Question

Use historical exchange rate information available on the Internet at www.x-rates.com, Historical Lookup, to find exchange rates between the U.S. dollar and each foreign currency

Use historical exchange rate information available on the Internet at www.x-rates.com, Historical Lookup, to find exchange rates between the U.S. dollar and each foreign currency for September 15, September 30, and October 15, 2018.

Determine the foreign exchange gains and losses that Pier Ten would have recognized in net income in the fiscal years ended September 30, 2018, and September 30, 2019, and the overall foreign exchange gain or loss for each transaction.

Determine for which transaction, if any, it would have been important for Pier Ten to hedge its foreign exchange risk. Pier Ten could have acquired a one-month put option on September 15, 2018, to hedge the foreign exchange risk associated with each of the four export sales. In each case, the put option would have cost $100 with the strike price equal to the September 15, 2018, spot rate. Determine for which hedges, if any, Pier Ten would have recognized a net gain on the foreign currency option.

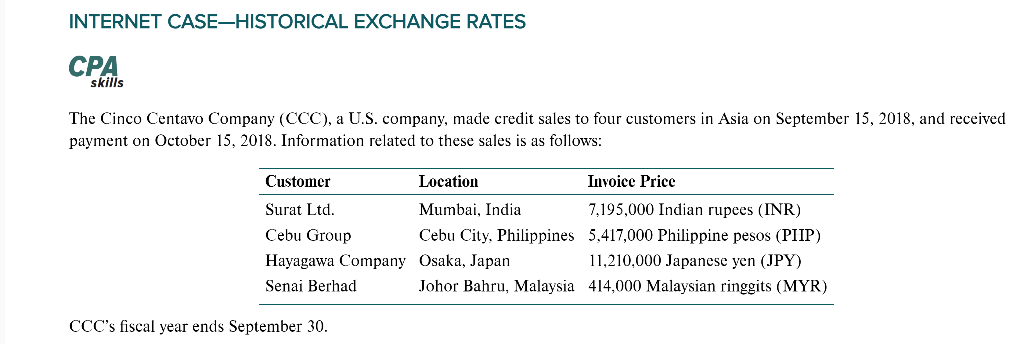

INTERNET CASE-HISTORICAL EXCHANGE RATES The Cinco Centavo Company (CCC), a U.S. company, made credit sales to four customers in Asia on September 15, 2018, and received payment on October 15,2018 . Information related to these sales is as follows: CCC's fiscal year ends September 30 . INTERNET CASE-HISTORICAL EXCHANGE RATES The Cinco Centavo Company (CCC), a U.S. company, made credit sales to four customers in Asia on September 15, 2018, and received payment on October 15,2018 . Information related to these sales is as follows: CCC's fiscal year ends September 30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started