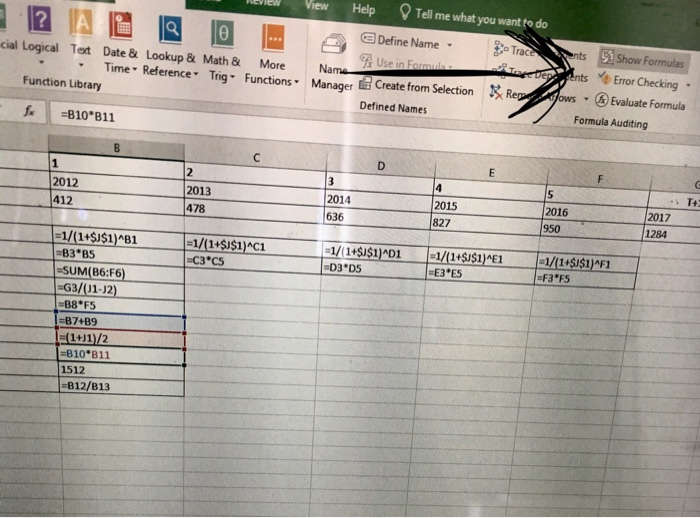

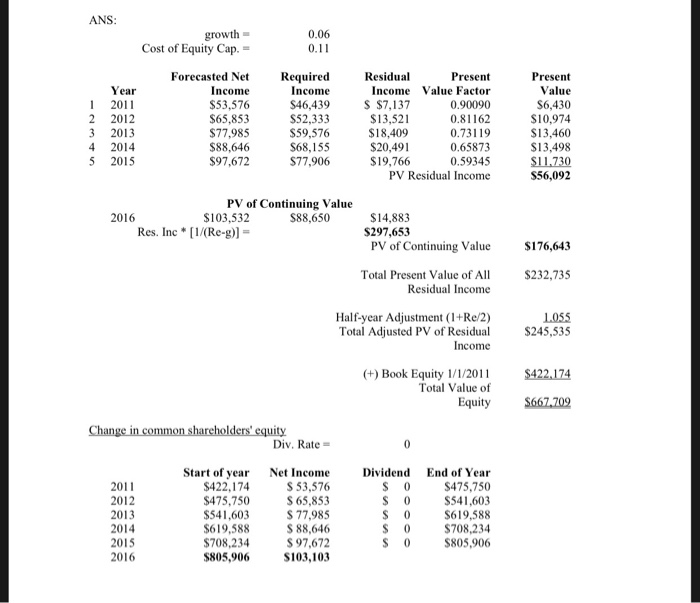

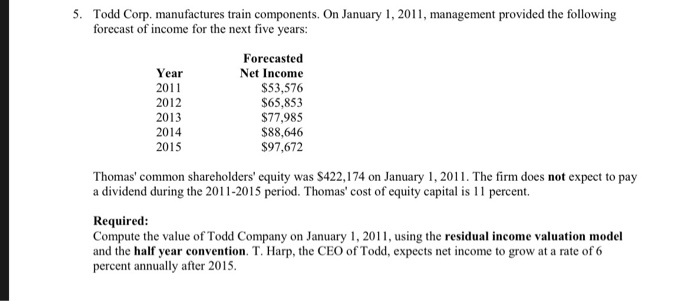

Use excel to solve this problem i need to see the formula that you used I have the answer but i do not know how they solve it If you get different answers, do not post yours! I upload an exmple of excel that how show your work (( i need like that))) For the problem you will solve it Is that clear? View Help Tell me what you want to do Define Name ntsError Checking ows Evaluate Formula cial Logical Tert Date &Lookup & Math & More Nama Time - Reference Trig- Functions Manager Create from Selection Function Library Defined Names Formula Auditing 2017 1284 2016 2012 412 2013 478 2014 636 2015 827 950 -03 05 -83 85 SUM(B6:F6) G3/(11-32) C3 C5 810 B11 1512 -B12/B13 ANS 0.06 0.11 growth Cost of Equity Cap.- Forecasted Net Income S53,576 $65,853 77,985 $88,646 97,672 Required Income $46,439 S52,333 S59,576 S68,155 S77,906 Residual Present Income Value Factor 0.90090 0.81162 0.73119 0.65873 0.59345 PV Residual Income Present Value S6,430 $10,974 S13,460 S13,498 S11.730 S56,092 Year 1 2011 2 2012 3 2013 4 2014 5 2015 S $7,137 $13,521 $18,409 $20,491 $19,766 PV of Continuing Value $14,883 $297,653 2016 103,532 $88,650 Res. Inc[ (Re-g) PV of Continuing Value $176,643 Total Present Value of All $232,735 Residual Income Half-year Adjustment (1+Re/2) Income 1055 245,535 Total Adjusted PV of Resid (+) Book Equity 1/1/20 S422,174 Total Value of Equity $667.709 Div, Rate- Start of year $422,174 $475,750 S541,603 $619,588 $708,234 S805,906 Net Income S 53,576 S 65,853 77,985 S 88,646 S97,672 S103,103 Dividend End of Year 475,750 541,603 $619,588 708,234 805,906 2011 2012 2013 2014 2015 2016 5. Todd Corp. manufactures train components. On January 1, 2011, management provided the following forecast of income for the next five years: Forecasted Net Income $53,576 S65,853 $77,985 $88,646 $97,672 Year 2011 2012 2013 2014 2015 Thomas' common shareholders' equity was $422,174 on January 1,2011. The firm does not expect to pay a dividend during the 2011-2015 period. Thomas' cost of equity capital is 11 percent. Required: Compute the value of Todd Company on January 1, 20, using the residual income valuation model and the half year convention. T. Harp, the CEO of Todd, expects net income to grow at a rate of 6 percent annually after 2015