URGENT - will upvote!!

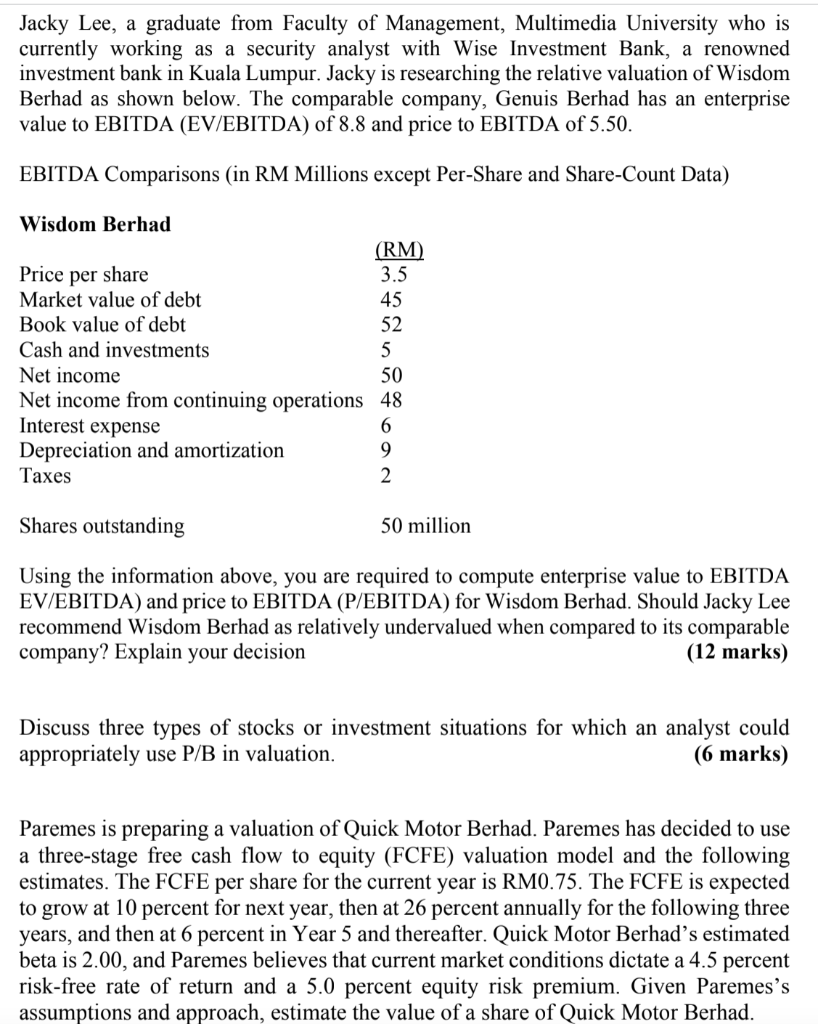

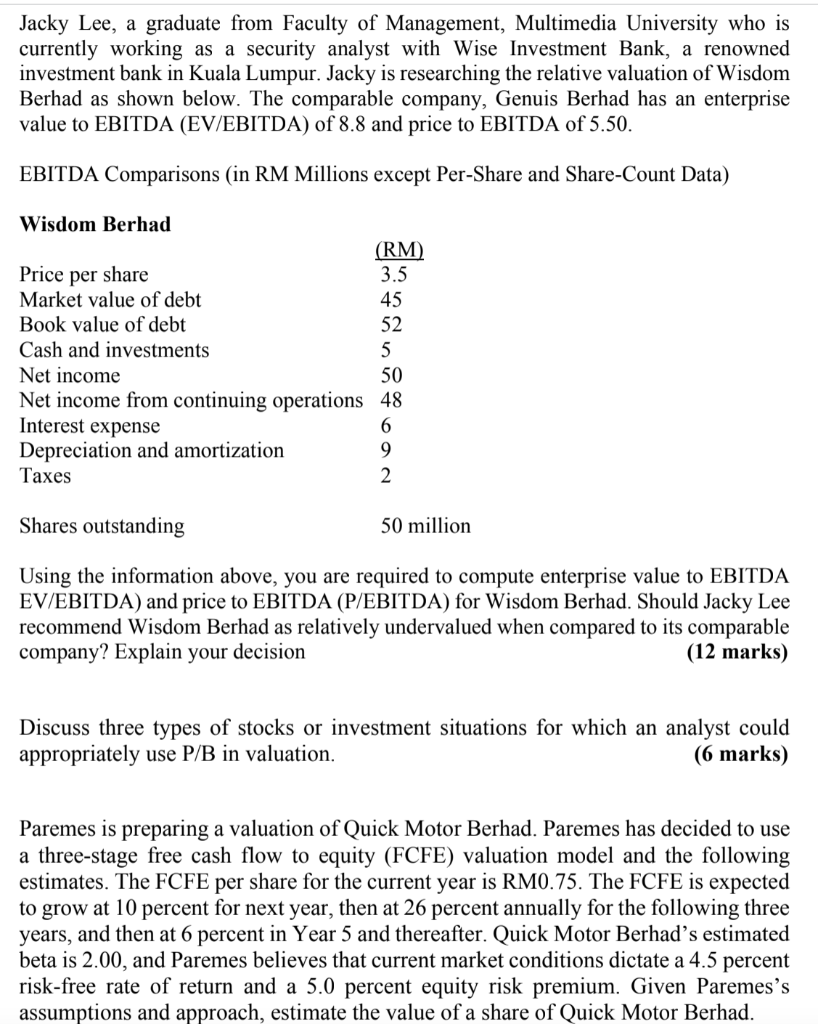

Jacky Lee, a graduate from Faculty of Management, Multimedia University who is currently working as a security analyst with Wise Investment Bank, a renowned investment bank in Kuala Lumpur. Jacky is researching the relative valuation of Wisdom Berhad as shown below. The comparable company, Genuis Berhad has an enterprise value to EBITDA (EV/EBITDA) of 8.8 and price to EBITDA of 5.50. EBITDA Comparisons (in RM Millions except Per-Share and Share-Count Data) Wisdom Berhad (RM) Price per share 3.5 Market value of debt 45 Book value of debt 52 Cash and investments Net income Net income from continuing operations 48 Interest expense Depreciation and amortization Taxes Noa unga Shares outstanding 50 million Using the information above, you are required to compute enterprise value to EBITDA EV/EBITDA) and price to EBITDA (P/EBITDA) for Wisdom Berhad. Should Jacky Lee recommend Wisdom Berhad as relatively undervalued when compared to its comparable company? Explain your decision (12 marks) Discuss three types of stocks or investment situations for which an analyst could appropriately use P/B in valuation. (6 marks) Paremes is preparing a valuation of Quick Motor Berhad. Paremes has decided to use a three-stage free cash flow to equity (FCFE) valuation model and the following estimates. The FCFE per share for the current year is RM0.75. The FCFE is expected to grow at 10 percent for next year, then at 26 percent annually for the following three years, and then at 6 percent in Year 5 and thereafter. Quick Motor Berhad's estimated beta is 2.00, and Paremes believes that current market conditions dictate a 4.5 percent risk-free rate of return and a 5.0 percent equity risk premium. Given Paremes's assumptions and