Answered step by step

Verified Expert Solution

Question

1 Approved Answer

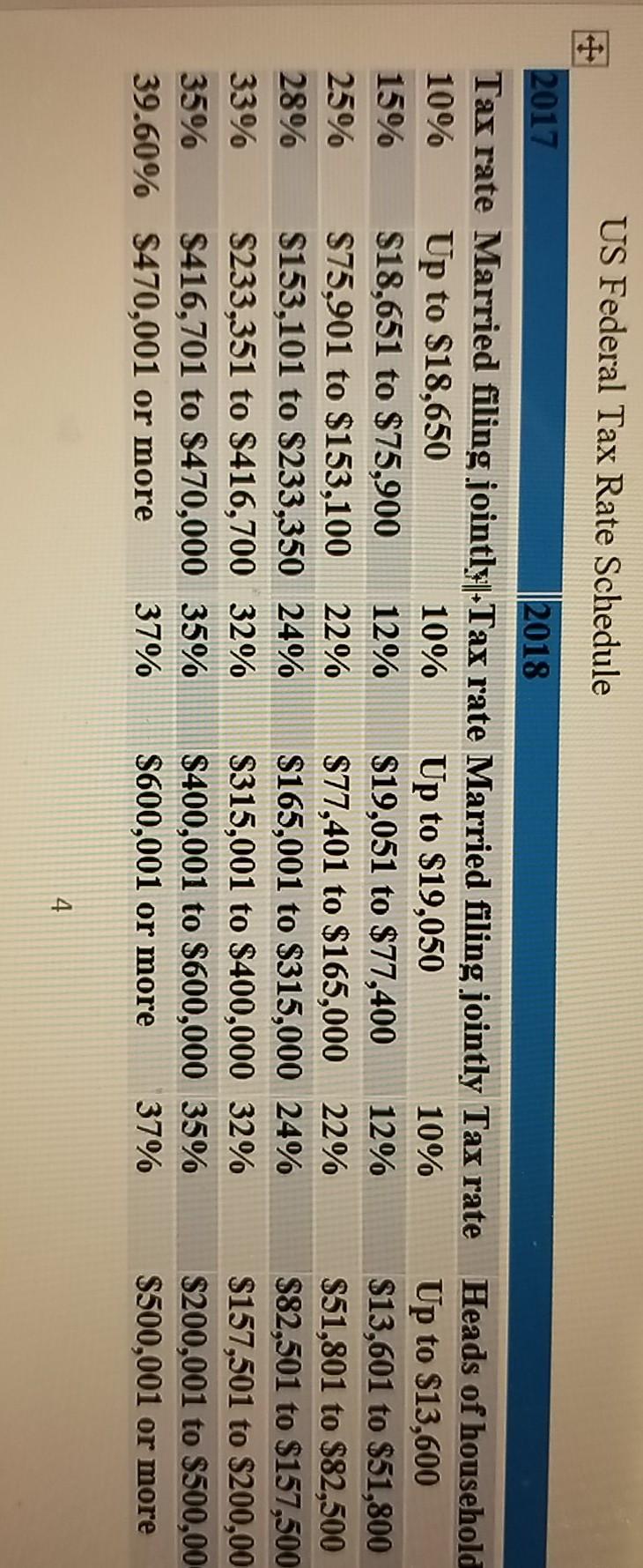

US Federal Tax Rate Schedule 2017 2018 Tax rate Married filing jointly-Tax rate Married filing jointly Tax rate 10% Up to $18,650 10% Up to

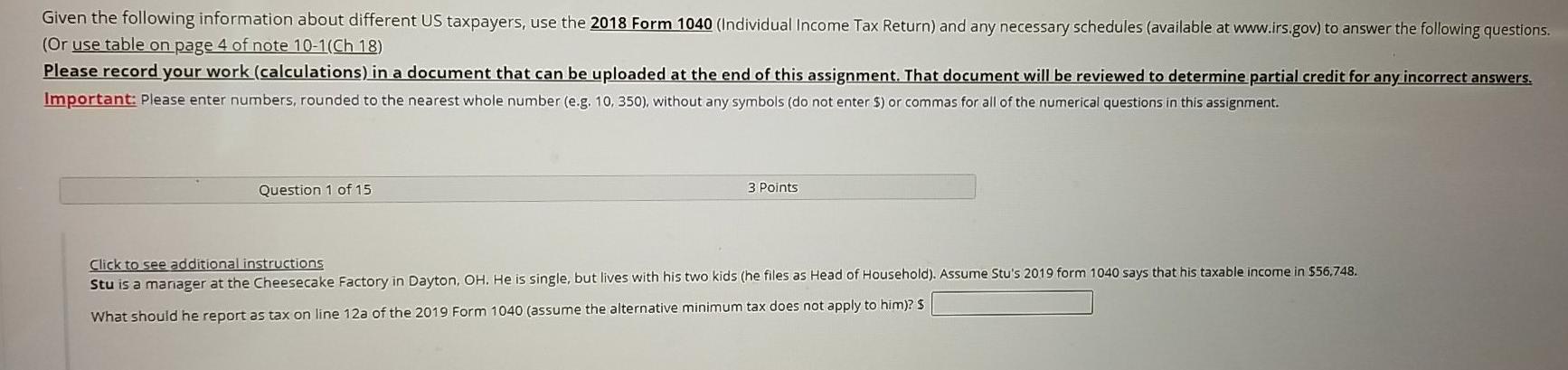

US Federal Tax Rate Schedule 2017 2018 Tax rate Married filing jointly-Tax rate Married filing jointly Tax rate 10% Up to $18,650 10% Up to $19,050 10% 15% $18,651 to $75,900 12% $19,051 to $77,400 12% 25% $75,901 to $153,100 22% $77,401 to $165,000 22% 28% $153,101 to $233,350 24% S165,001 to $315,000 24% 33% S233,351 to $416,700 32% $315,001 to $400,000 32% 35% $416,701 to $470,000 35% $400,001 to $600,000 35% 39.60% $470,001 or more 37% $600,001 or more 37% Heads of household Up to $13,600 $13,601 to $51,800 $51,801 to $82,500 $82,501 to $157,500 $157,501 to $200,00 $200,001 to $500,00 $500,001 or more 4 Given the following information about different US taxpayers, use the 2018 Form 1040 (Individual Income Tax Return) and any necessary schedules (available at www.irs.gov) to answer the following questions. (Or use table on page 4 of note 10-1(Ch 18) Please record your work (calculations) in a document that can be uploaded at the end of this assignment. That document will be reviewed to determine partial credit for any incorrect answers. Important: Please enter numbers, rounded to the nearest whole number (e.g. 10.350), without any symbols (do not enter $) or commas for all of the numerical questions in this assignment. Question 1 of 15 3 Points Click to see additional instructions Stu is a manager at the Cheesecake Factory in Dayton, OH. He is single, but lives with his two kids (he files as Head of Household). Assume Stu's 2019 form 1040 says that his taxable income in 556,748. What should he report as tax on line 12a of the 2019 Form 1040 (assume the alternative minimum tax does not apply to him)? $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started