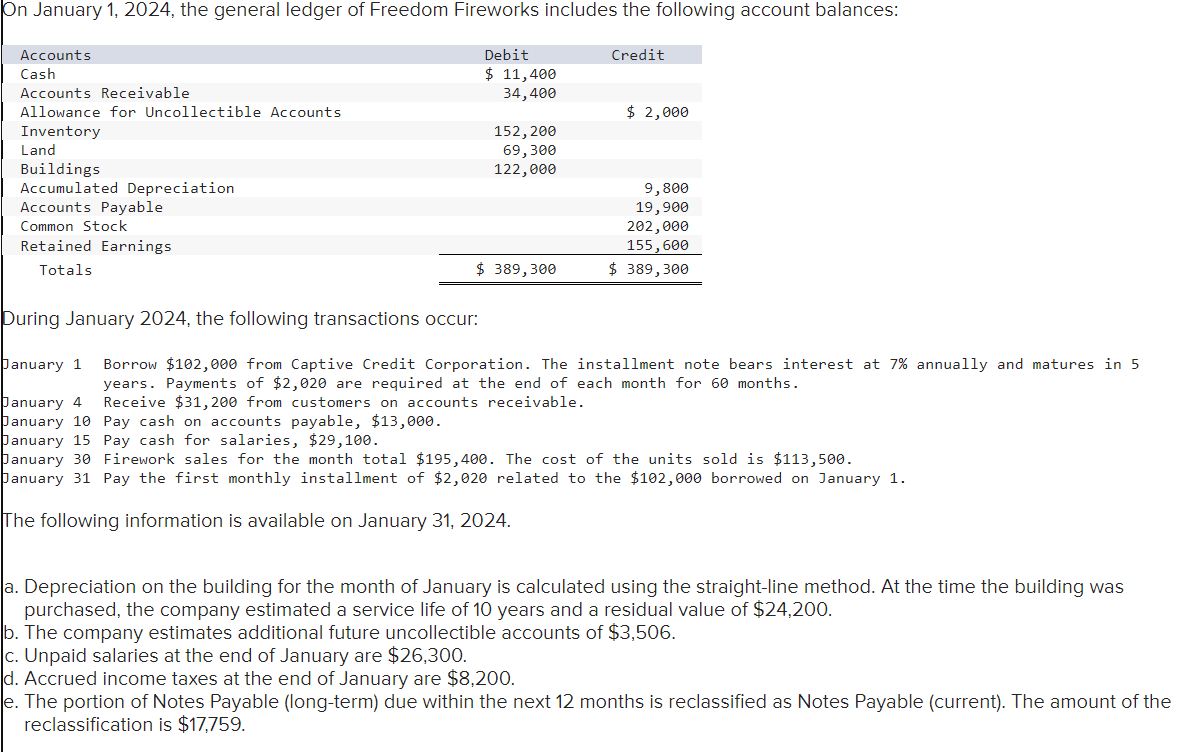

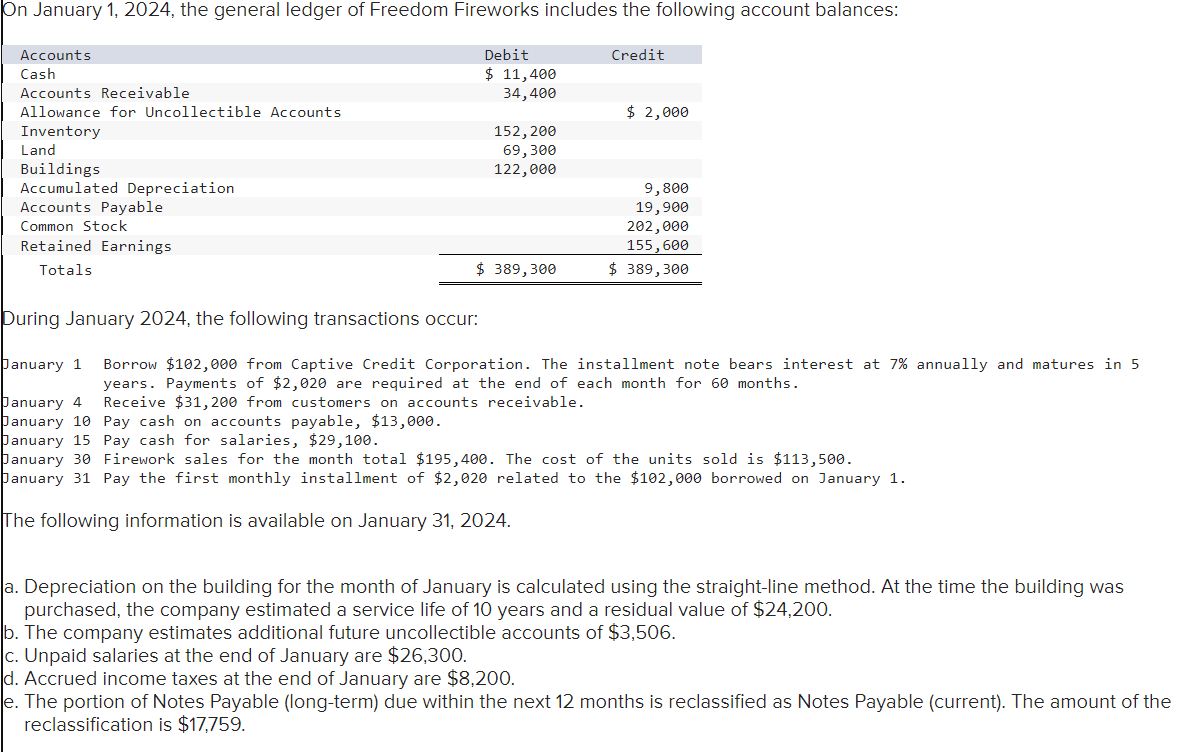

uring January 2024 , the following transactions occur: anuary 1 Borrow $102,000 from Captive Credit Corporation. The installment note bears interest at 7% annually and matures in 5 years. Payments of $2,020 are required at the end of each month for 60 months. anuary 4 Receive $31,200 from customers on accounts receivable. anuary 10 Pay cash on accounts payable, $13,000. anuary 15 Pay cash for salaries, $29,100. anuary 30 Firework sales for the month total $195,400. The cost of the units sold is $113,500. anuary 31 Pay the first monthly installment of $2,020 related to the $102,000 borrowed on January 1 . he following information is available on January 31,2024. Depreciation on the building for the month of January is calculated using the straight-line method. At the time the building was purchased, the company estimated a service life of 10 years and a residual value of $24,200. The company estimates additional future uncollectible accounts of $3,506. Unpaid salaries at the end of January are $26,300. Accrued income taxes at the end of January are $8,200. The portion of Notes Payable (long-term) due within the next 12 months is reclassified as Notes Payable (current). The amount of the reclassification is $17,759. uring January 2024 , the following transactions occur: anuary 1 Borrow $102,000 from Captive Credit Corporation. The installment note bears interest at 7% annually and matures in 5 years. Payments of $2,020 are required at the end of each month for 60 months. anuary 4 Receive $31,200 from customers on accounts receivable. anuary 10 Pay cash on accounts payable, $13,000. anuary 15 Pay cash for salaries, $29,100. anuary 30 Firework sales for the month total $195,400. The cost of the units sold is $113,500. anuary 31 Pay the first monthly installment of $2,020 related to the $102,000 borrowed on January 1 . he following information is available on January 31,2024. Depreciation on the building for the month of January is calculated using the straight-line method. At the time the building was purchased, the company estimated a service life of 10 years and a residual value of $24,200. The company estimates additional future uncollectible accounts of $3,506. Unpaid salaries at the end of January are $26,300. Accrued income taxes at the end of January are $8,200. The portion of Notes Payable (long-term) due within the next 12 months is reclassified as Notes Payable (current). The amount of the reclassification is $17,759