approach, estimate the value of a share of Quick Motor Berhad. Jacky Lee, a graduate from Faculty of Management, Multimedia University who is currently working as a security analyst with Wise Investment Bank, a renowned investment bank in Kuala Lumpur. Jacky is researching the relative valuation of Wisdom Berhad as shown below. The comparable company, Genuis Berhad has an enterprise value to EBITDA (EV/EBITDA) of 8.8 and price to EBITDA of 5.50. EBITDA Comparisons (in RM Millions except Per-Share and Share-Count Data) Wisdom Berhad (RM) Price per share 3.5 Market value of debt 45 Book value of debt 52 Cash and investments Net income Net income from continuing operations 48 Interest expense Depreciation and amortization Taxes Noa unga Shares outstanding 50 million Using the information above, you are required to compute enterprise value to EBITDA EV/EBITDA) and price to EBITDA (P/EBITDA) for Wisdom Berhad. Should Jacky Lee recommend Wisdom Berhad as relatively undervalued when compared to its comparable company? Explain your decision (12 marks) Discuss three types of stocks or investment situations for which an analyst could appropriately use P/B in valuation. (6 marks) Paremes is preparing a valuation of Quick Motor Berhad. Paremes has decided to use a three-stage free cash flow to equity (FCFE) valuation model and the following estimates. The FCFE per share for the current year is RM0.75. The FCFE is expected to grow at 10 percent for next year, then at 26 percent annually for the following three years, and then at 6 percent in Year 5 and thereafter. Quick Motor Berhad's estimated beta is 2.00, and Paremes believes that current market conditions dictate a 4.5 percent risk-free rate of return and a 5.0 percent equity risk premium. Given Paremes's assumptions and approach, estimate the value of a share of Quick Motor Berhad