Answered step by step

Verified Expert Solution

Question

1 Approved Answer

URGENT!! QUICKLY PLEASE DO QUESTION 1 2 - 1 6 Please show the formulas of how to find these answers step by step without excel

URGENT!! QUICKLY PLEASE DO QUESTION Please show the formulas of how to find these answers step by step without excel spreadsheet

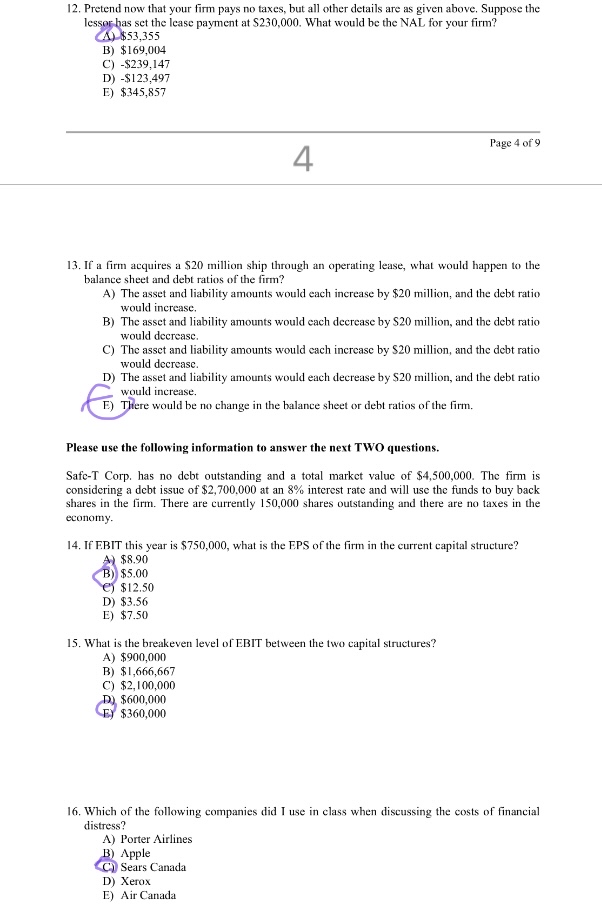

Pretend now that your firm pays no taxes, but all other details are as given above. Suppose the lesser bas set the lease payment at $ What would be the NAL for your firm?

A $

B $

C$

D$

E $

If a firm acquires a $ million ship through an operating lease, what would happen to the balance sheet and debt ratios of the firm?

A The asset and liability amounts would each increase by $ million, and the debt ratio would increase.

B The asset and liability amounts would each decrease by $ million, and the debt ratio would decrease.

C The asset and liability amounts would each increase by $ million, and the debt ratio would decrease.

D The asset and liability amounts would each decrease by $ million, and the debt ratio would increase.

E There would be no change in the balance sheet or debt ratios of the firm.

Please use the following information to answer the next TWO questions.

SafeT Corp, has no debt outstanding and a total market value of $ The firm is considering a debt issue of $ at an interest rate and will use the funds to buy back shares in the firm. There are currently shares outstanding and there are no taxes in the economy.

If EBIT this year is $ what is the EPS of the firm in the current capital structure?

A $

B $

e $

D $

E $

What is the breakeven level of EBIT between the two capital structures?

A $

B $

C $

D $

E $

Which of the following companies did I use in class when discussing the costs of financial distress?

A Porter Airlines

B Apple

C Sears Canada

D Xerox

E Air Canada

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started