Question

Use continuous compounding throughout. Consider a bond with face value 100, with maturity in three years and paying annual coupons of 16 in arrears.

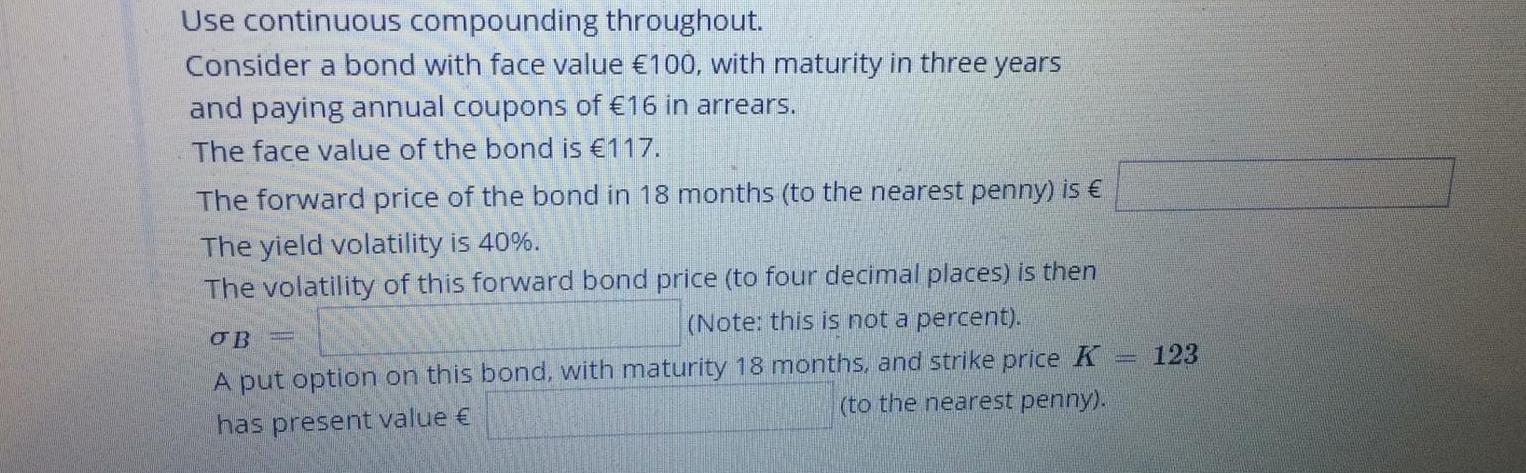

Use continuous compounding throughout. Consider a bond with face value 100, with maturity in three years and paying annual coupons of 16 in arrears. The face value of the bond is 117. The forward price of the bond in 18 months (to the nearest penny) is The yield volatility is 40%. The volatility of this forward bond price (to four decimal places) is then (Note: this is not a percent). A put option on this bond, with maturity 18 months, and strike price K (to the nearest penny). has present value 123

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

An Introduction To Financial Markets A Quantitative Approach

Authors: Paolo Brandimarte

1st Edition

1118014774, 9781118014776

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App