Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use differential analysis to solve the series of problems Differential Analysis Problems Attached Files: Differential Analysis Problems.xisx (40.262KB) Instructions: 1. The attached Excel file contains

Use differential analysis to solve the series of problems

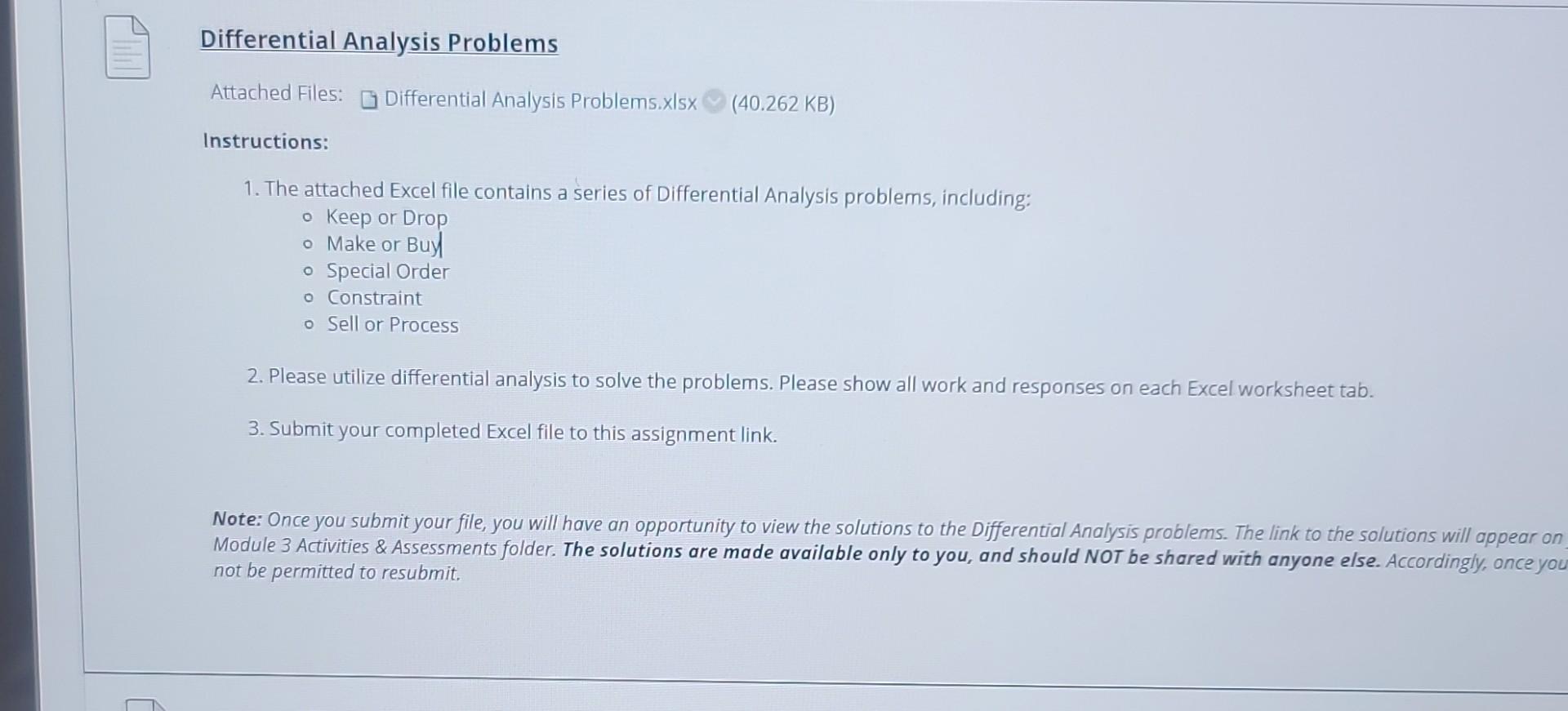

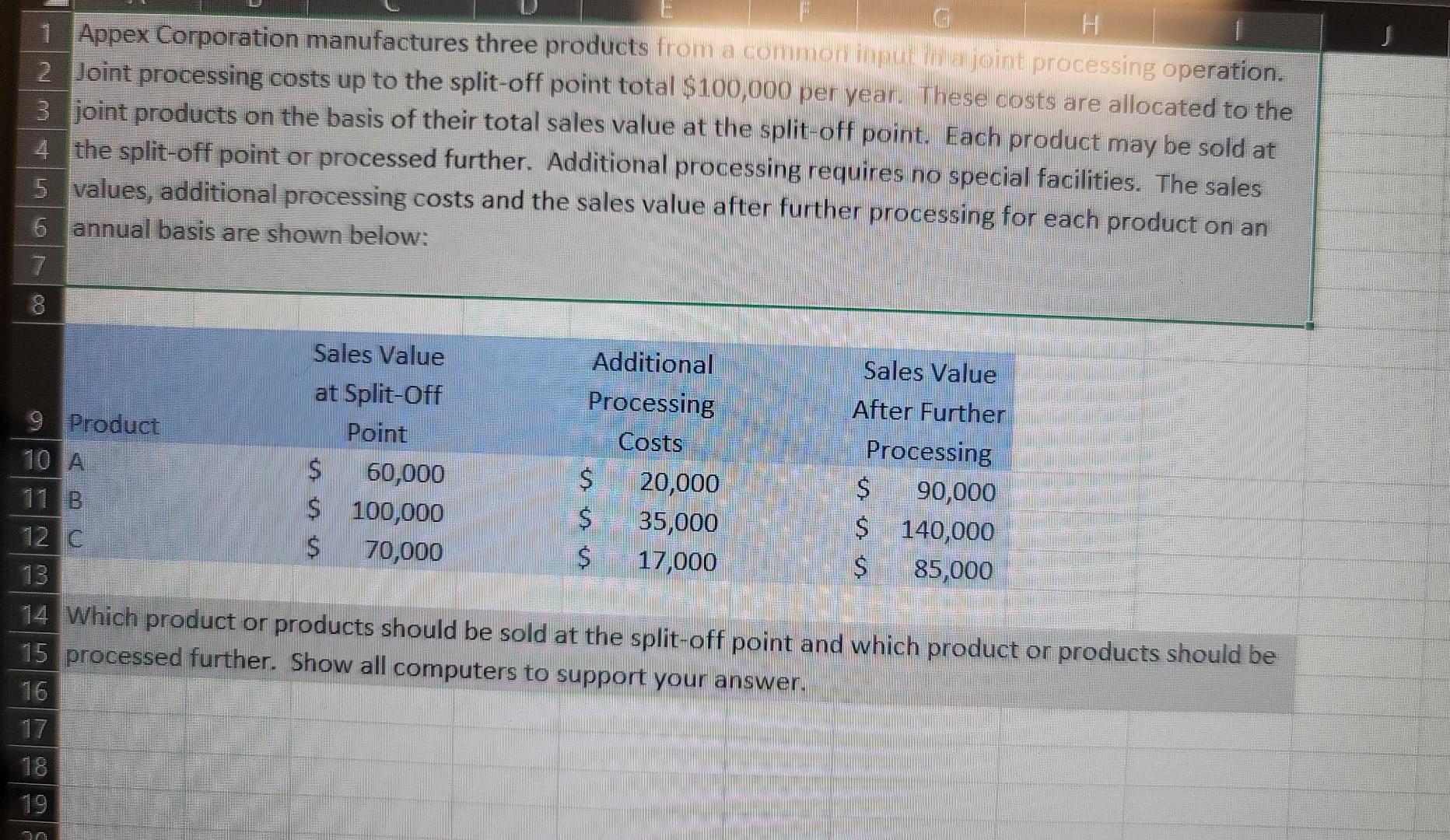

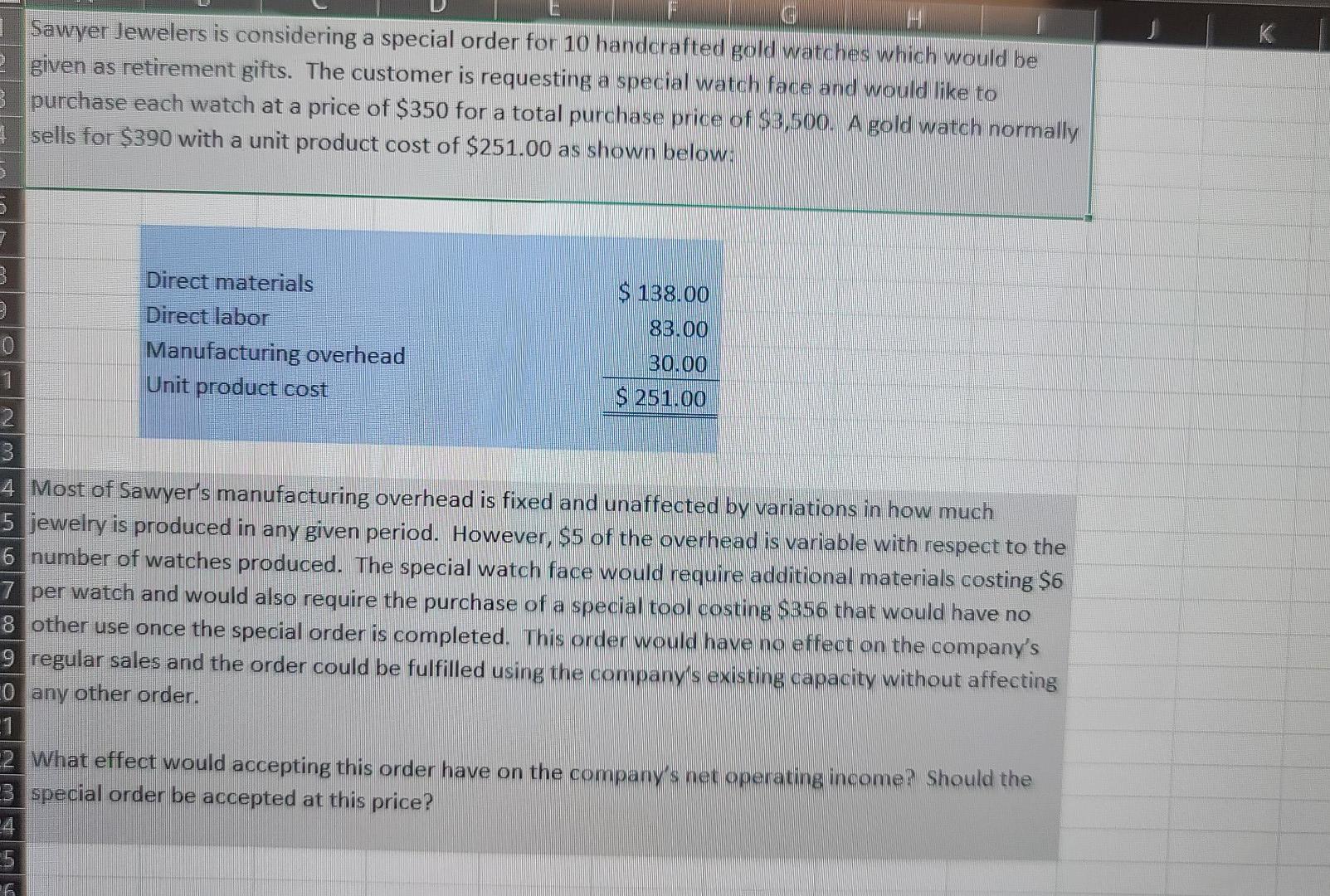

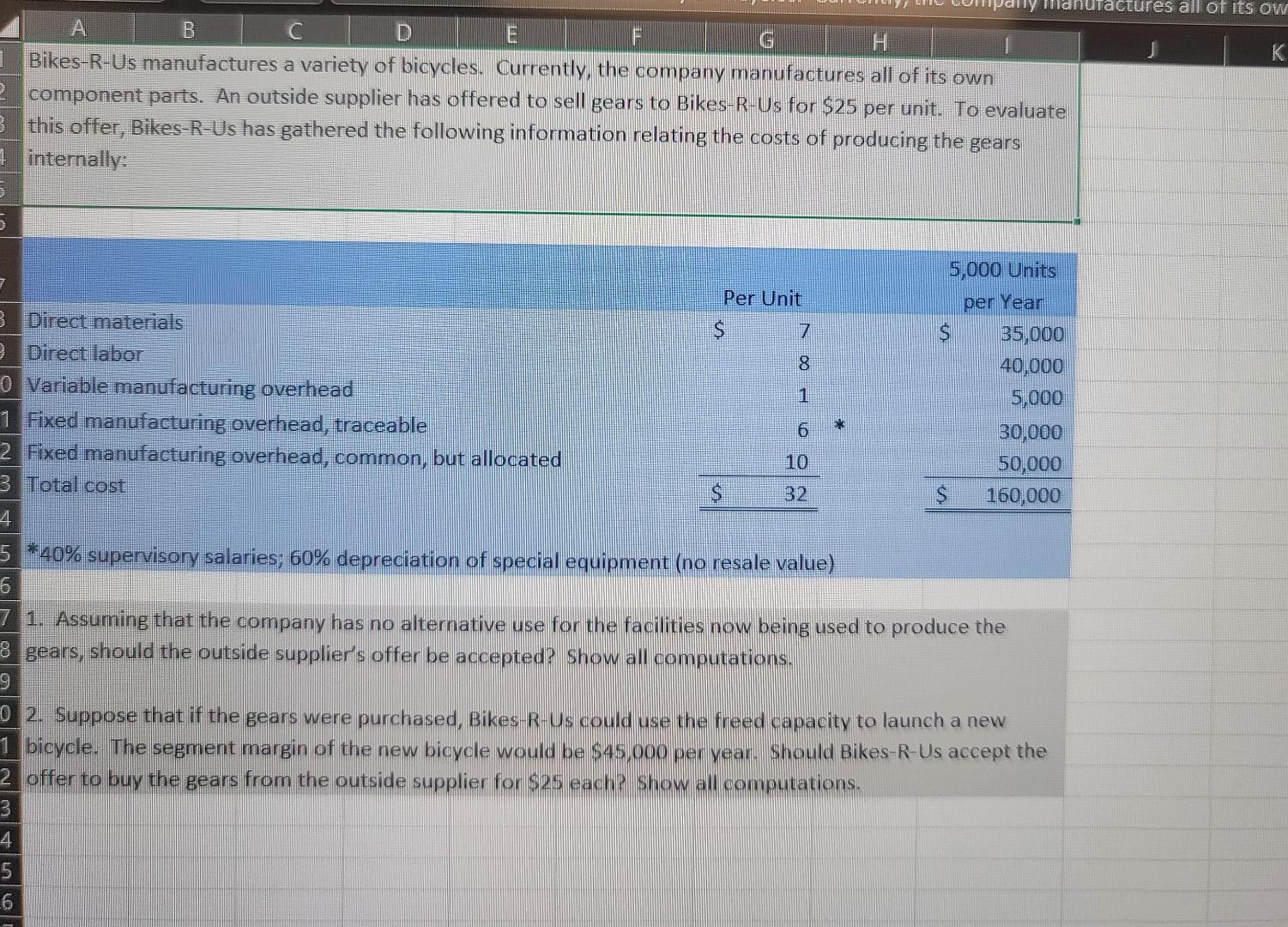

Differential Analysis Problems Attached Files: Differential Analysis Problems.xisx (40.262KB) Instructions: 1. The attached Excel file contains a series of Differential Analysis problems, including: - Keep or Drop - Make or Buy - Special Order - Constraint - Sell or Process 2. Please utilize differential analysis to solve the problems. Please show all work and responses on each Excel worksheet tab. 3. Submit your completed Excel file to this assignment link. Note: Once you submit your file, you will have an opportunity to view the solutions to the Differential Analysis problems. The link to the solutions will appear or Module 3 Activities \& Assessments folder. The solutions are made available only to you, and should NOT be shared with anyone else. Accordingly, once yo not be permitted to resubmit. Appex Corporation manufactures three products from a conmon inpui in a joint processing operation. Joint processing costs up to the split-off point total $100,000 per year. These costs are allocated to the joint products on the basis of their total sales value at the split-off point. