Answered step by step

Verified Expert Solution

Question

1 Approved Answer

urgrnt answers required plz help . 2 Questions Question- 1 (10 marks) The Dollar company is interested in a new potential project. The initial cost

urgrnt answers required plz help . 2 Questions

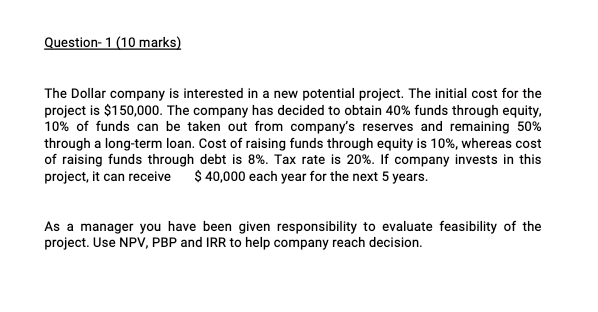

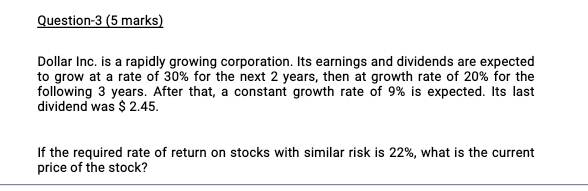

Question- 1 (10 marks) The Dollar company is interested in a new potential project. The initial cost for the project is $150,000. The company has decided to obtain 40% funds through equity, 10% of funds can be taken out from company's reserves and remaining 50% through a long-term loan. Cost of raising funds through equity is 10%, whereas cost of raising funds through debt is 8%. Tax rate is 20%. If company invests in this project, it can receive $ 40,000 each year for the next 5 years. As a manager you have been given responsibility to evaluate feasibility of the project. Use NPV, PBP and IRR to help company reach decision. Question-3 (5 marks) Dollar Inc. is a rapidly growing corporation. Its earnings and dividends are expected to grow at a rate of 30% for the next 2 years, then at growth rate of 20% for the following 3 years. After that, a constant growth rate of 9% is expected. Its last dividend was $ 2.45. If the required rate of return on stocks with similar risk is 22%, what is the current price of the stockStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started