debt in order to participate in a swap? d. Because Alford's long-term future may depend on the vagaries of the software market, Broadway requests that its lead bank, the Bank of Lancastria, intermediate the swap transaction. The bank requires a fee of 1/8 percent to do so. Structure a swap in which Alford saves 1/8 percent on its borrowing cost, the Bank of Lancastria receives its 1/8 percent, and the remaining interest savings from the swap is passed on to Broadway. e. How much does Broadway save using the swap? How much does Alford save? Reconcile the potential savings demonstrated in part a with actual savings of Broadway, Alford, and the fees charged by the Bank of Lancastria. 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started