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The sales values, additional processing costs and the sales value after further processing for each product on an annual basis are shown below: Which product or products should be sold at the split-off point and which product or products should be processed further. Show all computers to support your answer. Majors Design crafts fine upholstered furniture. The bottleneck in the production of Major's furniture is the time in the upholstery shop. Data regarding three of the company's top selling chairs appears below: 1. One strategy to make more time available in the upholster shop is to ask the employees who work in the upholstery shop to work overtime. If the extra time is used to produce the Leather Office Chairs, up to how much should the company be willing to pay per hour to keep the upholstery shop open after normal working hours? Show all computations. 2. A small, reputable company has offered to upholster furniture for Majors Design at a fixed charge of $50 per hour. Majors Design is confident that this company's workmanship is of high quality and the speed would be comparable to their own on more simple jobs such as the Savanah Armchair. Should management accept this offer? Explain. Show computations to support your answer. Sawyer Jewelers is considering a special order for 10 handcrafted gold watches which would be given as retirement gifts. The customer is requesting a special watch face and would like to purchase each watch at a price of $350 for a total purchase price of $3,500. A gold watch normally sells for $390 with a unit product cost of $251.00 as shown below: Most of Sawyer's manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $5 of the overhead is variable with respect to the number of watches produced. The special watch face would require additional materials costing $6 per watch and would also require the purchase of a special tool costing $356 that would have no other use once the special order is completed. This order would have no effect on the company's regular