Answered step by step

Verified Expert Solution

Question

1 Approved Answer

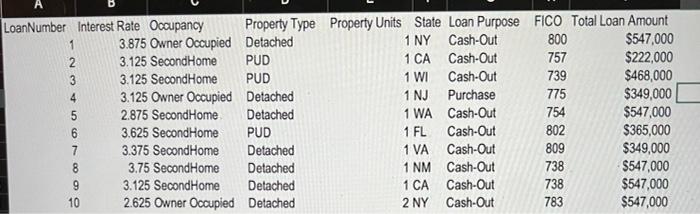

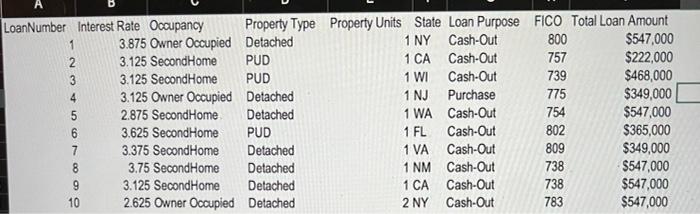

use excel and show formulas please LoanNumber Interest Rate Occupancy Property Type Property Units State Loan Purpose FICO Total Loan Amount 1 3.875 Owner Occupied

use excel and show formulas please

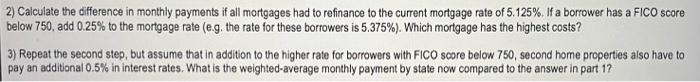

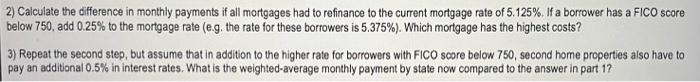

LoanNumber Interest Rate Occupancy Property Type Property Units State Loan Purpose FICO Total Loan Amount 1 3.875 Owner Occupied Detached 1 NY Cash-Out 800 $547,000 2 3.125 Second Home PUD 1 CA Cash-Out 757 $222,000 3 3.125 Second Home PUD 1 WI Cash-Out 739 $468,000 4 3.125 Owner Occupied Detached 1 NJ Purchase 775 $349,000 5 2.875 Second Home Detached 1 WA Cash-Out 754 $547,000 6 3.625 Second Home PUD 1 FL Cash-Out 802 $365,000 7 3.375 Second Home Detached 1 VA Cash-Out 809 $349,000 8 3.75 Second Home Detached 1 NM Cash-Out 738 $547,000 9 3.125 Second Home Detached 1 CA Cash-Out 738 $547,000 10 2.625 Owner Occupied Detached 2 NY Cash-Out 783 $547,000 000 2) Calculate the difference in monthly payments if all mortgages had to refinance to the current mortgage rate of 5.125%. If a borrower has a FICO score below 750, add 0.25% to the mortgage rate (e.g. the rate for these borrowers is 5.375%). Which mortgage has the highest costs? 3) Repeat the second step, but assume that in addition to the higher rate for borrowers with FICO score below 750, second home properties also have to pay an additional 0.5% in interest rates. What is the weighted average monthly payment by state now compared to the answer in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started