use excel

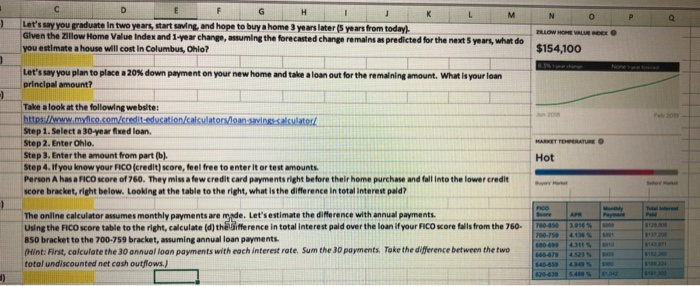

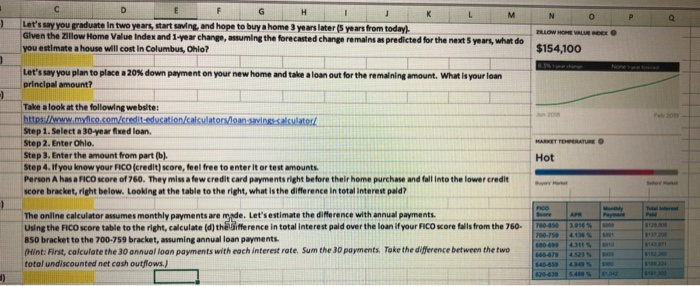

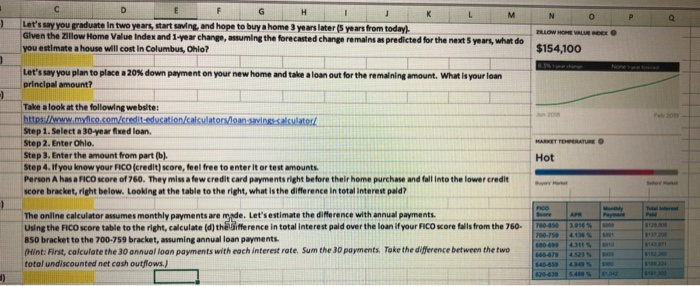

Let's say you graduste In two years start sving and hope to buy a home 3years later(Syears from todayl Given the Zallow Home Value Index and 1-year change, assuming the forecasted change remains as predicted for the next 5 years, what do you estimate a house will cost in Columbus, Ohlo? $154,100 Let's say you plan to place a 20% down payment on your new home and take principal amount? loan out for the remaining amount, what a your loan Take a look at the following website: https://www.myfico.com/cred Step 1. Select a 30-year fixed loan Step 2. Enter Ohio. Step 3. Enter the amount from part (b). Step 4. If you know your FICO (credit) score, feel free to enter it or test amounts Person A has a FICO score of 760. They miss a few credit card payments right before their home purchase and fall into the lower credit score bracket, right below. Looking at the table to the right, what is the difference in total Interest pald? MARKET TEPERATURE Hot Let's estimate the difference with annual payments The online calculator assumes monthly payments are Using the FICO score table to the right, calculate (d) thelsifference in total Interest paid over the loan if your FICO score falils from the 760- 850 bracket to the 700-759 bracket, assuming annual loan payments Mint: First, calculate the 30 annual loan payments with each interest rate. Sum the 30 payments, Take the difference between the two total undiscounted net cash outflows.) -ie 660479 640459 | Let's say you graduste In two years start sving and hope to buy a home 3years later(Syears from todayl Given the Zallow Home Value Index and 1-year change, assuming the forecasted change remains as predicted for the next 5 years, what do you estimate a house will cost in Columbus, Ohlo? $154,100 Let's say you plan to place a 20% down payment on your new home and take principal amount? loan out for the remaining amount, what a your loan Take a look at the following website: https://www.myfico.com/cred Step 1. Select a 30-year fixed loan Step 2. Enter Ohio. Step 3. Enter the amount from part (b). Step 4. If you know your FICO (credit) score, feel free to enter it or test amounts Person A has a FICO score of 760. They miss a few credit card payments right before their home purchase and fall into the lower credit score bracket, right below. Looking at the table to the right, what is the difference in total Interest pald? MARKET TEPERATURE Hot Let's estimate the difference with annual payments The online calculator assumes monthly payments are Using the FICO score table to the right, calculate (d) thelsifference in total Interest paid over the loan if your FICO score falils from the 760- 850 bracket to the 700-759 bracket, assuming annual loan payments Mint: First, calculate the 30 annual loan payments with each interest rate. Sum the 30 payments, Take the difference between the two total undiscounted net cash outflows.) -ie 660479 640459 |