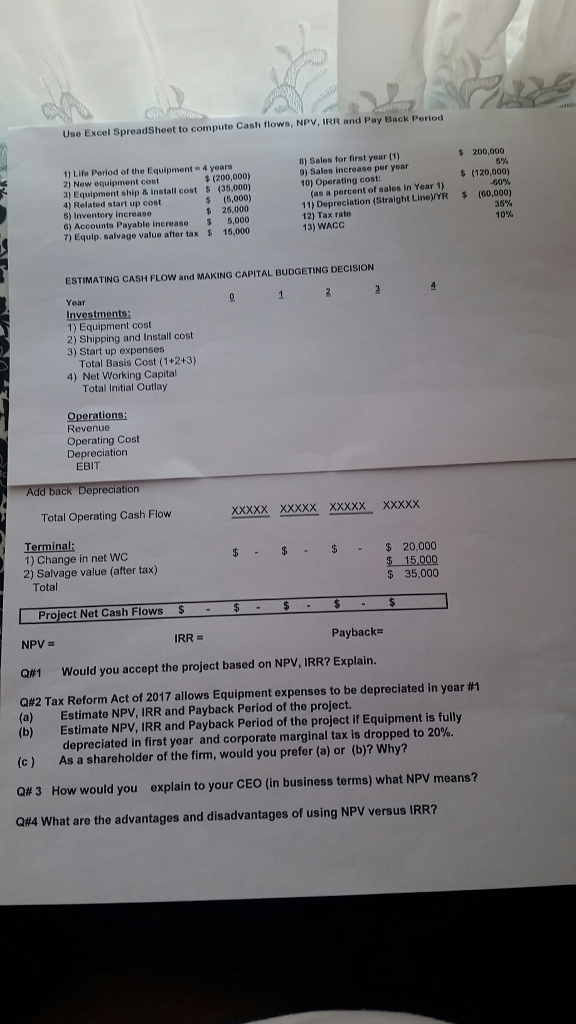

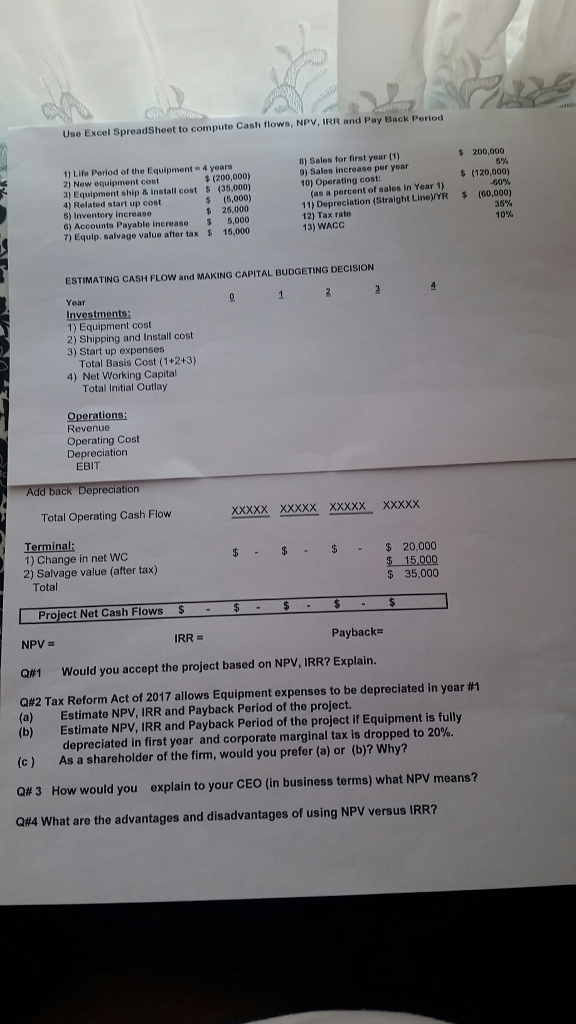

Use Excel SpreadSheet to computo Cash flows, NPV, IRR and Pay Back Period $ 200,000 8) Sales for first year (1) 9) Salos increase per year 10) Operating cost: 1) Life Period of the Equipment-4 years 2) New equipment cost 3) Equipment ship & install cost (35,000) 4) Related start up cost 5) Inventory increaso 6) Accounts Payable increase 5,000 7) Equip. salvage value after tax 15,000 5% (200,000) s(120,000) 60% s (5,000) 25,000 (as a percent of sales in Year 1) 11) Depreciation (Straight Line)YR 12) Tax rate (60,000) 35% 10% 13) WACC ESTIMATING CASH FLOW and MAKING CAPITAL BUDGETING DECISION Year 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Basis Cost (1+2+3) 4) Net Working Capita Total Initial Outlay Revenue Operating Cost Depreciation EBIT Total Operating Cash Flow Terminal: 1) Change in net WC 2) Salvage value (after tax) $ 20,000 Total $35,000 Project Net Cash Flows NPV Q#1 Would you accept the project based on NPV, IRR? Explain IRR = Payback- Q#2 Tax Reform Act of 2017 allows Equipment expenses to be depreciated in year #1 (a) Estimate NPV, IRR and Payback Period of the project. (b) Estimate NPV, IRR and Payback Period of the project if Equipment is fully depreciated in first year and corporate marginal tax is dropped to 20% As a shareholder of the firm, would you prefer (a) or (b)? Why? (c) 3 How would you explain to your CEO (in business terms) what NPV means? Q#4 What are the advantages and disadvantages of using NPV versus IRR? Use Excel SpreadSheet to computo Cash flows, NPV, IRR and Pay Back Period $ 200,000 8) Sales for first year (1) 9) Salos increase per year 10) Operating cost: 1) Life Period of the Equipment-4 years 2) New equipment cost 3) Equipment ship & install cost (35,000) 4) Related start up cost 5) Inventory increaso 6) Accounts Payable increase 5,000 7) Equip. salvage value after tax 15,000 5% (200,000) s(120,000) 60% s (5,000) 25,000 (as a percent of sales in Year 1) 11) Depreciation (Straight Line)YR 12) Tax rate (60,000) 35% 10% 13) WACC ESTIMATING CASH FLOW and MAKING CAPITAL BUDGETING DECISION Year 1) Equipment cost 2) Shipping and Install cost 3) Start up expenses Total Basis Cost (1+2+3) 4) Net Working Capita Total Initial Outlay Revenue Operating Cost Depreciation EBIT Total Operating Cash Flow Terminal: 1) Change in net WC 2) Salvage value (after tax) $ 20,000 Total $35,000 Project Net Cash Flows NPV Q#1 Would you accept the project based on NPV, IRR? Explain IRR = Payback- Q#2 Tax Reform Act of 2017 allows Equipment expenses to be depreciated in year #1 (a) Estimate NPV, IRR and Payback Period of the project. (b) Estimate NPV, IRR and Payback Period of the project if Equipment is fully depreciated in first year and corporate marginal tax is dropped to 20% As a shareholder of the firm, would you prefer (a) or (b)? Why? (c) 3 How would you explain to your CEO (in business terms) what NPV means? Q#4 What are the advantages and disadvantages of using NPV versus IRR