sales and the order could be fulfilled using the company's existing capacity without affecting any other order. What effect would accepting this order have on the company's net operating income? Should the special order be accepted at this price? Bikes-R-Us manufactures a variety of bicycles. Currently, the company manufactures all of its own component parts. An outside supplier has offered to sell gears to Bikes-R-Us for $25 per unit. To evaluate this offer, Bikes-R-Us has gathered the following information relating the costs of producing the gears internally: * 40% supervisory salaries; 60% depreciation of special equipment (no resale value) 1. Assuming that the company has no alternative use for the facilities now being used to produce the gears, should the outside supplier's offer be accepted? Show all computations. 2. Suppose that if the gears were purchased, Bikes-R-Us could use the freed capacity to launch a new bicycle. The segment margin of the new bicycle would be $45,000 per year. Should Bikes-R-Us accept the offer to buy the gears from the outside supplier for $25 each? Show all computations. Differential Analysis Problems Attached Files: Differential Analysis Problems.xisx (40.262KB) Instructions: 1. The attached Excel file contains a series of Differential Analysis problems, including: - Keep or Drop - Make or Buy - Special Order - Constraint - Sell or Process 2. Please utilize differential analysis to solve the problems. Please show all work and responses on each Excel worksheet tab. 3. Submit your completed Excel file to this assignment link. Note: Once you submit your file, you will have an opportunity to view the solutions to the Differential Analysis problems. The link to the solutions will appear or Module 3 Activities \& Assessments folder. The solutions are made available