Answered step by step

Verified Expert Solution

Question

1 Approved Answer

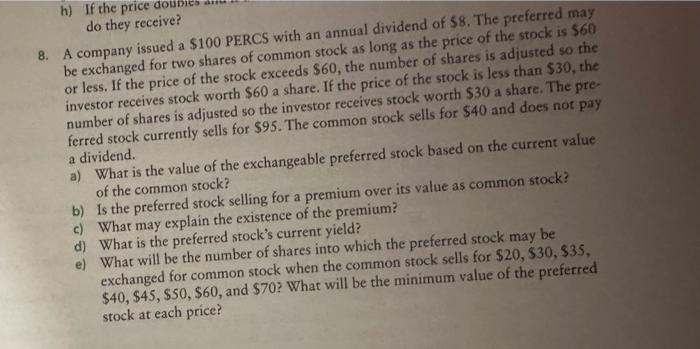

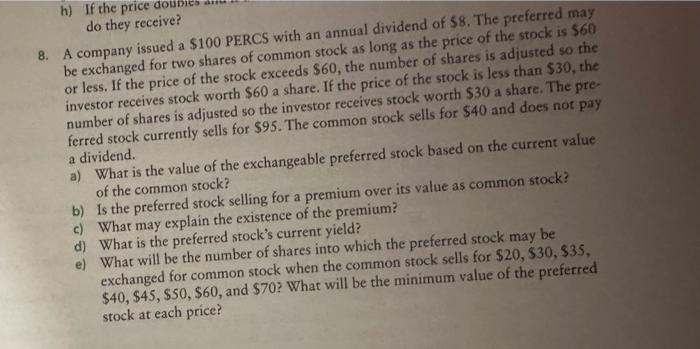

USE EXCEL FUNCTIONS PLEASE h) If the price dounies do they receive? 8. A company issued a $100 PERCS with an annual dividend of $8.

USE EXCEL FUNCTIONS PLEASE

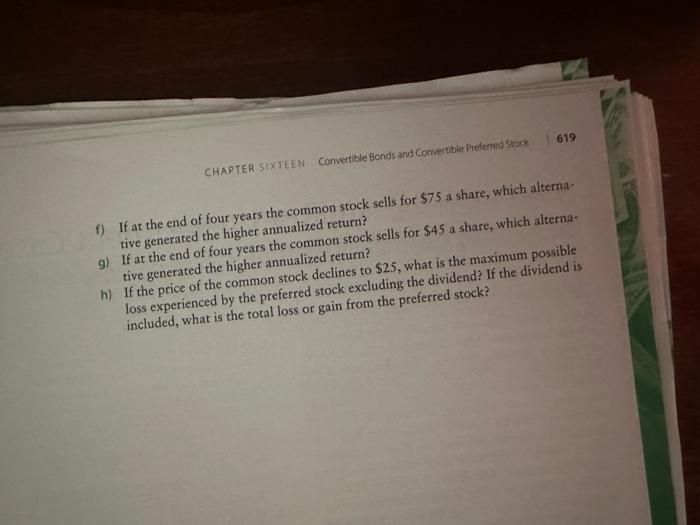

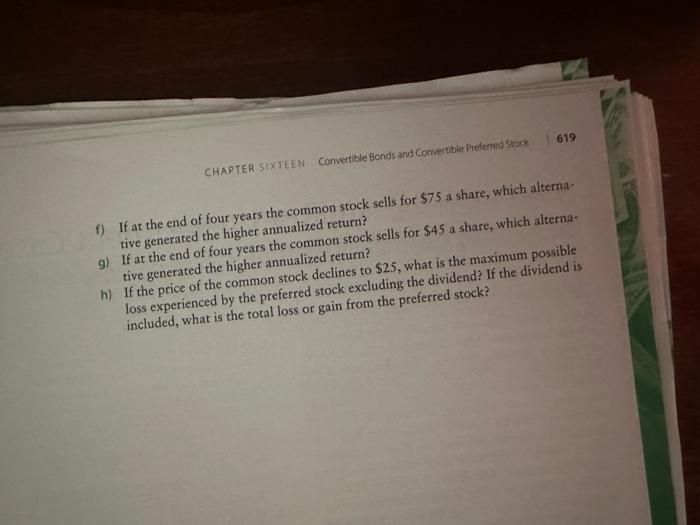

h) If the price dounies do they receive? 8. A company issued a $100 PERCS with an annual dividend of $8. The preferred may be exchanged for two shares of common stock as long as the price of the stock is $60 or less. If the price of the stock exceeds $60, the number of shares is adjusted so the investor receives stock worth $60 a share. If the price of the stock is less than $30, the number of shares is adjusted so the investor receives stock worth $30 a share. The preferred stock currently sells for $95. The common stock sells for $40 and does not pay a dividend. a) What is the value of the exchangeable preferred stock based on the current value of the common stock? b) Is the preferred stock selling for a premium over its value as common stock? c) What may explain the existence of the premium? d) What is the preferred stock's current yield? e) What will be the number of shares into which the preferred stock may be exchanged for common stock when the common stock sells for $20,$30,$35, $40,$45,$50,$60, and $70 ? What will be the minimum value of the preferred stock at each price? f) If at the end of four years the common stock sells for $75 a share, which alternative generated the higher annualized return? g) If at the end of four years the common stock sells for $45 a share, which alternative generated the higher annualized return? h) If the price of the common stock declines to $25, what is the maximum possible loss experienced by the preferred stock excluding the dividend? If the dividend is included, what is the total loss or gain from the preferred stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started