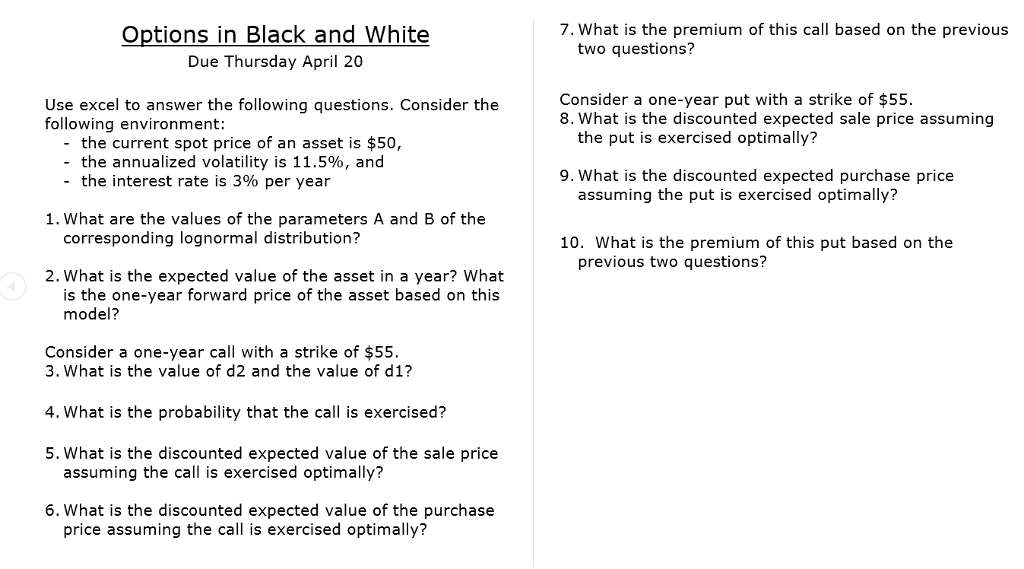

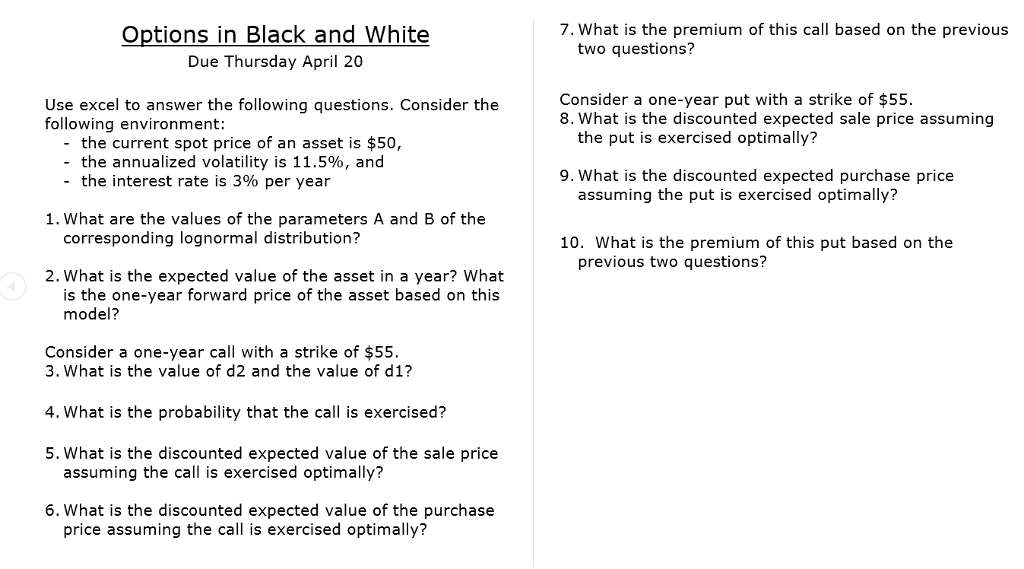

Use excel to answer the following questions. Consider the following environment: the current spot price of an asset is $50, the annualized volatility is 11.5%, and the interest rate is 3% per year What are the values of the parameters A and B of the corresponding lognormal distribution? What is the expected value of the asset in a year? What is the one-year forward price of the asset based on this model? What is the premium of this call based on the previous two questions? Consider a one-year put with a strike of $55. What is the discounted expected sale price assuming the put is exercised optimally? What is the discounted expected purchase price assuming the put is exercised optimally? What is the premium of this put based on the previous two questions? Consider a one-year call with a strike of $55. What is the value of d2 and the value of dl? What is the probability that the call is exercised? What is the discounted expected value of the sale price assuming the call is exercised optimally? What is the discounted expected value of the purchase price assuming the call is exercised optimally? Use excel to answer the following questions. Consider the following environment: the current spot price of an asset is $50, the annualized volatility is 11.5%, and the interest rate is 3% per year What are the values of the parameters A and B of the corresponding lognormal distribution? What is the expected value of the asset in a year? What is the one-year forward price of the asset based on this model? What is the premium of this call based on the previous two questions? Consider a one-year put with a strike of $55. What is the discounted expected sale price assuming the put is exercised optimally? What is the discounted expected purchase price assuming the put is exercised optimally? What is the premium of this put based on the previous two questions? Consider a one-year call with a strike of $55. What is the value of d2 and the value of dl? What is the probability that the call is exercised? What is the discounted expected value of the sale price assuming the call is exercised optimally? What is the discounted expected value of the purchase price assuming the call is exercised optimally