only to you, and should NOT be shared with anyone else. Accordingly, once yo not be permitted to resubmit. Appex Corporation manufactures three products from a conmon inpui in a joint processing operation. Joint processing costs up to the split-off point total $100,000 per year. These costs are allocated to the joint products on the basis of their total sales value at the split-off point. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The sales values, additional processing costs and the sales value after further processing for each product on an annual basis are shown below: Which product or products should be sold at the split-off point and which product or products should be processed further. Show all computers to support your answer. Majors Design crafts fine upholstered furniture. The bottleneck in the production of Major's furniture is the time in the upholstery shop. Data regarding three of the company's top selling chairs appears below: 1. One strategy to make more time available in the upholster shop is to ask the employees who work in the upholstery shop to work overtime. If the extra time is used to produce the Leather Office Chairs, up to how much should the company be willing to pay per hour to keep the upholstery shop open after normal working hours? Show all computations. 2. A small, reputable company has offered to upholster furniture for Majors Design at a fixed charge of $50 per hour. Majors Design is confident that this company's workmanship is of high quality and the speed would be comparable to their own on more simple jobs such as the Savanah Armchair. Should management accept this offer? Explain. Show computations to support your answer. Sawyer Jewelers is considering a special order for 10 handcrafted gold watches which would be given as retirement gifts. The customer is requesting a special watch face and would like to purchase each watch at a price of $350 for a total purchase price of $3,500. A gold watch normally sells for $390 with a unit product cost of $251.00 as shown below: Most of Sawyer's manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $5 of the overhead is variable with respect to the number of watches produced. The special watch face would require additional materials costing $6 per watch and would also require the purchase of a special tool costing $356 that would have no other use once the special order is completed. This order would have no effect on the company's regular sales and the order could be fulfilled using the company's existing capacity without affecting any other order. What effect would accepting this order have on the company's net operating income? Should the special order be accepted at this price? Bikes-R-Us manufactures a variety of bicycles. Currently, the company manufactures all of its own component parts. An outside supplier has offered to sell gears to Bikes-R-Us for $25 per unit. To evaluate this offer, Bikes-R-Us has gathered the following information relating the costs of producing the gears internally: * 40% supervisory salaries; 60% depreciation of special equipment (no resale value) 1. Assuming that the company has no alternative use for the facilities now being used to produce the gears, should the outside supplier's offer be accepted? Show all computations. 2. Suppose that if the gears were purchased, Bikes-R-Us could use the freed capacity to launch a new bicycle. The segment margin of the new bicycle would be $45,000 per year. Should Bikes-R-Us accept the offer to buy the gears from the outside supplier for $25 each? Show all computationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started